Income Inequality and the End of the Gold Standard

Income inequality has been a hot topic since the bailouts of the big banks following the 2008 financial crisis. A recent article from National Public Radio’s Planet Money shines a light on the history of the trend, which has only gotten worse in the past few years.

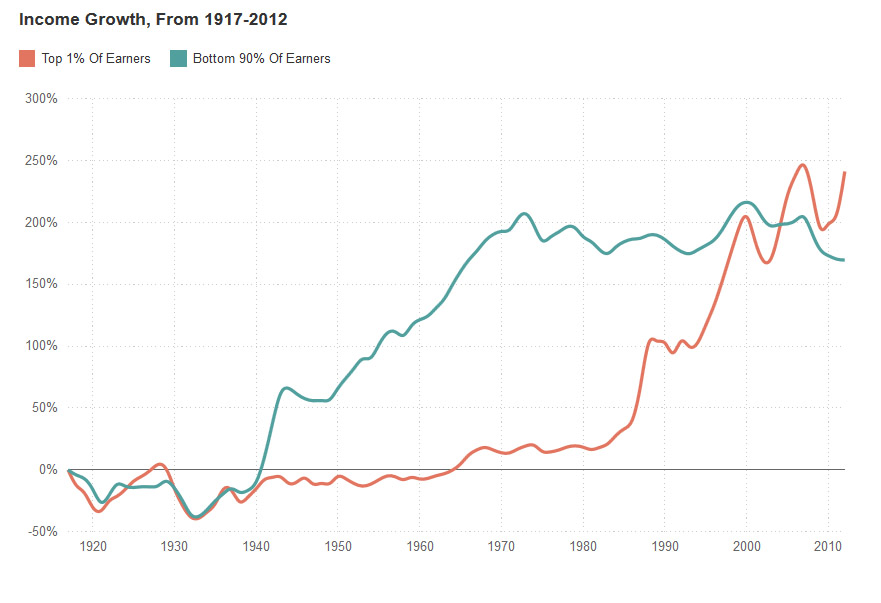

Beginning in the Great Depression, and continuing until about 1970, the average income of the bottom 90% of United States wage earners exploded. It grew more than 200%, while the top 1% saw just a tiny fraction of that income growth.

Beginning the 1980s, that trend reversed dramatically. Since then, the bottom 90% of Americans have had relatively stagnant income growth, while the top 1% has grown its income nearly 250%. What is NPR’s explanation for this?

…a combination of global competition, automation, and declining union membership, among other factors, led to stagnant wages for most workers.”

NPR simply blames the stagnant wages of America’s working class in the past four decades on shipping jobs overseas, technological advances, and a decline of unions. But NPR doesn’t take the next step of trying to explain these trends. Perhaps that’s because they would have to acknowledge the effects of central bank policies on America’s jobs picture.

What’s the most important date on the chart above? 1971 – the year Nixon closed the “gold window.” It was in this year that the US dollar officially become completely fiat. We could no longer exchange our paper money for gold.

This paved the way for the modern era of monetary manipulation by the Federal Reserve. Without a tie to the real value of gold, the US dollar becomes a much more fluid currency. Indeed, since 1971, the dollar has lost about 80% of its purchasing power. So not only are wages stagnant, but those wages buy less.

Even worse, as the Fed manipulates the dollar, it artificially inflates financial assets to benefit the financial elites. These same financial elites are the first to acknowledge the gains they reap from these policies. George Soros and Paul Singer said it not too long ago in Davos. Or watch this interview with Marc Faber who soundly thanks the Fed for padding his pockets with stock gains. However, he still warns that this era of central bank power will not end well.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

Leave a Reply