The latest jobs numbers were released today, and the financial media is making much of the drop in the unemployment rate – now 5.8% according to the Bureau of Labor Statistics. Obviously, the economy must be getting better, just like Janet Yellen and Barack Obama have been telling us, right? Not so fast. The results from Tuesday’s elections tell a different story, as exit polls showed that the vast majority of voters were primarily concerned about the economy. Main Street Americans are waking up to the fact that this recovery is a hoax.

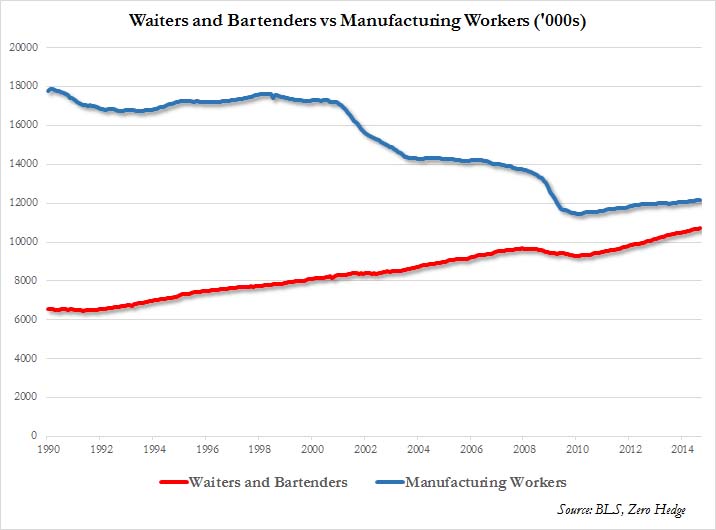

Even major news outlets like the LA Times are reporting on the new phenomenon of “secular stagnation,” which Peter Schiff addresses in his commentary below. ZeroHedge summarized how bogus the latest jobs numbers are, pointing out that most of the jobs gained are low-end service sector positions, while high-quality full-time work is dropping. Most alarmingly, it looks like there may soon be more waiters and bartenders in America than manufacturing workers:

This post was submitted by Erik Oswald, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

In this lecture, Dr. Andrew Bernstein discusses why capitalism is the best system for men to live under, from both socio-economic and moral standpoints. Free markets are ideal for society:

- They make available an abundance of inexpensive and effective consumer products.

- They give the poorest among us the opportunity to rise into the middle and upper classes of society.

- They create an environment where man’s mind is able to function to the best of its ability.

In his latest video, Peter Schiff appeals directly to Swiss voters – send a message to your government and the entire world by passing the “Save Our Swiss Gold” referendum on November 30th. This historic vote would force the Swiss National Bank to:

- Keep 20% of its assets in physical gold bullion (currently less than 8% of its reserves).

- Repatriate all Swiss gold holdings to Switzerland.

- Not sell any more Swiss gold.

Find more information about the initiative here, here, and here. Full transcript below.

SchiffGold and other major precious metals dealers have just received notice that the United States Mint has temporarily sold out of its Silver American Eagle bullion coins. There has been a huge surge in demand for silver bullion in the past week, as the price of the metal hit four year lows. Clearly investors are taking advantage of this buying opportunity.

We heard last week that US Mint sales of silver coins hit a 21-month high in October. The US Mint sold 5.79 million ounces of silver in October. This is the highest sales report since January 2013, when the Mint set a monthly record of 7.5 million ounces. As we reported last week, demand for silver coins has been on the rise across the globe, draining supplies from both private and national mints.

The price of silver has hit four-year lows. This isn’t because physical silver is no longer a valuable, safe-haven investment, but because mainstream economists and investors believe the Federal Reserve’s hype that the US economy is recovering. Peter Schiff explains why the economy isn’t recovering here.

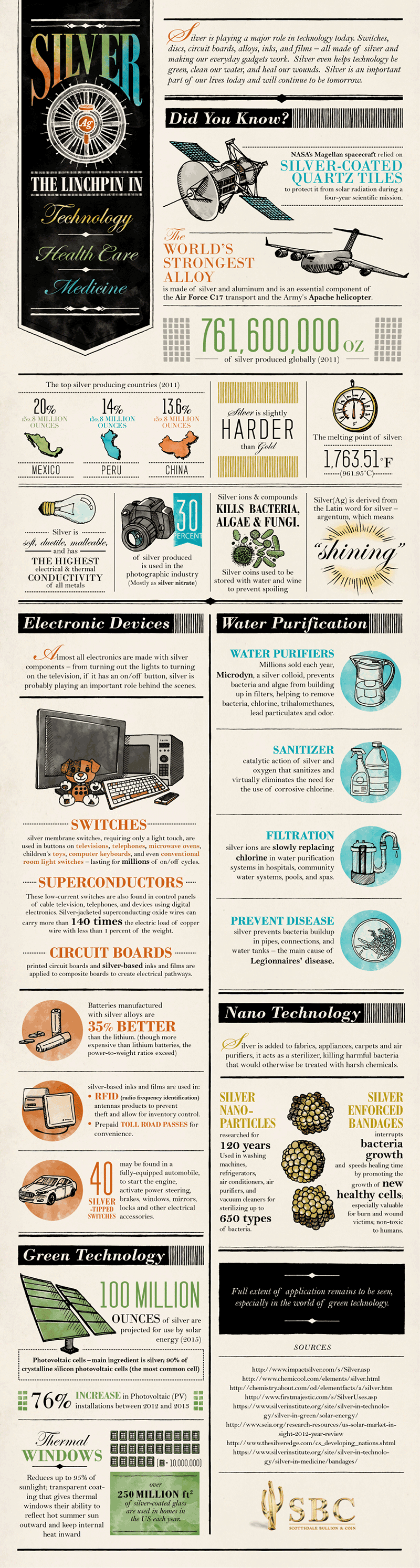

Physical silver is not just an important investment asset, though. As this thoroughly fascinating infographic from the Visual Capitalist shows, silver is an essential linchpin in modern technology, health care, and medicine. Silver’s industrial demand and diminishing supply is just another reason to buy the white metal now, while prices are still low.

The Mises Institute has released the second part of an exclusive interview between its President Jeff Deist and Patrick Barron, a private banking industry consultant. Find the first part of this engrossing interview here. In this second half, Deist and Barron discuss:

- How US dollar supremacy might come to an end with a whimper, instead of a bang.

- How the Bundesbank is a potential savior for the world monetary order, while the IMF is a paper tiger.

- How elites will have an increasingly hard time denying gold its role in the global monetary system.

- How America’s fiat dollar corrupts cultures, as well as economies.

The Canadian Gold Maplegram is the most barterable nationally minted and certified coin ever produced. Here’s Peter Schiff’s introduction:

One Week Introductory Offer

$4.99 Per Gram Over Spot

Call 1-888-GOLD-160 (1-888-465-3160)

The October issue of Silver News is now available from The Silver Institute. This edition begins with an interview with Ruth Crowell, Chief Executive of the London Bullion Market Association. Crowell talks mostly about the new silver pricing mechanism that replaced the London Silver Fix, which is begin administered by CME Group and Thomson Reuters. She described the main difference of the new system that was rolled out in August:

The major differences are that there is an independent third-party administrator as well as additional price participants and increased transparency. The information, which is displayed across multiple platforms, shows the live auction rounds, which mirrors what an actual participant sees while taking part.”

The October Silver News covers a variety of other developments in the silver industry, including:

- Silver is being used to mimic the camouflage capabilities of octopi.

On Friday, Peter Schiff reviewed the Halloween stock rally as an effect of the end of the Federal Reserve’s quantitative easing program. He focused on comparing the irrational euphoria of Wall Street to the dismal performance of gold stocks. Gold investors need to remain patient, because eventually the markets will realize that the United States is headed to another recession.

Last week, gold and silver analyst Dan Popescu interviewed Egon von Greyerz, Founder and Managing Partner of Matterhorn Asset Management. They spoke at length about the upcoming Swiss Gold Referendum, which we’ve previously reported on here and here. Von Greyerz provides great insight into the Swiss mindset and the importance of gold for central banks around the world. At the end of the interview, he even weighed in on the massive flow of physical gold from the West to China.