In his latest podcast, Peter Schiff reviews the latest economic data that indicates how poorly the economy is doing. Financial forecasts continue to be completely off-base, and many important data points have seen downward revisions. Meanwhile, the cost of basic necessities has gone up thanks to inflation. Peter expects the employment data is the outlier and will eventually catch up to the rest of these indicators.

In another interview on Yahoo! Finance, Peter Schiff contradicted the conventional narrative of the dollar’s future. He argued that the dollar’s brief, but dramatic dip this week is only a taste of what’s to come. Just like those who invested in subprime mortgages, people will get caught in the reversal and implosion of the dollar. This will likely come on the heels of massive consumer inflation thanks to the endless money-printing of global central banks. When this happens, investors will return to gold as a store of wealth. Peter pointed out that gold has no ceiling because there’s no limit to how low the dollar can sink.

Peter Schiff responds to the hubbub surrounding the Federal Reserve’s dropping of the word “patient” from its policy statement. Janet Yellen’s diction is meaningless, but if you look closely it also reveals that the Fed is far more dovish than people think. The Fed can play all the mind games it wants with the markets, but it can’t stop the inevitable crash of the US dollar. Remember — when you know how the game is going to end, play for the endgame.

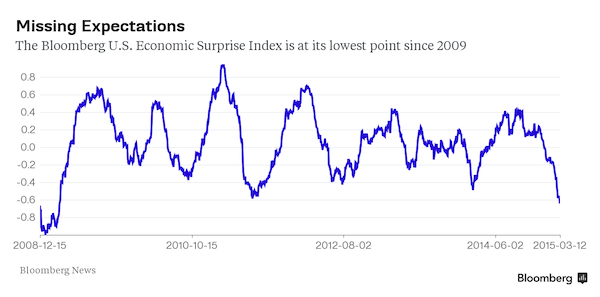

The Bloomberg ECO US Surprise Index is at its lowest since 2009, which means that forecasts for economic data haven’t been more wrong for six years. Bloomberg asks, “Is this a sign of unanticipated weakness in the economy?” At first, it seems like the mainstream media is actually waking up to the fact that the American economic recovery is bogus. However, the piece goes on to give a number of excuses for why nearly every piece of economic data beyond jobs numbers can be ignored.

Peter Schiff, on the other hand, has been answering Bloomberg’s question directly for months — yes, this is a sign of economic weakness and no, it’s not unanticipated. In his latest podcast, Peter asks the bigger question: Apart from employment figures, why are we seeing some of the worst economic data since the depths of the 2008 financial crisis?

In his latest podcast, Peter Schiff explains why the Dow Jones and S&P 500 are now negative on the year. The markets are eating up Janet Yellen’s talk of raising rates, but she’s painting herself into a corner with her hypocrisy. Peter also argues that the Obama administration’s plan to let student loans be discharged in bankruptcy is yet another bailout that will only inflate the debt bubble.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

After Federal Reserve Chairwoman Janet Yellen’s congressional testimony, the markets are still convinced the Fed could begin to raise rates sometime this summer. This is just plain wishful thinking. The Fed can no more raise rates than it can borrow money into oblivion. The reason is simple: the Fed must maintain the pretense of being solvent to maintain its credibility as a financial institution.

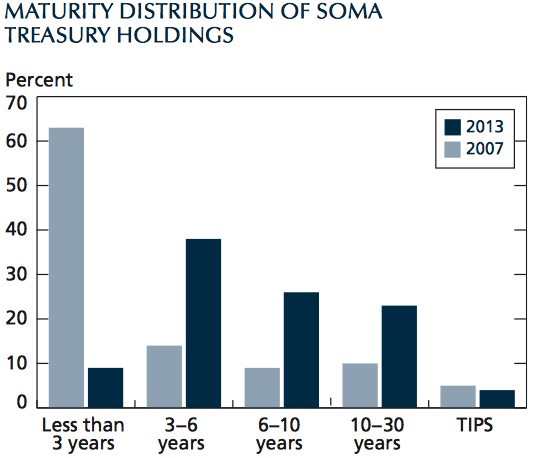

Think about the balance sheet of the Fed. Its assets are a mixture of government bonds, Treasury notes, and mortgage-backed securities. The dollars that the Fed issues to purchase those assets are its corresponding liability. Needless to say, it has purchased a lot of bonds since 2008 (QE1, QE2, QE3). So since 2008, its balance sheet has expanded on both sides.

This isn’t yet a problem, because of the duration of its assets and liabilities. Most of its assets – the bonds and mortgage debt – are long-term, with a rough average duration of over 10 years. Meanwhile, its liabilities are all short-term, current liabilities. These are deposited at the Fed by various banks, and the banks can demand them at any time.

Once again, Peter Schiff uses his latest podcast to dig into the real economic data of the United States. Here is a round up of the key figures that mainstream news ignores, while focusing almost solely on payroll numbers.

In Peter’s view, either the US economy is already in a recession, or we’re on our way there.

In 2014, a record number of Americans renounced their United States citizenship for the second year in a row. Even though exit fees are rising, more and more people are willing to jump through hoops to escape the American tax man. Indeed, our Chairman Peter Schiff even relocated one of his companies to Puerto Rico last year to reduce its tax burden. From his new condo in Puerto Rico, Peter shares his insights into this new American diaspora and how you can opt-out of overbearing government without leaving your country behind.

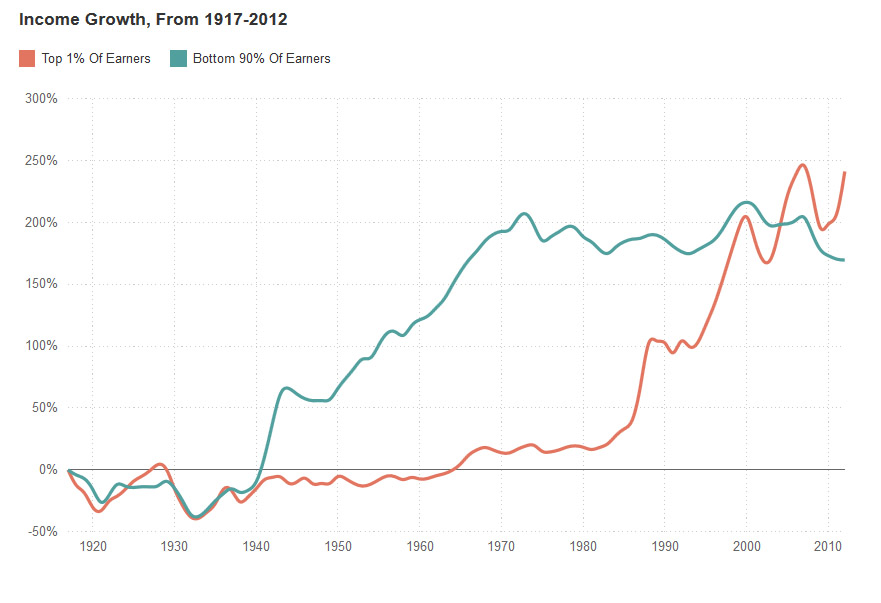

Income inequality has been a hot topic since the bailouts of the big banks following the 2008 financial crisis. A recent article from National Public Radio’s Planet Money shines a light on the history of the trend, which has only gotten worse in the past few years.

Beginning in the Great Depression, and continuing until about 1970, the average income of the bottom 90% of United States wage earners exploded. It grew more than 200%, while the top 1% saw just a tiny fraction of that income growth.

Beginning the 1980s, that trend reversed dramatically. Since then, the bottom 90% of Americans have had relatively stagnant income growth, while the top 1% has grown its income nearly 250%. What is NPR’s explanation for this?

In his latest video blog, Peter Schiff briefly reviews last week’s negative economic data. He then looks at a recent public interview with Alan Greenspan, who believes that the US economy is not nearly as strong as everyone would like to believe. While Greenspan blames this on Congress, he simultaneously credits the Federal Reserve for inflating the current stock market bubble. All this from an economist who once criticized the Fed for market manipulation. How the times have changed.

I think Alan Greenspan knows it’s going to end badly. That’s why he’s advocating that people buy gold. But in this particular interview, he’s trying to absolve the Fed, because he’s trying to absolve himself.”