This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

After Federal Reserve Chairwoman Janet Yellen’s congressional testimony, the markets are still convinced the Fed could begin to raise rates sometime this summer. This is just plain wishful thinking. The Fed can no more raise rates than it can borrow money into oblivion. The reason is simple: the Fed must maintain the pretense of being solvent to maintain its credibility as a financial institution.

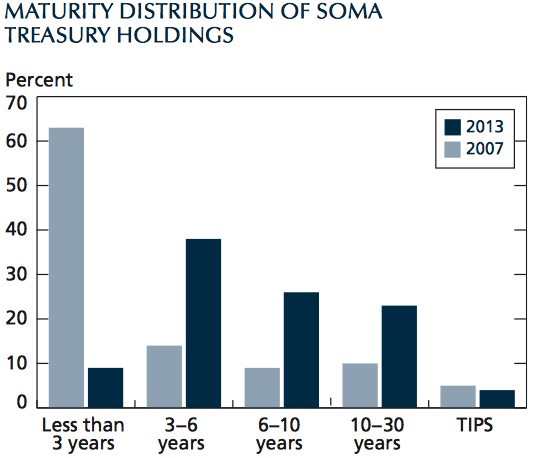

Think about the balance sheet of the Fed. Its assets are a mixture of government bonds, Treasury notes, and mortgage-backed securities. The dollars that the Fed issues to purchase those assets are its corresponding liability. Needless to say, it has purchased a lot of bonds since 2008 (QE1, QE2, QE3). So since 2008, its balance sheet has expanded on both sides.

This isn’t yet a problem, because of the duration of its assets and liabilities. Most of its assets – the bonds and mortgage debt – are long-term, with a rough average duration of over 10 years. Meanwhile, its liabilities are all short-term, current liabilities. These are deposited at the Fed by various banks, and the banks can demand them at any time.

Once again, Peter Schiff uses his latest podcast to dig into the real economic data of the United States. Here is a round up of the key figures that mainstream news ignores, while focusing almost solely on payroll numbers.

In Peter’s view, either the US economy is already in a recession, or we’re on our way there.

In 2014, a record number of Americans renounced their United States citizenship for the second year in a row. Even though exit fees are rising, more and more people are willing to jump through hoops to escape the American tax man. Indeed, our Chairman Peter Schiff even relocated one of his companies to Puerto Rico last year to reduce its tax burden. From his new condo in Puerto Rico, Peter shares his insights into this new American diaspora and how you can opt-out of overbearing government without leaving your country behind.

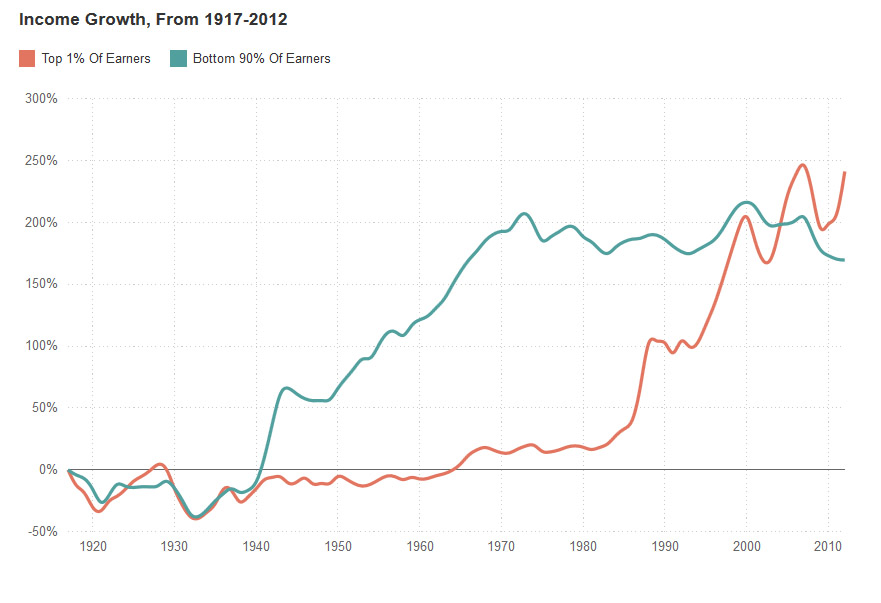

Income inequality has been a hot topic since the bailouts of the big banks following the 2008 financial crisis. A recent article from National Public Radio’s Planet Money shines a light on the history of the trend, which has only gotten worse in the past few years.

Beginning in the Great Depression, and continuing until about 1970, the average income of the bottom 90% of United States wage earners exploded. It grew more than 200%, while the top 1% saw just a tiny fraction of that income growth.

Beginning the 1980s, that trend reversed dramatically. Since then, the bottom 90% of Americans have had relatively stagnant income growth, while the top 1% has grown its income nearly 250%. What is NPR’s explanation for this?

In his latest video blog, Peter Schiff briefly reviews last week’s negative economic data. He then looks at a recent public interview with Alan Greenspan, who believes that the US economy is not nearly as strong as everyone would like to believe. While Greenspan blames this on Congress, he simultaneously credits the Federal Reserve for inflating the current stock market bubble. All this from an economist who once criticized the Fed for market manipulation. How the times have changed.

I think Alan Greenspan knows it’s going to end badly. That’s why he’s advocating that people buy gold. But in this particular interview, he’s trying to absolve the Fed, because he’s trying to absolve himself.”

After her testimony to Congress this week, the mainstream media reported that Janet Yellen has put the Federal Reserve on the path to raising interest rates. However, Peter Schiff digs into Yellen’s official testimony from this week, showing beyond a shadow of a doubt that the Fed hasn’t even begun to think about a rate hike. It’s all right there in Yellen’s official prepared remarks. Peter also addresses the ridiculous popular notion that inflation is necessary for economic growth.

The US Justice Department has begun to investigate whether 10 of the world’s largest banks have manipulated gold and silver prices. The Justice Department is just the latest in a series of financial regulators to investigate possibilities of precious metals manipulation, including the UK Financial Conduct Authority, Germany’s BaFin, and Switzerland’s competition commission WEKO. On top of that, there are a number of pending civil lawsuits in New York against some of these same banks for gold price rigging.

What should physical gold and silver investors take away from this news?

Gold surged more than 10% in January, but lost a lot of ground on news of continued strong jobs growth. Peter argues that Obamacare is skewing the employment data. To avoid the additional costs of full-time employees, businesses are cutting workers to part-time hours while hiring additional staff. But “job sharing” is a double-edged sword that will mean even bigger lay-offs when the market retrenches.

USAWatchdog’s Greg Hunter spoke with Peter Schiff this week. They discussed the intricate problems of Europe and Greece, the phony economic recovery in the United States, and how investors can protect themselves when wars break out. Peter also responded to the ongoing negative sentiment of gold bears who continue to predict a lower gold price despite evidence to the contrary.

Peter Schiff is flabbergasted that the financial media is reporting China’s large trade surplus as a negative for its economy, while America’s huge trade deficit is portrayed as a positive. Both China’s surplus and America’s deficit are blamed on the same thing – a strong currency. After debunking this misinformation, Peter moves on to tear apart the concept that America is running out of college educated workers. Just because college graduates have a lower unemployment rate, doesn’t mean high schoolers should hurry to go into debt for a PhD in Philosophy.