Trade Deficit: Another Record Shattered

January saw another record trade deficit.

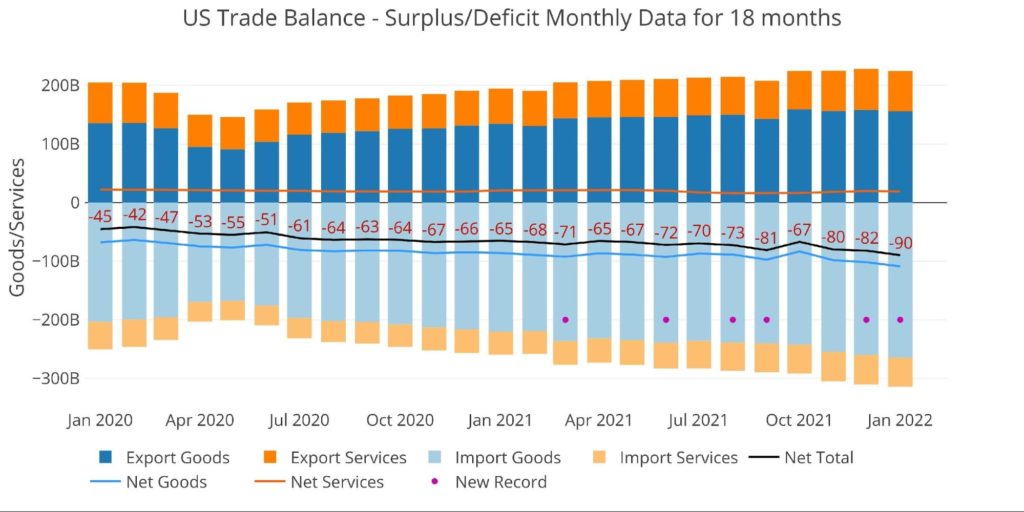

The $89.7 billion deficit shattered the $82 billion record set in December by 9.4%! Before March 2021, the Trade Deficit monthly record had been set in August 2006 at -$68B. This record stood for nearly 15 years! Records are now being broken almost every single month.

The chart below shows a purple dot every time a new record is made. A new record has been made in 6 of the last 11 months. Had September not had the data anomaly that over-inflated the deficit, the US would be looking at 6 months of new records in a row.

It’s very possible that new records will not be made for a few months as the Russia/Ukraine conflict slows international trade and most likely causes a global recession. That being said, the general trend of excessive trade deficits does not look likely to reverse anytime soon.

Figure: 1 Monthly Plot Detail

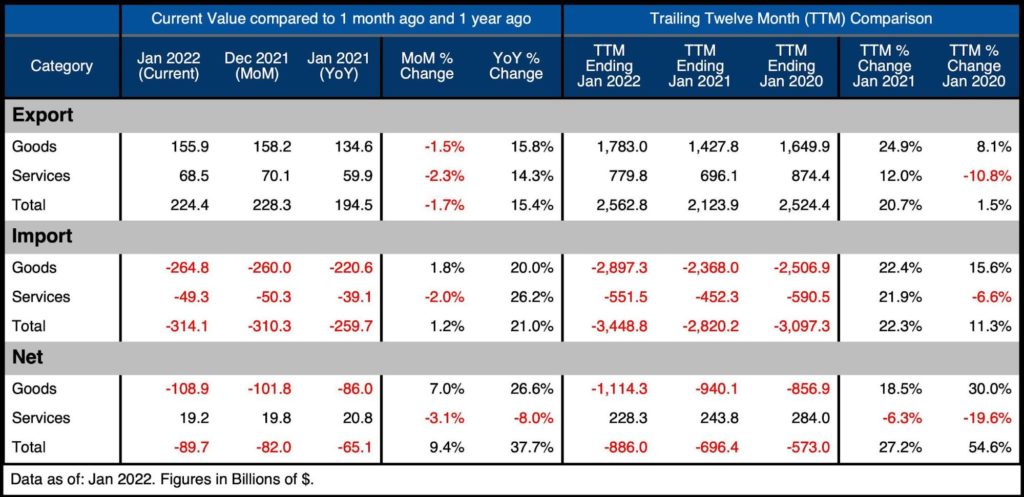

The table below provides detail.

Monthly Trade Deficit

- The massive surge was caused by a combination of the Goods Deficit increasing 7% and the Services Surplus decreasing 3%

- The Goods Deficit increase was driven by both falling exports (-1.5%) and increasing imports (1.8%)

- The Services Surplus decrease was driven by Exports falling by more than Imports ($1.6B vs $1.0B)

Looking at Trailing Twelve Month:

- The Total Net Deficit of $886B is a new all-time record

- This beats the record last month of $861B by $25B

- YoY, the Net Deficit is up 27% from $696B

- The TTM Services Surplus has fallen 19.6% from $284B to $228B since Jan 2020

- Over that time, the Goods Deficit has increased 30% from $857B to $1.1T

Figure: 2 Trade Balance Detail

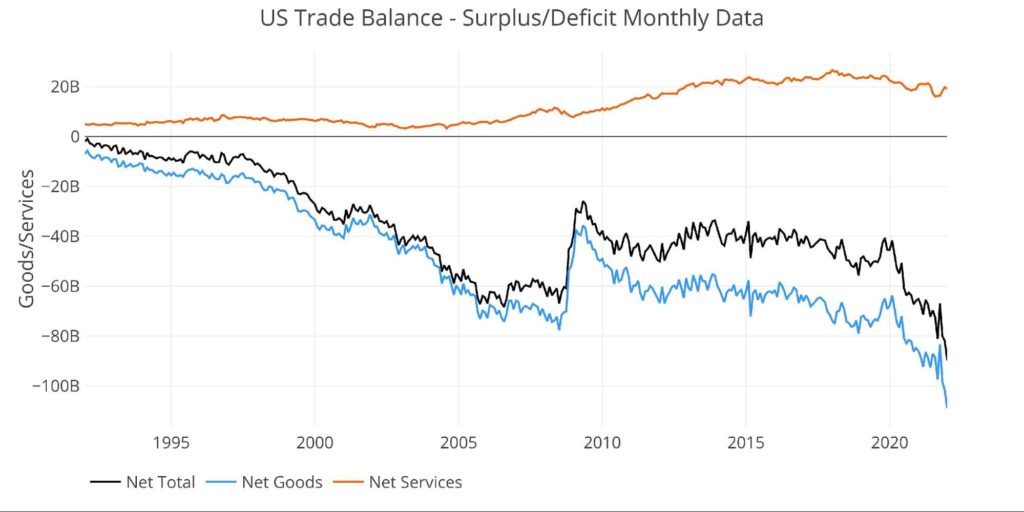

Historical Perspective

Zooming out and focusing on the Net numbers shows the longer-term trend and shows the magnitude of the current move. This plot also shows how much larger the Goods Deficit is compared to the Services Surplus. The Services Surplus has been declining since Jan 2018.

The recent uptick in the Services Surplus can be seen on the far right. Unfortunately, this uptick has been halted in the most recent month.

Figure: 3 Historical Net Trade Balance

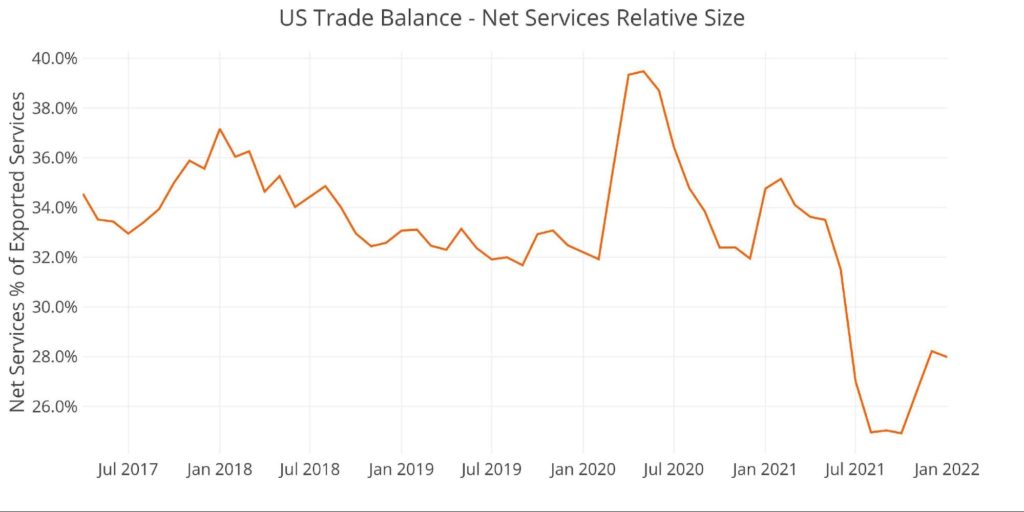

The chart below zooms in on the Services Surplus to show the wild ride it has been on in recent months. It compares Net Services to Total Exported Services to show relative size. After hovering near 35% since 2013, it dropped to 24.9% in Oct 2021 but has since recovered to 28%.

As mentioned above, the current recovery has already started to reverse as shown below.

Figure: 4 Historical Services Surplus

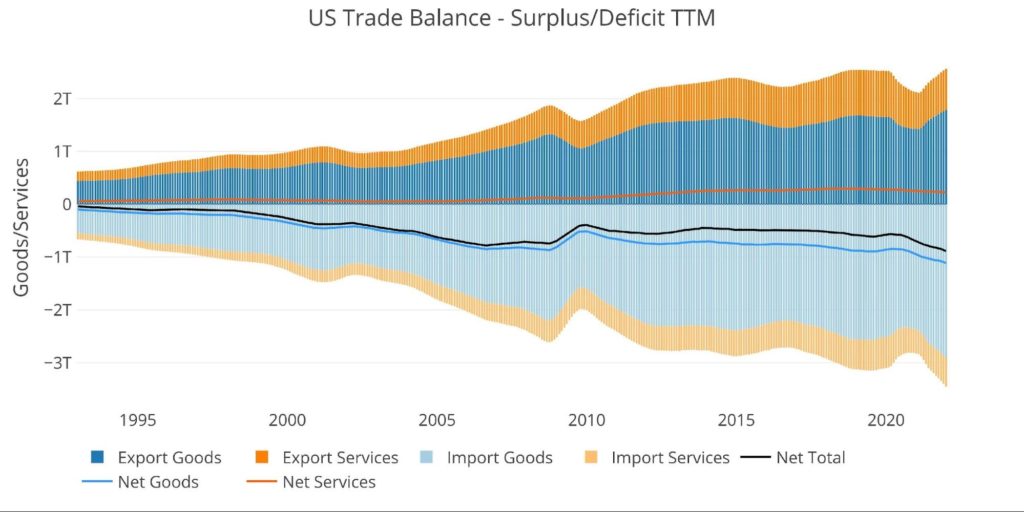

To put it all together and remove some of the noise, the next plot below shows the Trailing Twelve Month (TTM) values for each month (i.e., each period represents the summation of the previous 12-months).

Figure: 5 Trailing 12 Months (TTM)

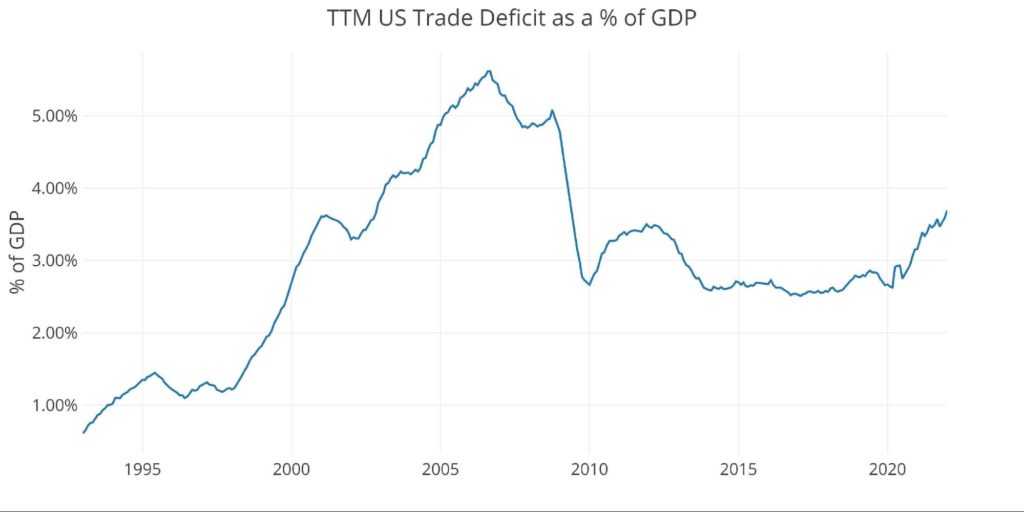

Although the Net Trade Deficits are hitting all-time records in dollar terms, it can be put in perspective by comparing the value to US GDP. As the chart below shows, the current records are still below the 2006 highs before the Great Financial Crisis.

That being said, the current 3.69% is the highest since May of 2009 and up from 3.59% only one month ago.

Figure: 6 TTM vs GDP

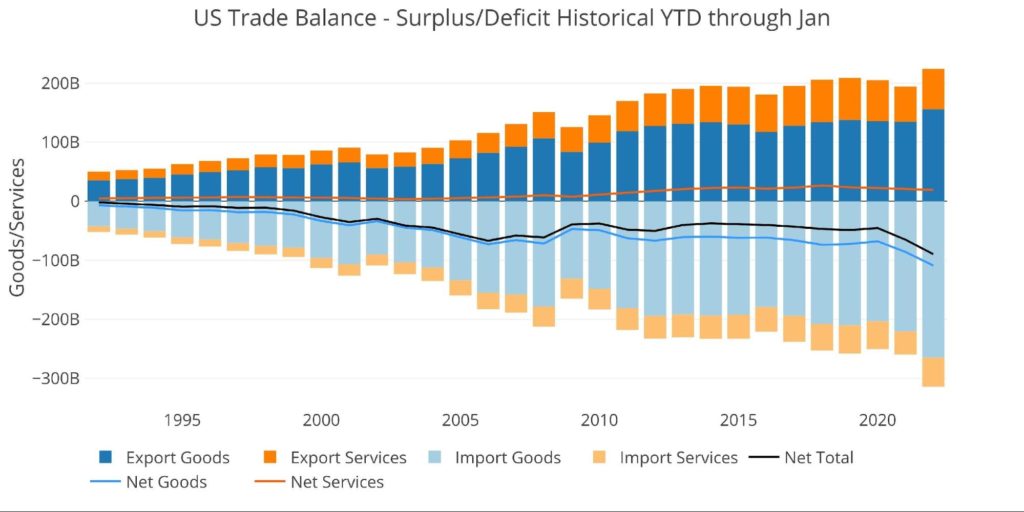

The chart below shows the YTD values. Because the current month is January, this chart shows how January 2022 compares to January previously.

Figure: 7 Year to Date

What it means for Gold and Silver

Gold has been on a wild ride in recent weeks with the Russia/Ukraine conflict creating mayhem across all markets. Gold recently touched a new record high before seeing instant selling pressure. However, trade is at the heart of the disruption and the reason for the massive repricing being seen. Oil has seen the biggest move recently as Russian supply has become far less certain.

As mentioned above, trade will likely slow causing fewer record Trade Deficits in the months ahead. Regardless, the US must walk delicately. Using the power of the reserve currency while also producing huge trade deficits could prompt other countries to seek alternatives to the dollar. No doubt, Russia wishes they had more physical gold in their vaults. Other countries are certainly taking notice.

Data Source: https://fred.stlouisfed.org/series/BOPGSTB

Data Updated: Monthly on one month lag

Last Updated: Mar 08, 2022, for Jan 2022

US Debt interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect.

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect. The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on. In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter.

In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter. Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]

Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]