Hi-Ho Silver! Away!

There has been a lot of focus on the recent gold rally. It has even caught the attention of the mainstream. But silver has also been quietly running upward. In fact, the white metal has outperformed gold this month. While the yellow metal has gained about 8% on the month, silver is up 11%.

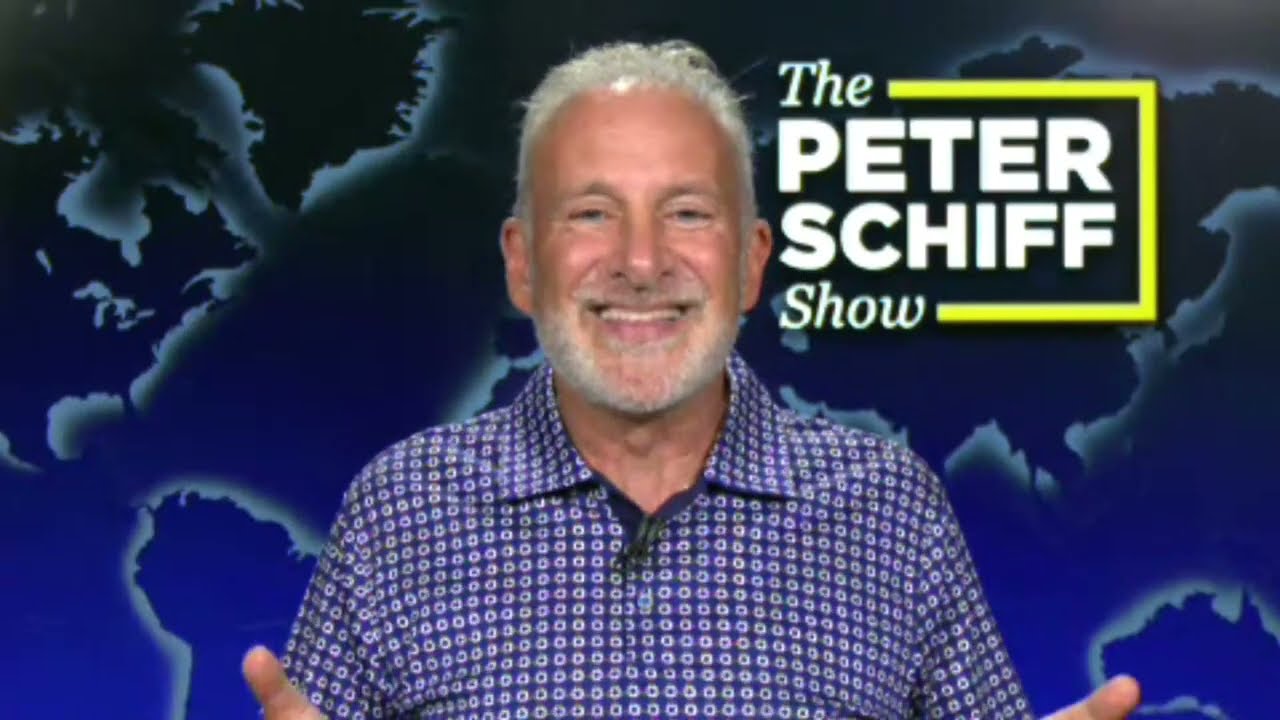

Yesterday (Aug. 27) gold was up $16 per ounce and closed at $1,542.50. It was the highest close in six years. But it was an even bigger day for silver. The white metal was up 53 cents and closed at $18.17. Peter Schiff has been pounding the table on silver in recent weeks, and he talked about the big silver rally in his latest podcast.

I’ve been telling people silver is the key. It is really cheap relative to gold. In fact, it was better than 90-to-1. You needed more than 90 ounces of silver to buy a single ounce of gold. That was an all-time record low for the price of silver. Now we’re at 85. The ratio has moved back in silver’s favor. But you still need 85 ounces of silver to buy one ounce of gold. That is historically extremely cheap.”

Peter said SchiffGold precious metals specialists have been calling clients and recommending that they sell their gold and buy silver because you can get so much silver for an ounce of gold.

It is a real bargain right now. Silver has never been this cheap and so if you have gold and don’t have any silver, it makes sense to buy some silver with your gold. And even after today’s move, I would still say that trade makes sense.”

Peter said if you’re bullish on gold, you should be bullish on silver as well. As you might recall, when silver really started to turn around last month Peter said that we have all the elements in place for a gold bull market.

We had the mining stocks outperforming the metal and then we had silver outperforming gold, and that is what always happens in a bull market. The stocks lead the metal and silver leads gold. In the bear market, silver was way underperforming gold. We now are in a bull market.”

Peter said the problem is a lot of investors don’t realize we’re in a bull market. Gold and silver sales at SchiffGold are still about 70 to 80% below where they were before Trump won the 2016 election. And some of SchiffGold’s competitors are faring even worse.

People are not buying gold and silver — at least not in the United States.”

Consider this, gold prices bottomed at $1,050 at the end of 2015. We’re up nearly $500 from that level today. And yet Americans still aren’t buying?

I don’t think you’re going to see the public moving into gold until it’s over $2,000 an ounce. And it’s going to get there. No question about it. It’s going to get there.”

Peter said the high in silver was close to $50. That was when gold hit $1,900. Peter said that if silver gets about $20 — and we’re close to that level now — it could quickly move to $50. Granted, it’s hard to make price predictions, but the dynamics are certainly in place.

Demand for silver was up last year and supply fell for the third straight year. And it appears silver mine production is continuing to fall. As we reported earlier this week, mine output fell significantly in three of the world’s top silver-producing countries through the first half of the year.

If you adjust silver’s $49 high for inflation, you’re looking at a price of around $150 per ounce. In other words, silver has a long way to run up. As one analyst put it, “With the long-term downside potential of silver very low versus its current valuation, the risk/reward is one of the best investments on the planet.”

Peter leads off this week with an episode covering last Friday’s stock catastrophe, Bitcoin’s recent performance, and the start of President Trump’s so-called “hush-money” trial.

Peter leads off this week with an episode covering last Friday’s stock catastrophe, Bitcoin’s recent performance, and the start of President Trump’s so-called “hush-money” trial. Peter’s back in Puerto Rico this week for his podcast after another week of record gold prices. In this episode, he discusses media coverage of inflation, this week’s CPI report, and Bitcoin’s weakening price relative to gold.

Peter’s back in Puerto Rico this week for his podcast after another week of record gold prices. In this episode, he discusses media coverage of inflation, this week’s CPI report, and Bitcoin’s weakening price relative to gold. This week Peter recaps another stellar week for precious metal. He also discusses Friday’s jobs report, commodity prices, and Bitcoin.

This week Peter recaps another stellar week for precious metal. He also discusses Friday’s jobs report, commodity prices, and Bitcoin. This week Peter returned from vacation, and he was just in time for a surge in the price of gold. He discusses the factors contributing to gold’s record prices, the similarities between today and the 1970s, and data pointing to future inflation in America.

This week Peter returned from vacation, and he was just in time for a surge in the price of gold. He discusses the factors contributing to gold’s record prices, the similarities between today and the 1970s, and data pointing to future inflation in America. This time Peter tackles Jerome Powell’s speech from Wednesday, in which he announced that the Fed is holding the federal funds rate between 5.25 and 5.5%. He also briefly discusses Bitcoin’s pullback and the media’s lies about Donald Trump.

This time Peter tackles Jerome Powell’s speech from Wednesday, in which he announced that the Fed is holding the federal funds rate between 5.25 and 5.5%. He also briefly discusses Bitcoin’s pullback and the media’s lies about Donald Trump.