Billionaire investor Stanley Druckenmiller didn’t mince words when asked for recommendations at the Sohn Investment Conference.

Sell US stocks. Buy gold:

The conference wants a specific recommendation from me. I guess ‘Get out of the stock market’ isn’t clear enough.”

Druckenmiller went on to sing gold’s praises:

This Silver Institute has released its April issue of Silver News. This edition highlights exceptionally strong silver jewelry sales in the US.

Silver jewelry sales in the United States were solid in 2015 with 60% of jewelry retailers reporting increased sales, according to a survey conducted on behalf of the Silver Institute’s Silver Promotion Service (SPS). This marked the seventh consecutive year of growth for silver jewelry sales and confirmed that silver jewelry is an increasingly important category for many retailers”

The average growth in jewelry sales for 2015 was 15%.

As the Wall Street Journal put it, the debt crisis in Puerto Rico entered a “more perilous phase” after the Government Development Bank defaulted on a $422 million payment Monday:

The missed principal payment, the largest so far by the island, is widely viewed on Wall Street as foreshadowing additional defaults this summer, when more than $2 billion in bills are due.”

Download SchiffGold’s Free White Paper: Why Buy Gold Now?

Congress is debating legislation to grant the territory new power to restructure its more than $70 billion in debt. If Congress fails to act, the US taxpayer could ultimately end up footing the bill for Puerto Rico’s debacle:

In a letter to Congress, Treasury Secretary Jacob Lew warned on Monday that a US ‘taxpayer-funded bailout may become the only legislative course available’ if the proposed restructuring legislation isn’t approved.”

Doug Casey: Gold’s 18% Rise Is a Small Move – Peter Schiff’s Gold Videocast with Albert K Lu (Video)

Gold has gone up more than 18% this year, but Doug Casey told Albert K Lu this is just a small move. He sees gold going much higher in the next year:

I think there’s going be a panic into gold and out of paper currencies. So this small up-move that we’ve gotten here since the beginning of the year, that’s just a harbinger. I think this time around, we’re looking at $2,000, $3,000 an ounce. I think it’s going be incredible.”

The question is why? Casey explains his bullish outlook on gold – and how silver could hit $100 an ounce – in Lu’s latest Gold Videocast.

So much for that socialist paradise.

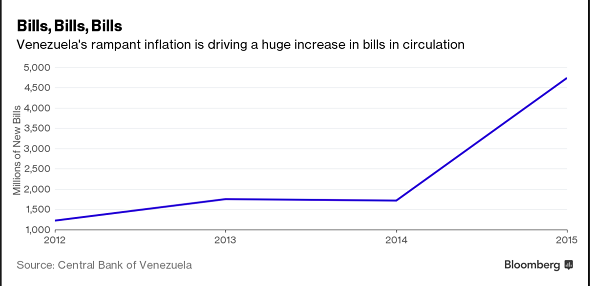

Last summer we reported that hyperinflation had devalued the Venezuelan bolivar to the point that people were using 2-bolivar notes as napkins. In order to keep up with the rate of devaluation, the Venezuelan government literally flew in 747s full of cash. Now we’ve learned that the Venezuelan government is so broke, it can’t even pay to print more money.

So, what is a benevolent socialist government to do?

Naturally, raise the minimum wage.

Peter Schiff has been saying for months that the US is probably already in a recession. In fact, during his April 4 podcast, Peter made the case that the “very massive recession,” Donald Trump predicted has already begun (Scroll down to listen.):

Everybody is saying he is nuts because the economy is great. Look at the numbers. The numbers tell a different story. And I believe that Trump is wrong. I don’t think we’re headed for a massive recession. I think we’re already in a massive recession.”

Mike Maloney agrees with Peter, and he recently released a video that highlights four sets of data showing the “robust” economic recovery was all smoke and mirrors created by the Federal Reserve, and the US economy is likely already in recession:

I have a feeling that when the Federal Reserve, and the people who put all this data together, when they finally declare a recession, we’re going to find out that we’re already in a recession – right now.”

Jim Grant appeared on CNBC’s Closing Bell to discuss the Fed’s latest non-move in interest rates, noting that “it seems awful familiar.”

Grant offered a stinging indictment of the Fed’s role in the world, pointing out that central planners simply can’t juggle all of the varying factors in the economy. Every move the Federal Reserve makes to “fix” a problem brings about another set of unintended consequences.

The Fed is in the business of making things worse as it seeks to make things better.”

Grant went on to discuss the notion that sovereign debt is some kind of “risk free” investment. “Of course it has risk,” he exclaimed, noting that in 2005, mortgage debt was the favored asset of the cycle.

The asset of the cycle now is sovereign debt yielding just about nothing.”

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Due to the high level of response from our readers to the first article we posted on the benefits of our low cost vault storage solutions, we wanted to follow up and delve into the details of how to buy and sell gold and silver stored in a domestic or international vault.

To begin with, creating a storage account through our storage partners is a simple and easy process. Individuals as well as corporations, LLC’s, trusts, partnerships and other legal entities, can open an account. There is a one-page form to fill out, a couple of identification documents to provide, and in about two to three business days, your storage account will be opened. As our website details, we have domestic storage locations here in the US in addition to strategic international jurisdictions abroad.

Once the storage account is created and you have your assigned account number, you can then proceed to buy your physical metals from our firm.

As we’ve been reporting for months, China is quietly becoming a dominant player in the world gold market, as the yellow metal shifts from the West to the East. Now the mainstream media is starting to take notice.

Not only is China the top consumer of gold in the world, ahead of fellow Asian nation India, it is also gaining stature as a player in the global market. Just last week, China launched twice daily gold fixing to establish a regional benchmark that will further bolster the country’s influence.

Earlier this week, NewsMax Finance published an article highlighting five trends in China it says will change the gold market forever. The piece nicely summarizes the trends we’ve been pointing out for more than a year. Based on these trends, NewsMax predicts China will become a dominant force on the world stage:

The gold market will soon be very different than from what we see today—largely due to the current developments in China. China’s influence will impact not just gold investors but everyone who has a vested interest in the global economy, stock markets, and the US dollar. After all, China will be a dominant force in all, as most analysts project.”

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

You know the old saying. “There’s a sucker born every minute.”

Sadly, many Americans have been suckered into thinking their pension was going to provide a stable and comfortable retirement. But government mismanagement and central bank monetary policy are quickly turning that retirement dream into a nightmare.

Pensions have been a major contributor to the Greek financial crisis, and the American system is looking increasingly Greek.

Just last week, Central States Pension Fund, one of the largest pension funds in the nation, filed an application to cut participant benefits. Central States handles retirement benefits for current and former Teamster union truck drivers across various states including Texas, Michigan, Wisconsin, Missouri, New York, and Minnesota. And in Illinois, pensions are underfunded to the tune of $111 billion.

This is not just an American phenomenon. A UK pension fund is also having serious issues and is slashing benefits.