No one is talking about the US trade deficit in the current fiscal year, but it is likely to be another record, bringing with it new rounds of trade sanctions and protectionism.

In this article, I explain why the twin deficit hypothesis will apply, bearing in mind a likely budget deficit outturn of $3 trillion and a negative savings rate.

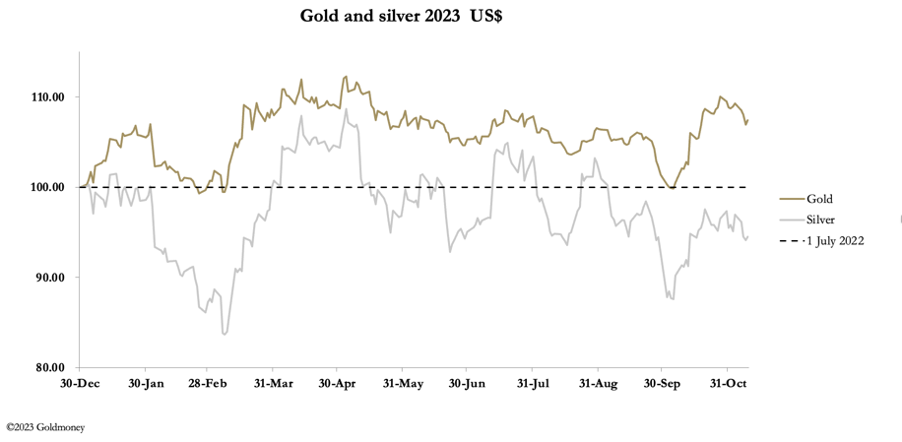

Ahead of a possible challenge on the $2,000 level, gold consolidated recent rises this week, and silver held up well. This morning in European trade, gold was $1995, up $15 from last Friday’s close, and silver was $23.70, unchanged on the week. Comex volumes were healthy, despite the Thanksgiving holiday in the US.

This article concludes that the current downturn in bond yields is part of a continuing market manipulation by central banks in order to restore confidence in the global economic outlook.

There is a long history of government intervention in markets. In the nineteenth century, it was by legal regulation, the most notable of which was the 1844 Bank Charter Act, which had to be suspended in 1847, 1857, and 1866.

The technical position for gold is looking very positive for higher prices. But technical analysis should be backed by fundamentals.

To a large extent, fundamentals are in the eye of the beholder, whose opinions in any situation can vary from positive to negative and everything in between. But even for the economic optimists, there are gathering clouds on the horizon likely to continue undermining the global economic outlook, the dollar, and all financial asset values. Fiat currencies are being downgraded relative to real money, which is gold.

This week, gold and silver extended their correction of October’s sharp rise. In European trade this morning, gold was $1953, down $24 from Last Friday, and silver was $22.54, down 66 cents. Comex volume in both contracts was moderate.

The Great Game of Geopolitics faces a new challenge. The new hotspot is Israel and the Muslim Middle East. Ukraine is all but over, and the US is likely to abandon her to her fate — like Afghanistan.

We shall have to see how both will play out. Meanwhile, energy prices are set to keep inflation and interest rates high, undermining governments, banking systems, and businesses dependent on cheap credit.

The writing of this market report was at a time of great volatility, due to it coinciding with the speech of the Hezbollah leader, Hassan Nasrallah. The drift of it appears to be that Hezbollah will support Hamas. If so, it means an intensification of the Palestinian crisis Which would presumably drive gold and silver prices higher. This market report should be read in this context.

The day of reckoning for unproductive credit is in sight.

With G7 national finances spiraling out of control, debt traps are being sprung on all of them, with the sole exception of Germany.

This week, gold and silver went their separate ways, with gold rising and silver falling. In European trade this morning, gold was $1985, up $4 from last Friday’s close, while silver was 22.81, down 21 cents. Gold is edging higher, while silver edges lower.

This article defines credit, a subject upon which there is a lack of public knowledge. What people call money is in fact credit, and money itself, which is physical gold without counterparty risk, rarely if ever circulates. Nearly everyone, including most economists, fails to understand credit and the importance of its value being tied to money.

Nor do they understand that bank credit is just a minor part of the colossal system of credit.