In his podcast yesterday evening, Peter Schiff shared his thoughts on the huge surge in the stock market over the past couple days. He also takes a look at the latest news from Switzerland. Just weeks after defeating an attempt to back the Swiss franc with more gold, the Swiss National Bank has set negative interest rates in an attempt to further weaken the franc. Finally, Peter digs back into Janet Yellen’s latest statements about the US economy and drop in the price of oil.

In his latest podcast, Peter Schiff talks about the Federal Reserve removing the phrase “considerable time” from its policy statement yesterday. While they technically did change the language, Peter points out that they then used some linguistic tricks to essentially maintain the same position on the possibility of future interest rate hikes. You can see for yourself in the quote from the Fed’s press release:

Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy. The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program in October…”

After picking apart the Fed’s statement, Peter tries to puzzle out the economic conditions that will justify an interest rate hike in the coming months.

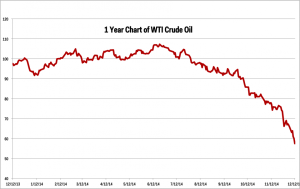

Peter Schiff’s new commentary at Euro Pacific Capital examines the supply and demand factors that could be influencing the plunging price of oil. If you want to listen to Peter discuss the economic repercussions of this possible bubble in black gold, listen to his podcast here.

The stunning 40% drop in the price of oil over the past few months has scrambled global economic forecasts, changed the geo-political landscape, and has severely pressured many energy sector investments. Economists are scratching their heads to determine if the drop is good or bad for the economy or whether cheap oil will add to or decrease unemployment, or complicate the global effort to “defeat” deflation. While all of these issues merit detailed discussions, the first question to address is if the steep drop is here to stay and whether energy prices will stay low enough, for long enough, to seriously reshuffle the economic deck.

Earlier today, we reported on the potential effect plunging oil prices could have on the Federal Reserve’s plans to raise interest rates. Peter Schiff addressed exactly this is problem in his latest podcast. While many people see lower oil prices as a boon to the economy (who doesn’t want to pay less to fill up their gas tank?), Peter explains why this is a narrow-minded analysis. If the oil boom was actually a bubble, it could have dire implications for the United States.

If you want to understand the fundamental issues at play with the plunge in oil prices that is rocking the financial world, you can’t miss this segment from the Peter Schiff Show.

I don’t believe the Fed… is going to allow that recession [from falling oil prices]. They’re going to do the only thing they can do to stop it. That is unleash a tidal wave of new money in QE4, which is going to be bigger than QE1, 2, and 3 combined…”

Ben Swann and Peter Schiff discussed the news of China surpassing the United States as the world’s largest economy. Peter explained why it’s only a matter of time before China and many other countries jettison the dollar as the world’s reserve currency. When that day comes, the US is in for a rude awakening.

Peter hopes that crisis will inspire Americans to re-embrace their free market roots and return to a sound currency backed by gold.

In his latest commentary with Euro Pacific Capital, Peter Schiff digs into all the poor economic data that the mainstream news completely ignores. He just brushes the surface, but there are far more than the few he mentioned in his podcast on the topic last week. Peter reminds us that there is more to an economy than GDP and jobs.

There can be little doubt that data releases rather than experience or intuition are driving the economic conversation. This is perhaps a function of the disconnection that many people feel about an economy that they no longer understand. Rather than trusting their own eyes or their own gut to form an opinion, it’s much easier to grab a set of convenient numbers. The big question then becomes what numbers you choose to look at and which you choose to ignore.

Last week, Peter Schiff defended the intrinsic value of gold by briefly explaining how many uses it has beyond bullion investment. Many people have no idea how integral gold is to products they rely upon every day, not to mention exciting technologies of the future.

People who argue that gold is becoming less useful in the modern world simply don’t understand the basic fact that the applications of gold are expanding every year, not shrinking. Either that, or they expect the human race to abruptly curtail its exploration of space, stop making high-end electronics, and find a more stable element for use in medicine. On top of that, gold detractors must assume that the age-old association of gold with prestige, success, and wealth is going to suddenly vanish from the earth.

So what makes gold so valuable outside of its monetary value?

In his latest video blog post, Peter Schiff dissects the latest jobs numbers. While the media paints a rosy picture of the economy with the employment numbers, Peter takes a look at the economic data that everyone seems to ignore.

Peter Schiff and Rick Santelli spoke today about Peter’s latest article published in the Washington Times. Read the article and then watch the video below.

Recent statements by Federal Reserve officials would lead just about anyone to believe that one of the bank’s central missions has always been to guard against the lurking threat of deflation. They warn that since official inflation has remained below the Fed’s 2 percent target for almost two years, the country is liable to fall into a stagnant morass unless the Fed acts boldly to hit its target. It may surprise many that this view is strictly a 21st-century development. The fear (some would say paranoia) regarding sub-2 percent inflation was nowhere in evidence in the past, even when inflation was lower than it is today.”

In December’s Gold Videocast, Peter Schiff responds to the Swiss voters’ rejection of the “Save Our Swiss Gold” initiative. He explains why the results of the referendum spell the end of a stable Swiss franc, but also the long-term success of gold. With no truly sound, safe-haven currencies left in the world, both Swiss and international investors will inevitably return to gold to protect their savings. Peter stresses that the Swiss vote is a wake-up call to the world: you can’t rely on central banks to protect the purchasing power of your currency. However, you can start your own, personal gold standard today.