Negative Interest Rates Positively Driving Gold Demand

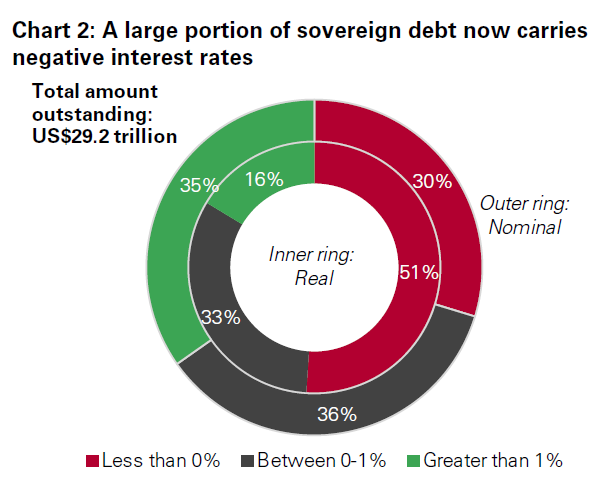

More than half the world’s sovereign debt now carries negative interest rates, and data keeps coming in confirming that it is driving demand for gold.

A couple of weeks ago, CNBC reported central bank action appears to be rejuvenating gold in Europe, as the entrenchment of negative interest rates makes depositing cash in banks less and less rewarding. Now we have hard data reported by Bloomberg confirming a similar spike in Japanese gold demand since that country’s central bank plunged interest rates into negative territory earlier this year:

Gold sales surged in Japan through March after the country’s move to set negative interest rates sent investors scurrying for a shelter, a further sign that global central bank policy of keeping borrowing costs low or below zero is stoking demand for bullion. Bar sales climbed by 35% to 8,192 kilograms in the three months ended March 31 from a year earlier, Tanaka Kikinzoku Kogyo K.K., the country’s biggest bullion retailer, said in a statement Thursday.

The surge in gold purchases since the Bank of Japan’s interest rate move comes on top of a significant increase in demand last year. Consumer demand for the yellow metal almost doubled to 32.8 tons in 2015, up from 17.9 tons a year earlier.

More than half of the world’s sovereign debt now carries negative interest rates. The European Central Bank, Denmark, Switzerland, and Sweden, along with Japan, all currently have negative interest rates, and there is no sign that they will rise any time soon. Janet Yellen has even said that the US Federal Reserve will consider negative rates if economic conditions dictate:

Potentially anything – including negative interest rates – would be on the table. But we would have to study carefully how they would work here in the US context.”

The World Gold Council recently released a report on gold in a negative interest rate environment, highlighting two important points:

- Gold returns in periods of low rates are historically twice as high as their long-run average

- Investors may benefit from increasing their gold holdings up to 2.5 times, depending on the asset mix, even under conservative assumptions for gold.

Simply put, the report recommends to buy gold:

Looking forward, government bonds are likely to have limited upside, due to their low-to negative yields and, in our view, would be less effective than gold in mitigating risk, ensuring portfolio diversification, and helping investors achieve their long-term investment objectives. Portfolio analysis suggests that gold allocations in a low rate environment should be more than twice their long term average. We believe that, over the long run, negative interest rate policy may result in structurally higher demand for gold from central banks and investors alike.”

As SchiffGold Precious Metal Specialist Dickson Buchanan pointed out in a recent article, as opportunities for yield in the marketplace decrease, investors have to consider the adverse effects of being charged a negative yield to play it safe in the bond market. In such an environment, non-yielding assets, which at one point looked unattractive, begin to look much more attractive compared to negative yielding bonds – and gold is the largest non-yielding asset in today’s financial markets.

Precious metals also provide the opportunity to protect your wealth while maintaining complete privacy. You just need to understand the rules. The SchiffGold Guide to Tax-Fee Gold & Silver Buying makes it easy. Download the free report HERE.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Leave a Reply