Student loan debt continues to balloon. Data released in March revealed that 46% of student loans are not currently being repaid. That doesn’t even include debt held by students still in school or those within the six-month grace period after graduation.

Clearly, this has major implications on the financial futures of Americans saddled with this debt. It could mean putting off major purchases like homes and cars, further dragging down an already sluggish economy. And what happens when these debtors begin to default? Everyday Americans are on the hook. Total taxpayer exposure to student loan debt, including government guarantees for private loans, stands at more than $1.3 trillion and is increasing at about $2,726.27 every second.

In a recent New York Times column, economist Paul Krugman tried to justify central bank interventionist monetary policy by comparing it to giving insulin to a diabetic.

How should we think about these incredibly low interest rates? Recently Narayana Kocherlakota, the former president of the Minneapolis Fed, offered a brilliant analogy. Responding to critics of easy money who denounce low rates as ‘artificial’ – because economies shouldn’t need to keep rates this low – he suggested that we compare low interest rates to the insulin injections that diabetics must take. Such injections aren’t part of a normal lifestyle, and may have bad side effects, but they’re necessary to manage the symptoms of a chronic disease.”

Bob Murphy took apart Krugman’s reasoning in an episode Contra Krugman, utilizing an analogy Peter Schiff often employs. It isn’t insulin central bankers are injecting into the economy. It’s heroin.

Bill Gross took a peek into the future in his most recent Monthly Investment Outlook for Janus Capital, and he saw money raining from the sky.

Gross said he believes the structural changes currently occurring in the US economy will ultimately lead to so-called helicopter money.

Of course, choppers wouldn’t literally drop cash from the sky. But helicopter money is the ultimate stimulus program. The newly printed cash goes directly into the hands of the people themselves. Basically, the government hands out money – or figuratively drops it from a helicopter. A recent Guardian article explained the policy this way:

As the Deutsche research makes clear, the most basic variant of helicopter money involves a central bank creating money so that it can be handed to the finance ministry to spend on tax cuts or higher public spending. There are two differences with QE. The cash goes directly to firms and individuals rather than being channeled through banks, and there is no intention of the central bank ever getting it back.”

Basically helicopter money is stimulus that isn’t paid for with private borrowing or taxes. It’s “free money.” Kind of.

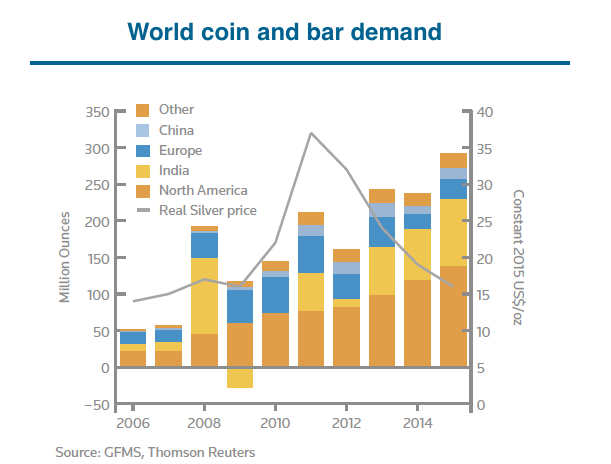

Silver demand hit a record high in 2015 and it shows no sign of waning.

GFMS, in collaboration with the Silver Institute, released its annual silver survey last week. Coin, bar, jewelry, and photovoltaic sectors boosted silver sales to a record 1.17 billion ounces.

High demand coupled with shrinking supply resulted in the third consecutive annual silver deficit. The gap between silver supply and demand was 60% larger than 2014. According to the report, mine production growth slowed to 2% last year. Scrap sales were also weak.

Well, that didn’t take long.

In February, we reported that a former Obama economic adviser/ex-Treasury Secretary had floated the idea of eliminating the $100 bill and the 500-euro note in the escalating war on cash.

On Wednesday, the European Central bank announced it will stop producing and issuing 500-euro notes around the end of 2018. Once the bank stops issuing the notes, those remaining in circulation will remain legal tender – at least for the time being.

In a press release, the EBC said it made the decision to eliminate the 500-euro note due to “concerns that this banknote could facilitate illicit activities.”

Capitalism appears to be falling out of favor. Socialism is in vogue. Or at least that’s the impression one gets when talking to millennials in America. A recent Harvard University poll shows that more than half of Americans in the 18-29 age bracket oppose capitalism.

Ron Paul appeared on RT America’s Boom or Bust show earlier this week to address this issue and pointed out the problem isn’t a failure of capitalism per se. The problem is that so few people actually understand what capitalism is. In fact, Paul argues that America’s economic system isn’t really free market capitalism:

I think the problem is all in semantics. When they say they oppose today’s capitalism – I oppose today’s so-called capitalism. I don’t even like the world capitalism, I like free markets. But if you say free markets and capitalism together, we don’t have that. We have interventionism. We have a planned economy. We have a welfare state. We have inflationism. We have central economic planning by a central bank. We have a belief in deficit financing. It is so far removed from free-market capitalism that it’s foolish for people to label it free market…”

Paul went on to say people are right to reject the system in America as it operates today because “it’s designed to fail,” but embracing socialism certainly isn’t the solution.

People should reject what we have, but they shouldn’t reject liberty and freedom and sound economic policies, because that is not the problem. The problem is we don’t have enough free markets.”

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

The monetary landscape of today looks pretty grim. We are in the middle of the perennial decline in the rate of interest. Central bankers are convinced they can get us all out of this mess. But can they really?

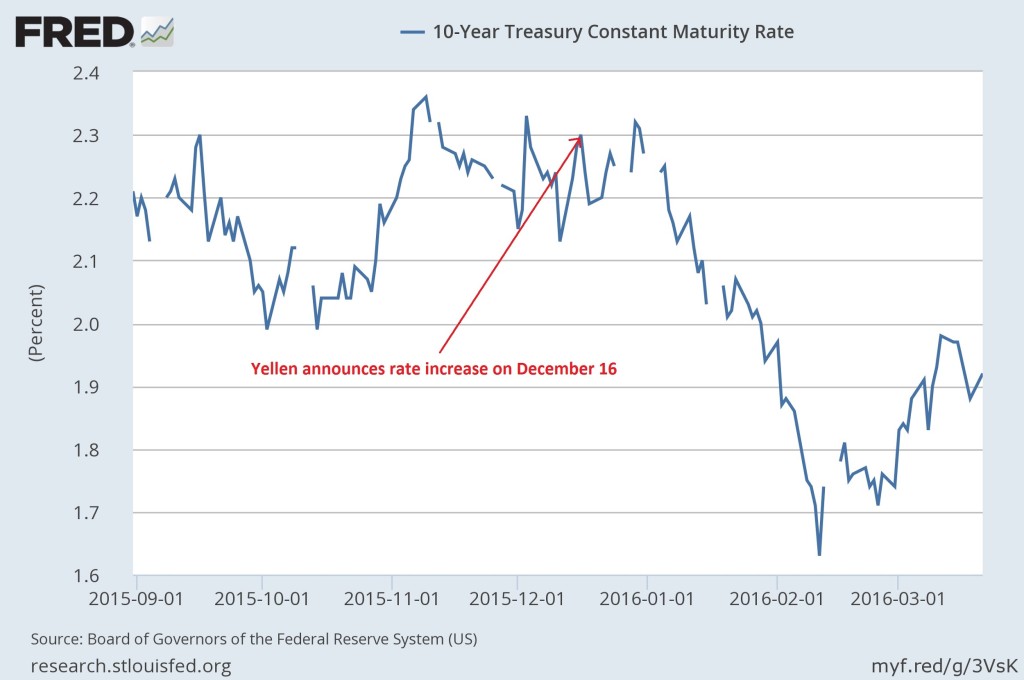

Janet Yellen timidly tried to go against the decade long trend by raising rates at the end of last year. It has not panned out so well. In fact, rates actually declined despite her announcement and subsequent plan to keep raising rates throughout the year.

Zooming out a bit we get a much clearer picture of the long term trend.

Billionaire investor Stanley Druckenmiller didn’t mince words when asked for recommendations at the Sohn Investment Conference.

Sell US stocks. Buy gold:

The conference wants a specific recommendation from me. I guess ‘Get out of the stock market’ isn’t clear enough.”

Druckenmiller went on to sing gold’s praises:

This Silver Institute has released its April issue of Silver News. This edition highlights exceptionally strong silver jewelry sales in the US.

Silver jewelry sales in the United States were solid in 2015 with 60% of jewelry retailers reporting increased sales, according to a survey conducted on behalf of the Silver Institute’s Silver Promotion Service (SPS). This marked the seventh consecutive year of growth for silver jewelry sales and confirmed that silver jewelry is an increasingly important category for many retailers”

The average growth in jewelry sales for 2015 was 15%.

As the Wall Street Journal put it, the debt crisis in Puerto Rico entered a “more perilous phase” after the Government Development Bank defaulted on a $422 million payment Monday:

The missed principal payment, the largest so far by the island, is widely viewed on Wall Street as foreshadowing additional defaults this summer, when more than $2 billion in bills are due.”

Download SchiffGold’s Free White Paper: Why Buy Gold Now?

Congress is debating legislation to grant the territory new power to restructure its more than $70 billion in debt. If Congress fails to act, the US taxpayer could ultimately end up footing the bill for Puerto Rico’s debacle:

In a letter to Congress, Treasury Secretary Jacob Lew warned on Monday that a US ‘taxpayer-funded bailout may become the only legislative course available’ if the proposed restructuring legislation isn’t approved.”