A new study by the Evans School of Public Policy and Governance shows Seattle’s minimum wage increase has also increased unemployment. No surprise there given what happened in Puerto Rico. Basic economics states the higher the price of something, the less that something will be purchased. In the case of Seattle’s experiment of increasing their minimum wage to $15 an hour, it seems that something was low-skilled jobs.

Admittedly, Seattle has experienced an economic boom since the city first instigated its stair-stepped wage increase. One of the city’s biggest growth sectors is in the labor market. However, according to the Seattle Times, “Much of that success, though, can be attributed to trends separate from the minimum-wage law itself, such as the growth of Seattle’s tech sector and its construction boom.”

Admittedly, Seattle has experienced an economic boom since the city first instigated its stair-stepped wage increase. One of the city’s biggest growth sectors is in the labor market. However, according to the Seattle Times, “Much of that success, though, can be attributed to trends separate from the minimum-wage law itself, such as the growth of Seattle’s tech sector and its construction boom.”

As precious metals resume their long-term bull market in 2016, investors are once again asking the perennial question – should I buy ETFs or physical metals?

With the gold price on the rise, gold funds and stocks recently experienced the largest one-week inflows on record. Mainstream investors seem to prefer “paper gold” in times of uncertainty. But are these assets the right choice for your portfolio?

Or worse – could ETFs even cost you money over time?

SchiffGold now has the definitive guide to precious metals ETFs like GLD and SLV. In ETFs vs. Physical Precious Metals: Comparing GLD to Gold, we get to the bottom of the debate. This FREE white paper will teach you:

- The misunderstood costs of gold and silver ETFs.

- The potential effects of economic crises on various assets.

- Which asset offers no counterparty risk and financial privacy.

SchiffGold is excited to announce that we will be merging with GoldMoney (formerly Bitgold), a rapidly growing financial technology company that offers a diverse variety of gold-based products. By combining forces, Peter Schiff will be joining the likes of well-known gold experts, James Turk and Eric Sprott.

This joint venture will enhance the services SchiffGold can offer our customers and the reach we will have on the global market. Our formula will stay the same – SchiffGold will continue providing personal service to our customers, expert 1-on-1 guidance, and among the lowest pricing for physical gold and silver in the industry.

The GoldMoney/SchiffGold team share a like-minded passion for gold and offering the highest quality services to our customers. With the help of our existing and future customers, we look forward to re-introducing gold into the modern-day-world.

In this video Peter Schiff explains the details of the merger and touches on the exciting enhancements of GoldMoney’s offerings. Peter Schiff speaks with GoldMoney’s co-founder and commodity king Josh Crumb. This fun and highly educational video is a must watch!

If you’ve been waiting to buy gold and silver the wait is over.

In his most recent Gold Videocast, Peter Schiff looks at how the price of silver has just surged to a high it hasn’t seen since January of last year. In the aftermath of Brexit, Peter takes this as a good sign that the prices of both gold and silver are about to really break out and begin moving up in significant bursts. Now that gold is holding steady above $1,300 an ounce, investors who have been waiting on the sidelines to buy should consider acting soon – before sellers start hoarding their metals as the prices move up.

Peter’s forecast is based less on the United Kingdom leaving the European Union, and more on what is going to happen in America. Peter reiterated what he said in his recent appearance on CNBC’s Trading Nations: the Brexit basically gave Janet Yellen a get out of jail free card:

I believe the Federal Reserve is going to use the turmoil in the markets that followed that vote as the excuse it’s been waiting for not only not to raise rates, but to cut rates and to launch QE4. In fact, that is the main reason, I believe, that the markets have recovered somewhat from their Brexit related losses. Because if you look at the financial markets, they are now pricing in for the first time a higher probability that the next move by the Federal Reserve will be to cut rates, not to raise them.”

According to Peter Schiff, the Brexit vote is just what the doctor ordered for Janet Yellen.

Stocks plunged and gold surged in the wake of Brexit. As of Monday morning, gold was up more than 5%. Most analysts think gold went up because of the UK’s decision to leave the European Uniion, but Peter said even before the vote that he thought it didn’t really matter. In fact, he called the Brexit vote a “non-event” as far as its long-term impact on the gold market.

In his latest podcast, Peter reiterated the point. Yes, gold is going up, but he said it was going up regardless of the outcome of the referendum:

You know, a lot of people think the reason gold is up is because Brexit. I mean, that was a catalyst for the rally today, but it was going up anyway…I think even if they had voted to remain, I believe gold would have gone up. I don’t think it mattered. But this is an easy excuse for people who don’t understand why the gold is going up; they can just chalk it up to the uncertainty and not look at all the things we’re actually certain of in the US economy, and with the Fed and the dollar that are the real driving force behind gold.”

Peter went on to look at some recent economic news lost in all of the Brexit talk, and said the outcome of the vote was great news for Janet Yellen:

On his most recent Peter Schiff Show podcast, Peter broke down Janet Yellen’s recent testimony before Congress.

He focused on her apparent cluelessness about the state of the US economy and talked in depth about why the Fed won’t raise rates. He also noted that Yellen’s comments about the impossibility of stagflation seem to indicate she has no clue about Murphy’s Law – what can go wrong will.

Peter went on to reiterate a point he made on his recent appearance on CNBC – that the Fed will ultimately sacrifice the dollar on the altar of the stock market and that the US economy is heading toward a currency crisis.

Peter pointed out that somebody asked Yellen about Donald Trump’s comments regarding a Treasury default. She said, “Yes. It would be a real disaster if there was a haircut on US Treasuries.” Peter then zeroed in on the real looming disaster.

Janet Yellen said it would be a real disaster if there was a haircut on US Treasuries. That’s a disaster as far as the Fed is concerned. But the Fed thinks nothing about giving people a crewcut, in fact shaving them bald, when it comes to a haircut on the dollar…When the Treasury defaults, or there is a restructuring, the only people who are hurt are the people dumb enough to buy the Treasuries in the first place. But when Janet Yellen runs the printing presses non-stop, when we have massive inflation, or hyperinflation, everybody dumb enough to have dollars gets hurt.”

All eyes have turned toward Great Britain with the Brexit vote looming this week. A lot of people are speculating about what Britain’s potential exit from the EU means for gold. Peter Schiff says in the long-run, it doesn’t really matter.

In his most recent podcast, Peter said he thinks gold will go up no matter what Britain does. The yellow metal is on the rise because of what is happening in the US, not in Europe – specifically what is happening with the Federal Reserve.

And what is happening with the Fed? Basically nothing. In fact, Peter said an alien invasion is more likely than an interest rate hike in July.

He went on to point out that interest rates are actually lower now than they were at the depths of the 2001 economic downturn after the dot-com collapse and 9/11. In other words, this so-called recovery is weaker than most recessions. If this recovery is weaker than your typical recession imagine what the next recession is going to be like.

The bottom line is all of this is good for gold.

We’ve had this pretty good run-up in the price of gold with everybody expecting the Fed to hike rates. You know, they’ve been dialing back when they believe those hikes are coming, but the anticipation is still for higher rates, just when. But imagine how much stronger gold is going to be when people no longer believe in the Tooth Fairy…they no longer believe that we are going to get higher interest rates and they start factoring in lower interest rates, they start factoring in quantitative easing. And not just factoring it in, but they have to absorb it because the Fed is doing it.”

The Federal Reserve kicks off its Federal Open Market Committee meeting Tuesday. Just a couple of weeks ago, it was a foregone conclusion that the Fed would announce a rate hike during the meeting. But after the shockingly bad May employment report, most agree the interest rate increase is off the table.

In fact, Peter Schiff says this meeting is going to be a dud.

In his most recent podcast, Peter said the Fed will use the Brexit as the excuse as to why it is not going ahead with the rate hike, but that isn’t the reason at all:

Again, I just think all that stuff is an excuse. I mean, they’re really concerned about the US bubble-economy and the problems domestically, but they don’t want to acknowledge that. So, they want to rationalize it or blame things on problems abroad because that doesn’t play as badly at home.”

This article was submitted by Joel Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Joel Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

When central bankers talk about gold, it’s usually with an attitude of disdain. So, why do they hate gold so much?

The Federal Reserve operates under a dual mandate. It must maintain price stability while also simultaneously promoting maximum employment.

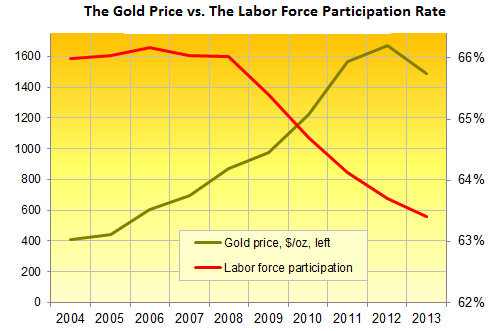

The Fed hates it when the price of gold rises because it correlates with a rising unemployment rate.

Gold also reveals the weakness in the US dollar and the Fed’s failure to stabilize prices. For this reason a rising gold price is an embarrassment to the Federal Reserve as it undermines its purposes.

With May’s shockingly bad jobs report, it’s pretty much a forgone conclusion that a June Federal Reserve rate hike is off the table. After the report came out Friday, Peter Schiff stuck a fork in the June hike possibilities in his SchiffReport Video Blog.

Now with the June rate almost certainly a no-go, pundits are starting to look ahead to later in the summer or this fall. But Peter, along with some like-minded people such as Jim Grant, believes the Fed won’t raise rates at all. It simply can’t. In fact, Peter argues that the next move will be rate cuts and another round of quantitative easing:

This is just the beginning. When people actually figure out the box that we’re in – because they still think the Fed is going to raise rates. Now they’re saying ‘OK, maybe they’ll raise rates in July, or maybe they’ll raise rates in December.’ Wait until the conversation turns to rate cuts. Wait until the conversation turns to QE4, or negative interest rates. Wait until people think that I was right from day one, that the Fed checked us into a monetary roach motel, that there is no way out of this monetary policy.”