Gold Hits Record Highs in CNY, JPY

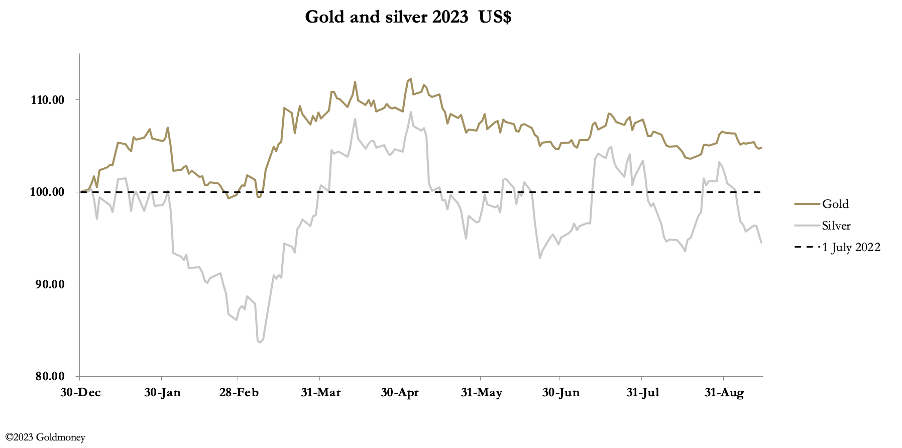

Gold and silver drifted lower this week before a modest recovery Friday morning, which can be put down to bear closing. Meanwhile, gold hit record levels in yuan and yen terms.

Here’s a breakdown of this week’s gold and silver markets.

In European trading this morning, gold was $1918, unchanged from last Friday’s close after testing the $1900 level yesterday. Silver was $23.05, down 3 cents, after testing $22.30. Comex volumes in gold were moderately healthy, and they picked up in silver yesterday on the sell-off.

The performance of gold and silver has been disappointing for dollar bulls, but looking at it from the bears’ point of view prices refused to go lower yesterday when the ECB raised its deposit rates and the dollar’s TWI powered ahead. The TWI is next.

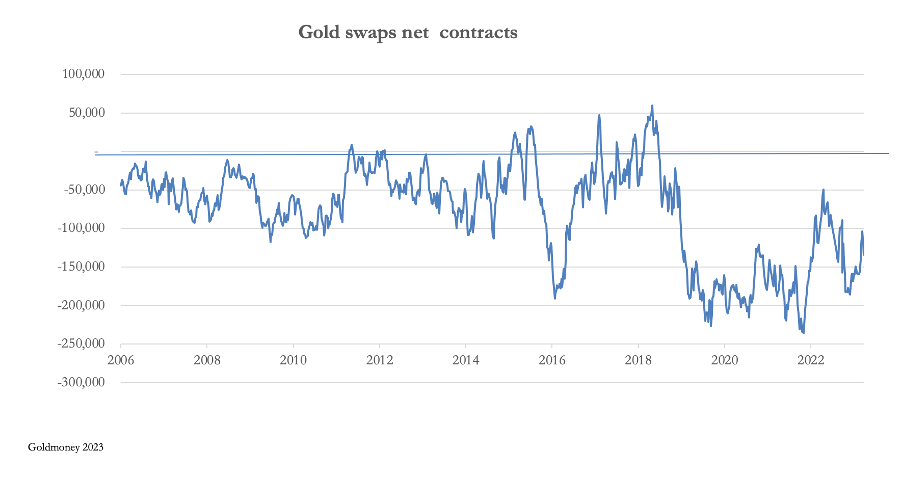

Perhaps the bears need a little more time. Their hopes will devolve on interest rates and bond yields going higher or at least remaining firm, which is seen to be bearish for gold. The short positions of the Swaps on Comex have reduced in value, but probably not enough. The next chart is of their net position, and it can be seen that before 2019 the average net short position was less than today.

With de-dollarisation by the Global South, it would appear to be a struggle for the Swaps to reduce their shorts much more.

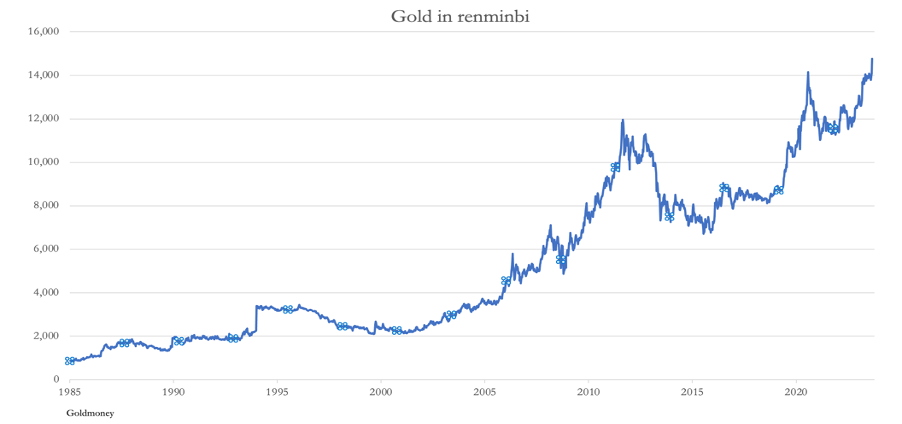

One story consistently hitting the headlines this week has been the gold price premiums on the Shanghai Gold Exchange, hitting as much as 6% — taking it to over $2000 equivalent. Certainly, the demand on the SGE is real, but this is driven by gold being the only hedge available to resident Chinese against a falling yuan (due to currency controls). Our next chart shows how weak the yuan has been, despite zero price inflation.

With the recent dip below the 7.27 level, which had steadied the rate in October 2022, you can see why the Chinese public would be bearish on the yuan and bullish for gold. And here is the price on the SGE, which hit a record Y14,765 yesterday.

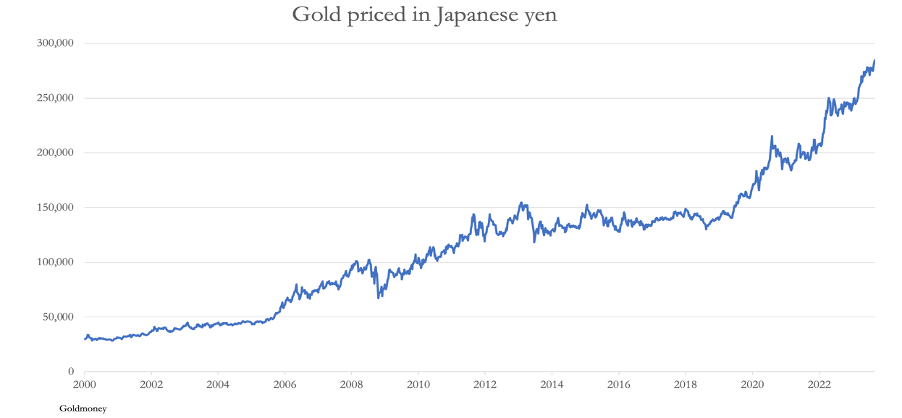

The other story gaining traction is the price in Japanese yen, which is also hitting new records due to the weakness of the currency. This is next.

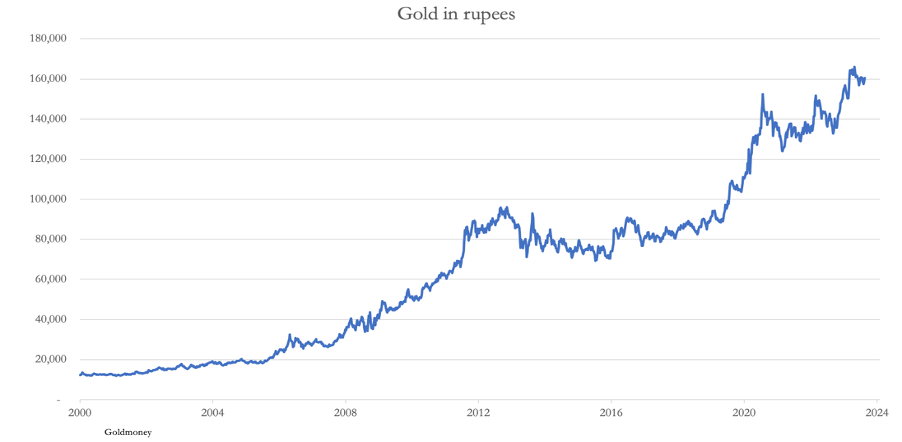

And next up is the price in Indian rupees.

Not quite at all-time highs, but the trend is clear.

This goes to show that it is only in the dollar and a few of the leading currencies that gold disappoints. And it would be a mistake to think that the BRICS currency story is dead. Under Russia’s chairmanship from January, we can expect it to resurface. There is also a strong possibility that Russia may seek to stabilise the rouble through a gold standard, having failed to persuade the BRICS nations to do so with a trade settlement currency first.

As if to echo these thoughts, central banks have been continually buying bullion reserves. According to World Gold Council data, in July central banks added 44 tonnes. We await to see how central banks have responded to lower dollar prices over the last month.

Ahead of a possible challenge on the $2,000 level, gold consolidated recent rises this week, and silver held up well. This morning in European trade, gold was $1995, up $15 from last Friday’s close, and silver was $23.70, unchanged on the week. Comex volumes were healthy, despite the Thanksgiving holiday in the US.

Ahead of a possible challenge on the $2,000 level, gold consolidated recent rises this week, and silver held up well. This morning in European trade, gold was $1995, up $15 from last Friday’s close, and silver was $23.70, unchanged on the week. Comex volumes were healthy, despite the Thanksgiving holiday in the US. This week, gold and silver extended their correction of October’s sharp rise. In European trade this morning, gold was $1953, down $24 from Last Friday, and silver was $22.54, down 66 cents. Comex volume in both contracts was moderate.

This week, gold and silver extended their correction of October’s sharp rise. In European trade this morning, gold was $1953, down $24 from Last Friday, and silver was $22.54, down 66 cents. Comex volume in both contracts was moderate. The writing of this market report was at a time of great volatility, due to it coinciding with the speech of the Hezbollah leader, Hassan Nasrallah. The drift of it appears to be that Hezbollah will support Hamas. If so, it means an intensification of the Palestinian crisis Which would presumably drive gold and silver […]

The writing of this market report was at a time of great volatility, due to it coinciding with the speech of the Hezbollah leader, Hassan Nasrallah. The drift of it appears to be that Hezbollah will support Hamas. If so, it means an intensification of the Palestinian crisis Which would presumably drive gold and silver […] This week, gold and silver went their separate ways, with gold rising and silver falling. In European trade this morning, gold was $1985, up $4 from last Friday’s close, while silver was 22.81, down 21 cents. Gold is edging higher, while silver edges lower.

This week, gold and silver went their separate ways, with gold rising and silver falling. In European trade this morning, gold was $1985, up $4 from last Friday’s close, while silver was 22.81, down 21 cents. Gold is edging higher, while silver edges lower. This week, a firmer trend in gold continued as markets realized the seriousness of the deteriorating situation in the Middle East.

This week, a firmer trend in gold continued as markets realized the seriousness of the deteriorating situation in the Middle East.