This article was submitted by JD Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

One of the common questions we hear from gold buyers is, “Is it possible that the government might come after my gold and confiscate it?”

In a time when the governments are waging a war on cash, it’s not hard for people to imagine that a war on gold is next.

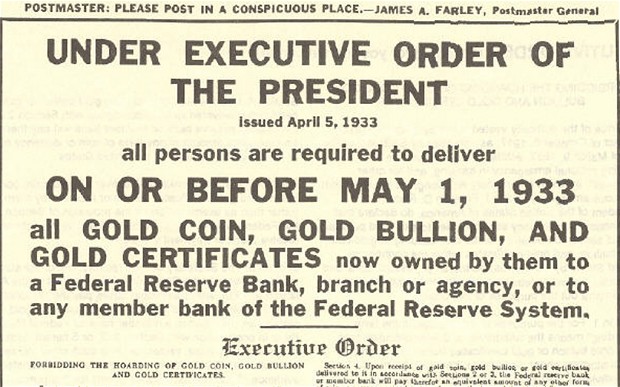

There is some precedence for this, after all. On April 5, 1933, Franklin D. Roosevelt’s Executive Order 6102 “[forbade] the Hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” Americans who owned gold were told to deliver their gold to the bank and in exchange receive paper dollars of equivalent value, $20.67 per ounce at the time.

To be very clear though, contrary to common belief, the government did not conduct a widespread seizure of gold, nor did it go door-to-door nor systematically raid safety deposit boxes. While a $10,000 fine and ten year prison sentence threatened the masses into obedience, only a handful of sting operations were conducted against a few offenders to serve as an example.

Despite some good numbers in April, a look at the fundamentals indicates the rout in retail will likely continue long-term.

Mainstream media wants us to think that our economy is still humming along. With the stock market recovering from a recent drop, unemployment numbers staying steady, and other areas of the globe dealing with much greater issues than the US, most people can be forgiven for nodding their heads in agreement.

But there are clearly serious issues plaguing the economic health of this nation. Take for instance the area of retail.

The retail sector has suffered mightily, as this so-called recovery, the weakest on record, has not delivered as advertised. Consumers are clearly in no mood to spend these days. Instead, they are tightening their belts and paying off credit cards.

In my latest post titled Inflation: A Semantic Change Worth Noting, I briefly reviewed the changing connotation of the terms ‘inflation’ and ‘deflation.’

In this final post in my 2-part series on inflation and banking, I look at the inflation process who whom it benefits.

The inflationary process is facilitated by two means: expanding the Federal Reserve’s balance sheet, and through credit expansion via fractional reserve banking.

As the Fed buys assets, it creates the money to purchase them out of nothing but a promise. This is what most TV pundits refer to as “printing money.” The larger the Fed’s balance sheet grows, the more money must be created in order to finance these purchases.

Are Wall Street banks finally getting on the right side of the gold trade?

In an interview with CNBC, Solita Marcelli, global head of fixed income at JP Morgan, revealed that the Wall Street investment bank is recommending that clients position themselves for a “new and very long” bull market in gold.

She explained that negative interest rates around the world are making gold a more attractive investment. Since gold is a non-yielding asset and has minimal storage costs, it actually compares quite favorably with the increasing number of negative yield bonds on the global stage. It has a positive carry.

In light of the economic malaise around the United Kingdom, the Bank of England may be releasing additional monetary stimulus in the near future. They will do this in response to increased unemployment rates and lack of private investing.

But the BoE is waiting on a June 23 referendum in which Britain and will decide whether or not to leave the European Union before taking action. The BoE is worried about the possible negative economic consequences this decision will have on its economy. Businesses have already been putting investments on hold until after the vote is has been decided. Mark Carney, the governor of the bank of England and Chairman of the Monetary Policy Committee (MPC), said the pending vote on what has become known as Brexit is weighing on growth and clouding the economic outlook.

The monetary landscape of today looks pretty grim. We are in the middle of the perennial decline in the rate of interest. Central bankers are convinced they can get us all out of this mess. But can they really?

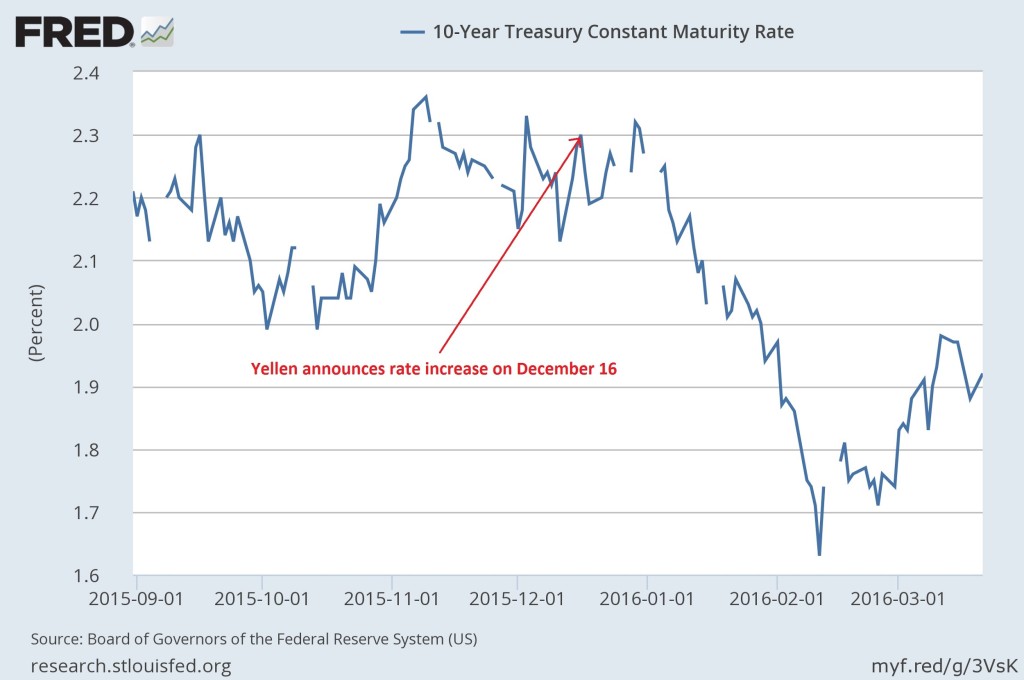

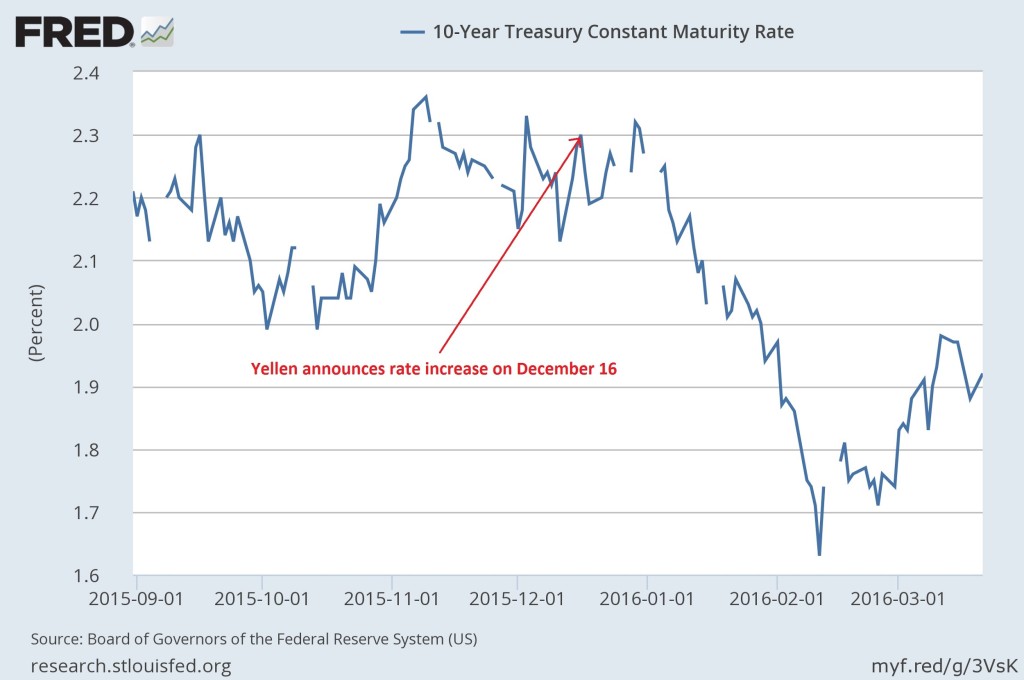

Janet Yellen timidly tried to go against the decade long trend by raising rates at the end of last year. It has not panned out so well. In fact, rates actually declined despite her announcement and subsequent plan to keep raising rates throughout the year.

Zooming out a bit we get a much clearer picture of the long term trend.

Due to the high level of response from our readers to the first article we posted on the benefits of our low cost vault storage solutions, we wanted to follow up and delve into the details of how to buy and sell gold and silver stored in a domestic or international vault.

To begin with, creating a storage account through our storage partners is a simple and easy process. Individuals as well as corporations, LLC’s, trusts, partnerships and other legal entities, can open an account. There is a one-page form to fill out, a couple of identification documents to provide, and in about two to three business days, your storage account will be opened. As our website details, we have domestic storage locations here in the US in addition to strategic international jurisdictions abroad.

Once the storage account is created and you have your assigned account number, you can then proceed to buy your physical metals from our firm.

You know the old saying. “There’s a sucker born every minute.”

Sadly, many Americans have been suckered into thinking their pension was going to provide a stable and comfortable retirement. But government mismanagement and central bank monetary policy are quickly turning that retirement dream into a nightmare.

Pensions have been a major contributor to the Greek financial crisis, and the American system is looking increasingly Greek.

Just last week, Central States Pension Fund, one of the largest pension funds in the nation, filed an application to cut participant benefits. Central States handles retirement benefits for current and former Teamster union truck drivers across various states including Texas, Michigan, Wisconsin, Missouri, New York, and Minnesota. And in Illinois, pensions are underfunded to the tune of $111 billion.

This is not just an American phenomenon. A UK pension fund is also having serious issues and is slashing benefits.

On Tuesday, the Obama administration announced that the federal government will open the door to forgive nearly 400,000 student loans. According to a MarketWatch report, if every eligible debtor takes advantage of this pathway to forgiveness, it will total more than $7.7 billion:

The Department of Education will send letters to 387,000 people they’ve identified as being eligible for a total and permanent disability discharge, a designation that allows federal student loan borrowers who can’t work because of a disability to have their loans forgiven. The borrowers identified by the Department won’t have to go through the typical application process for receiving a disability discharge, which requires sending in documented proof of their disability. Instead, the borrower will simply have to sign and return the completed application enclosed in the letter.”

According to MarketWatch, about 179,000 of the borrowers eligible for discharge under the program are already in default. A group of about 100,000 are at risk of having their tax refunds or Social Security checks garnished to pay off the debt.

It’s important to keep in mind this money doesn’t just disappear into thin air. The US taxpayer is ultimately on the hook for every forgiven dollar.

We hear on the news all the time, “The Fed is fighting deflation,” or, “Central banks are responsible for maintaining a healthy 2% inflation rate.” But what exactly is the Fed fighting? What exactly is inflation and deflation?

The concepts of inflation and deflation have been completely misconceived by the public and economists alike. Back in grad school I was in the middle of class, and I realized the definition of inflation used by my professor was different than what I had originally learned. In fact, the definition given depended on whom I asked, or which book I read.

One can look up the definitions in any Webster’s dictionary published from 1864 through 2003 and find inflation defined as: “Undue expansion or increase, from over-issue; — said of currency.” This definition is seen in older versions of the American College Dictionary describing inflation as “Undue expansion or increase of the currency of a country, especially by the issuing of paper money not redeemable in specie.”