US manufacturing activity contracted in August, according to the latest data.

The Institute for Supply Management (ISM) PMI index for August came in at 49.1. Any number under 50 signals a drop in manufacturing. This was the first contraction in three years and the first time the index has dropped below 50 since August 2016. August marked the fifth straight monthly decline.

Meanwhile, IHS Markit PMI hit 50.3, the lowest number since September 2009 – in the aftermath of 2008 crash.

The Federal Reserve makes life easier for politicians by pursuing monetary policies that shield them from the consequences of bad economic decision-making. By keeping interest rates low and printing money, the Fed hides the nefarious impact of government spending, trade wars and other bad policies.

Peter Schiff talked about this in a recent podcast.

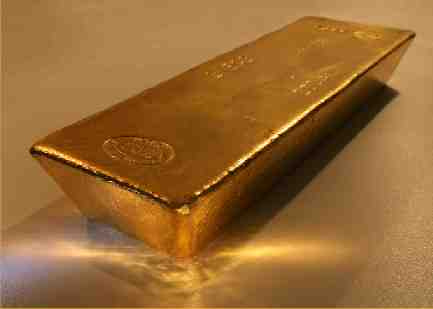

There has been a lot of focus on the recent gold rally. It has even caught the attention of the mainstream. But silver has also been quietly running upward. In fact, the white metal has outperformed gold this month. While the yellow metal has gained about 8% on the month, silver is up 11%.

Yesterday (Aug. 27) gold was up $16 per ounce and closed at $1,542.50. It was the highest close in six years. But it was an even bigger day for silver. The white metal was up 53 cents and closed at $18.17. Peter Schiff has been pounding the table on silver in recent weeks, and he talked about the big silver rally in his latest podcast.

Donald Trump went on a Twitter rant Friday. In his latest podcast, Peter Schiff said the president basically “lost it.”

There was a lot of news on Friday before Trump went off on Twitter. Jerome Powell gave his speech at Jackson Hole. He was generally upbeat about the economy. Then China announced additional tariffs on $75 billion in American imports. But the real fireworks started with Trump’s tweets in response to the Chines tariff retaliation.

Last week, the yield curve inverted, with the yield on the 10-year Treasury falling below the yield on the 2-year for the first time in 12 years. This has historically been a good predictor of recessions. US stock markets sold off on the news, with the Dow shedding 800 points. As Peter Schiff noted in his most recent podcast, the mainstream also suddenly started talking about the possibility of an economic downturn.

As Peter put it, the media has flipped the narrative on Trump.

The gold market took a one-two punch on Tuesday as Trump made some concessions in the trade war and inflation numbers came in a bit higher than expected. Peter Schiff talked about it in his latest podcast, saying gold traders still don’t understand the gold rally.

Several currencies have been strong against the dollar over the last couple of days, but as Peter Schiff said in his podcast, the biggest gainer wasn’t a currency at all. It was real money – gold.

Gold hit six-year highs on Monday and set records in a number of currencies. It continued to move upward on Tuesday. Overnight, the yellow metal pushed briefly above $1,500.

April’s jobs report came out better than expected. According to the Labor Department, the economy added 263,000 jobs last month. That came in well above the expectation of 180,000 jobs. The unemployment rate dropped to 3.6%, the lowest level since December 1969.

But in his most recent podcast, Peter Schiff said the job headlines actually mask the real story.

The Federal Reserve Open Market Committee meeting wrapped up yesterday with Fed policy still in neutral.

As expected, the FOMC left interest rates unchanged and seemed to indicate it doesn’t plan to do anything at all in the near-term. Jerome Powell’s comments dampened expectations that the central bank might move to cut rates in the coming months.

The committee is comfortable with current policy stance. Don’t see a strong case for a rate move either way.”

Most took Powell’s comments to be less dovish than expected, but Peter Schiff said he thinks the Fed is a lot more dovish than it admits.

The Commerce Department released the first estimate of Q1 GDP growth on Friday. It came in higher than expected at 3.2%.

Somewhat surprisingly, the price of gold rose on the news and the dollar showed some weakness. The primary reason was presumably lower inflation. This means the Fed still has the excuse it needs to continue the Powell Pause.

There was also some data in the Commerce Department’s report that reveals shakiness in that growth number. In fact, Peter Schiff said he thinks this will likely be the strongest growth of the year.