This week, a firmer trend in gold continued as markets realized the seriousness of the deteriorating situation in the Middle East.

An important error in statistical analysis is that mathematical economists have lost sight of what their beloved statistics represent —none more so than with GDP.

In this analysis, I explain why GDP is simply the total of accumulating currency and credit which is wrongly taken to reflect economic progress — there being no such thing as economic growth, only the growth of credit. Once that point is grasped, the significance of this basic error becomes clear, and the fiat currency paradigm is revealed for what it is: a funny money game that will go horribly wrong.

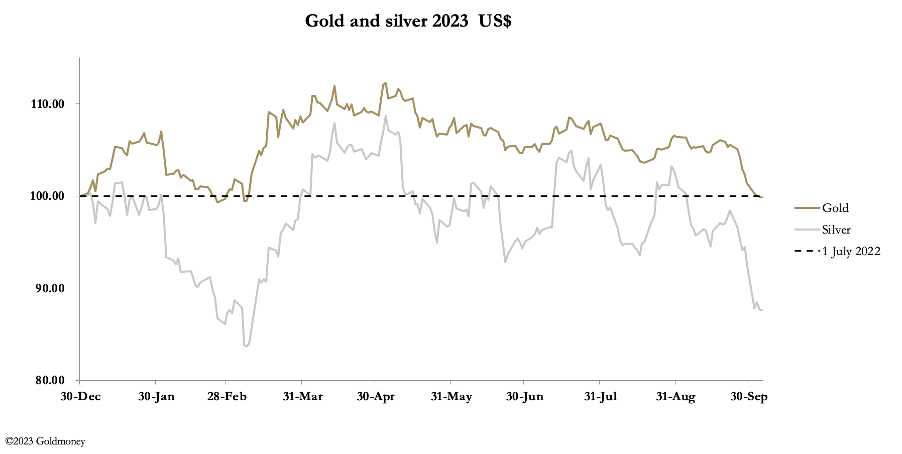

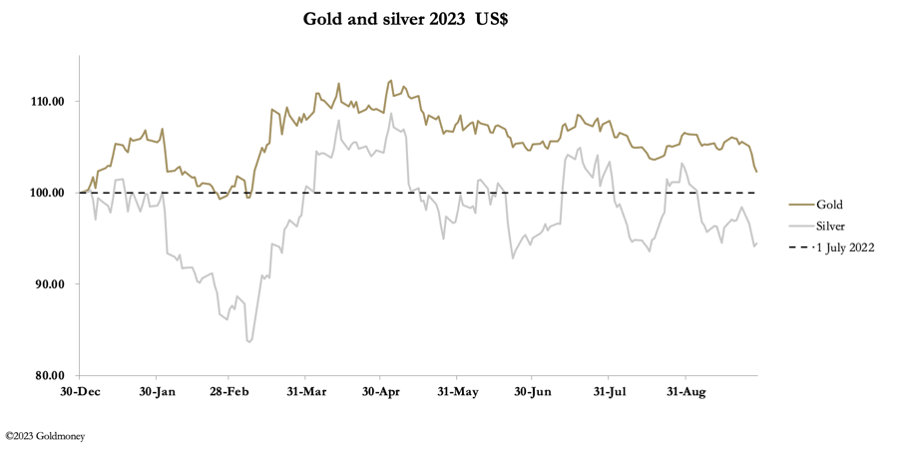

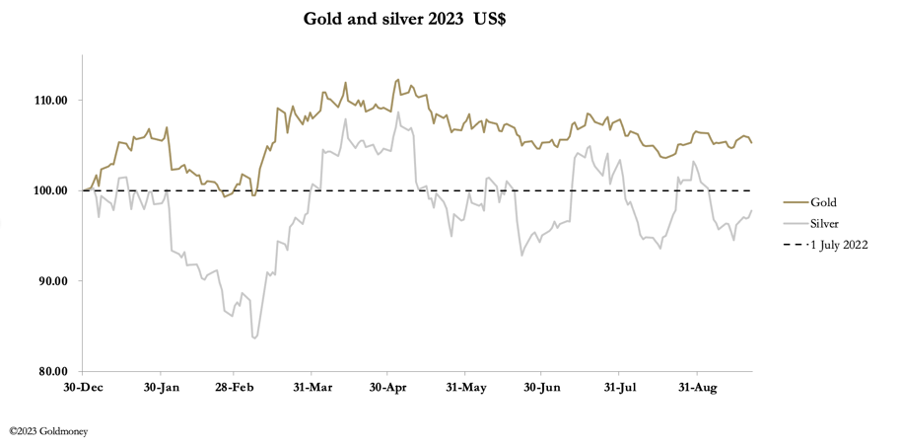

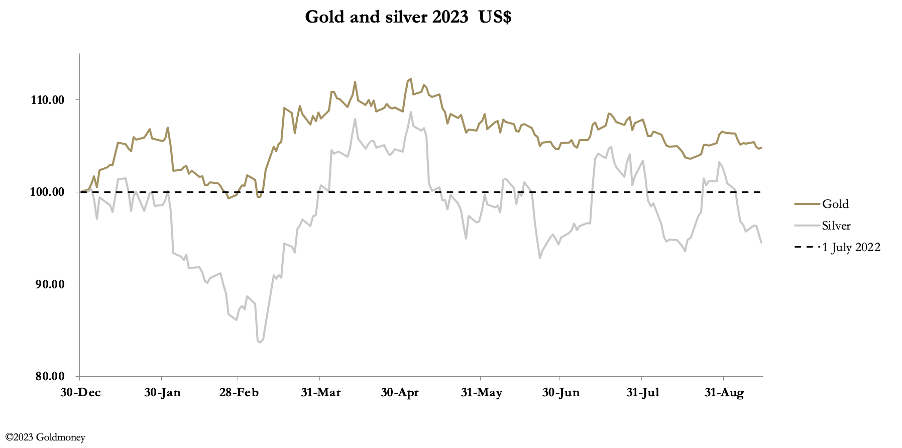

The sell-off in precious metals continued as bond yields continued to rise and a strong dollar persisted. In early trade in Europe this morning, gold was $1822, down another $26, unchanged on the year. Silver traded at $21, down $1.17. Comex volumes in both metals declined from good levels, indicating that selling pressure is declining.

This article looks at the collateral side of financial transactions and some significant problems that are already emerging.

At a time when there is a veritable tsunami of dollar credit in foreign hands overhanging markets, it is obvious that continually falling bond prices will ensure bear markets in all financial asset values leading to dollar liquidation. This unwinding corrects an accumulation of foreign-owned dollars and dollar-denominated assets since the Second World War both in and outside the US financial system.

As the yield on the 10-year US Treasury note soared, gold and silver came under selling pressure this week. But ahead of the weekend, bear closing in precious metals is evident. In European trade this morning, silver rallied to $23.00, down a net 55 cents from last Friday’s close. And gold traded at $1871, down a net $53. The numbers in other currencies were not nearly so grim due to dollar strength. The chart below shows the dollar’s Trade Weighted Index:

With the Asian hegemons undoubtedly able to introduce gold standards, where does that leave the dollar?

This article describes just how precarious the fiat dollar’s position has become.

The FOMC and the Bank of England stood pat on interest rates this week. Following the FOMC’s decision, gold and silver fell on the back of its hawkish statement before recovering slightly. In Europe this morning, gold was $1926 up a net $2 from last Friday’s close. Silver fared much better at $23.68, up 65 cents. Silver is obviously in a bear squeeze, while hedge funds have become disinterested in gold.

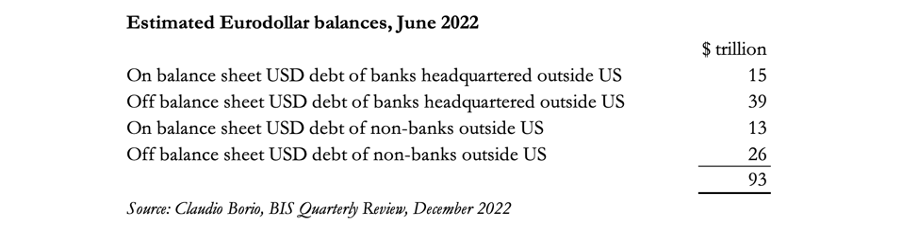

Among the many problems currencies the markets face, there is one that is undocumented: the eurodollar market. This is yet another very large elephant in the room.

This article quantifies eurodollars and eurodollar bonds, which are additional to US money supply and credit.

Gold and silver drifted lower this week before a modest recovery Friday morning, which can be put down to bear closing. Meanwhile, gold hit record levels in yuan and yen terms.

Here’s a breakdown of this week’s gold and silver markets.

Russia and the Saudis are driving up oil and diesel prices. But these moves are likely to undermine the rouble more than they undermine the dollar, euro, and other major currencies. Therefore, higher energy prices will rebound on the Russians this winter: if they shiver in Germany, they will freeze in Russia. If the dollar is king of the fiats, the rouble is just a lowly serf.

There is little doubt that Putin and his advisers are aware of this problem. Plan A was to introduce a new gold-backed BRICS currency which might be expected to weaken the dollar and euro relative to the rouble. Plan B was more drastic: to back the rouble itself with gold. This is the financial equivalent of dropping a hydrogen bomb on the dollar and the global fiat currency system upon which it is based.