Last week, I published an article on the causes and consequences of negative interest rates. In it, I talked briefly about how negative yields hold significant implications for gold as an asset class. In this followup article, I will explain why that is.

Capital and Negative Yields

Capital in waiting – capital sitting on the sidelines waiting for a good investment opportunity – typically gets parked in government bonds. This is true for a number of reasons. Bonds are less speculative compared to most assets. The only risks are a sudden rise in yields or a fall in the denominated currency if it’s a foreign bond. Of course, some governments and jurisdictions are less appealing than others, as anyone with exposure to Greek bonds will tell you.

Despite a less than perfect track record, government bonds are still considered the “risk free” asset. Setting aside whether they truly are“risk free” (they aren’t) they are certainly less risky than buying a stock, or trading a commodity or a piece of real estate. In the former two options you risk immediate price exposure with every tick, and in the latter, there are natural liquidity restraints. Additionally, the bond market is the only market big enough and liquid enough to absorb this kind of capital. If you are thinking about money in the bank, make no mistake, there are little to no physical cash reserves sitting in the bank. All the deposited funds are moved into another asset at the bank’s discretion within regulatory restraints.

Perhaps you are familiar with David Stockman and his mind-bogglingly long in-depth economic analyses topped off with blustery bombastic titles. Clearly, he’s an incredibly smart guy, and he’s produced some great stuff. But something is off in this recent article, and unfortunately, it betrays a fundamental lack of understanding of what’s really going on in the financial system.

It only took the first two paragraphs of his tirade for him to go astray:

Simple Janet should have the decency to resign. The Fed’s craven decision last week to punt on interest rate normalization is not merely a reminder that she is clueless and gutless; we already knew that much. That’s right. In the midst of vastly inflated and combustible financial markets, the all-powerful Fed is being led by a Keynesian school marm stumbling around in an explosives vest. She apparently has no idea that a 38 bps money market rate is not a pump toggle on some giant bathtub of GDP; it’s an ignition fuse that is fueling the greatest speculative mania in modern history.”

Essentially, Stockman is calling for Yellen’s resignation because all the economic data is pointing toward the appropriateness of a Fed rate hike after almost a decade of ZIRP. Instead, at the latest Fed meeting Yellen, “paused” the rate normalization, and, as such, is merely fanning the flames of the current speculative bubbles at work in the economy that will inevitably burst.

Stockman makes two errors in his analysis.

Central Banks are under the mistaken belief that negative interest rates could be the magic kiss which turns their toad economics into Prince Charmings. Why exactly do they think this? What makes Draghi, Kuroda, and others think imposing negative interest rates will stimulate credit and lending in their respective economies?

It is important to understand the logic behind this historic moment in global monetary history. Negative interest rates are unprecedented and show how far we have gone off course in terms of policy related to money and credit markets. They are already having a tremendous effect in several European countries and Japan, and they may eventually be coming to the US. Negative rates hold significant future implications for gold as well.

Unfortunately, too few people remember or know of the story of MF Global Inc.

MF Global was one of the most respected primary dealers for stock, bond, and futures trading. The firm had been operating over 200 years, formerly known as Man Financial. In 2010, the company was directed by Jon Corzine, who was a senator, governor, and at one time was the CEO of Goldman Sachs. MF Global was second-to-none, and it serviced some of the wealthiest private traders and institutions.

In the fall of 2011, 38,000 accounts were adversely affected when MF Global illegally transferred $1 billion in funds out their clients’ trading accounts. MF Global used these funds to cover the company’s personal trading losses after some European bond investments went belly-up.

Why Bother with Cash When You Can Own Gold? – Peter Schiff’s Gold Videocast with Albert K Lu (Video)

The conventional knock on gold is that it is inconvenient and expensive to hold, and doesn’t provide yield. But as Albert K Lu shows in his latest Gold Videocast, in a world of negative interest rates, this argument is becoming applicable to cash.

For instance, the world’s second largest reinsurance company has decided to pull cash from banks and store it in its own vaults to avoid negative rates. If you are going to do that, why not buy gold? Especially in a very weak economic environment.

I think people are figuring out that if you’re going to go to all this trouble holding physical bills, taking your deposits out of the bank where they once were very liquid and apparently very safe, and go to the trouble of vaulting them at home or in your company’s vaults as in Munich Re, maybe you should start thinking about gold.”

In his book Crash Course: The Unsustainable Future of Our Economy, Energy & Environment, author Chris Martenson describes the three types of wealth. Following is a brief breakdown of those three wealth categories and in which types you should focus your investment strategy. (For further reading on this topic, I suggest Crash Course and Second Chance by Robert Kiyosaki. Both books were referenced in the following article.)

The three types of Wealth are: primary, secondary and tertiary.

For international customers who want to invest in physical gold and silver, taking delivery of metals can be an irksome situation.

The cost of shipping isn’t the problem. Shipping and insuring gold internationally is actually quite affordable, and SchiffGold offers low international shipping rates to over 60 different countries.

However, the real problems occur at the border of the receiving country. Despite international customs regulations which allow .9999 pure gold to remain free from value added taxes or duties, many customs officials will charge a fee to have the metals released. Sometimes this fee is as large as 20% of the total value of the package. This is particularly a problem in Central and South America where corruption at the border is rampant.

Many people have been talking recently about the “war on cash.” With policymakers seriously talking about eliminating cash, it can be worrisome. But there is a way to avoid the consequences of the “war on cash. You just need to pick the right strategy.

With the endless lowering of interest rates and the possibility that they could turn negative, there is more incentive than ever for people to pull their dollar savings from banks and just hold on to the paper cash at home. After all, why risk your dollars in a bank that yields zero return or even charges you to hold your money? As a result, people are buying up safes, pulling their dollars out of the bank, and storing them at home.

They are kind of missing the point though. As this article points out, if interest rates are making you want to hold your money outside the banking system, why not just get REAL money and hold it outside of the banking system? Why not just buy physical gold and silver coins and bars? If you are going to buy a safe, THAT’S what you should be storing in it.

With apologies to Freddy Mercury and Queen, it looks like another one has just bit the dust.

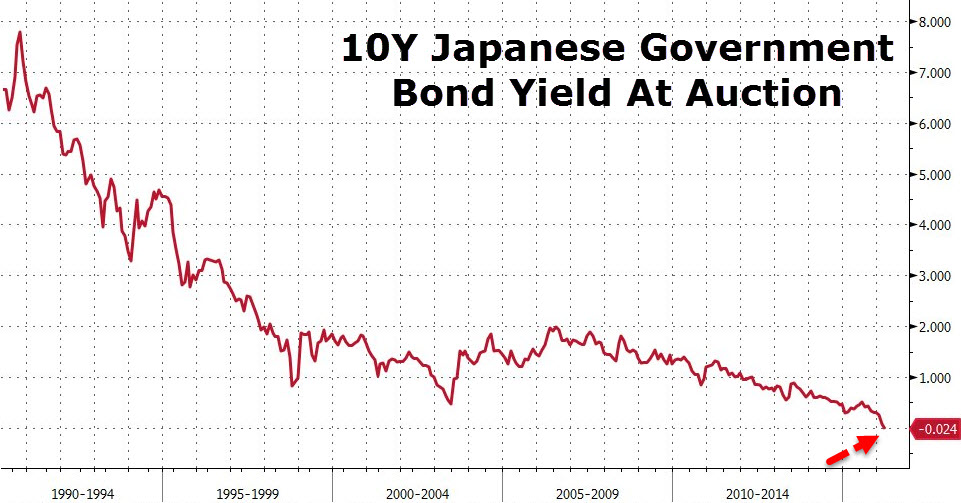

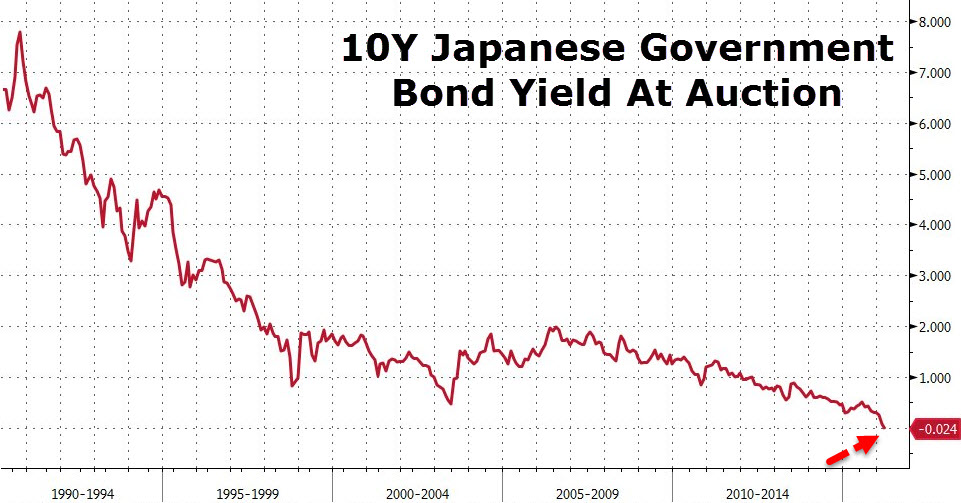

You can now add the Japanese central bank to the list of banks that have ventured deep into negative interest rate territory with the sale of a negative rate bond.

The Swiss are already languishing in that territory with negative rates out on their 20 year bond – if you can believe it. Steve Barrow, a G10 strategist at Standard Bank tells us that there will be others soon enough. He contends that, “Germany will get there as well, and yields will continue falling, going negative where they aren’t negative.”

Money is not a collector item, and buyers should beware of Scammers trying push buyback guarantee contracts on customers for products they should never be considering in the first place.

Despite our efforts to reveal the most common gold scams, there always seems to be a new trick up the gold scammer’ sleeves. At this time, we are hearing about a lot of companies offering special buyback guarantees or special contracts that “ensure” clients a buyback price on the products they are selling.

At first glance, this is all sounds good. Who doesn’t want the added security of a contractual agreement to buy back a certain product at a later date? However, upon closer inspection, such an agreement is a proverbial wolf in sheep’s clothing.