Why Does the Fed Hate Gold?

This article was submitted by Joel Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Joel Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

When central bankers talk about gold, it’s usually with an attitude of disdain. So, why do they hate gold so much?

The Federal Reserve operates under a dual mandate. It must maintain price stability while also simultaneously promoting maximum employment.

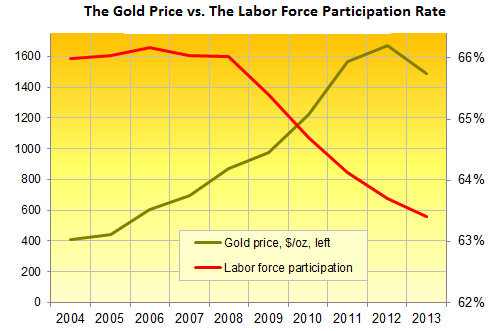

The Fed hates it when the price of gold rises because it correlates with a rising unemployment rate.

Gold also reveals the weakness in the US dollar and the Fed’s failure to stabilize prices. For this reason a rising gold price is an embarrassment to the Federal Reserve as it undermines its purposes.

The hatred of gold is nothing new. When it operated on a gold standard, the US government was limited in terms of its ability to pursue deficit spending. It could only accrue so much debt. The gold standard forced the practice of austerity. When the government abandoned the gold standard, it gained the power to finance any national expense by simply borrowing from the Federal Reserve. Today, no amount gold is necessary for the Fed to purchase treasury bonds. It is blessed with the ability to expand their balance sheet with zero limitations.

Simply put, gold limits the power and influence of central bankers. No wonder they hate it.

Despite what the central bankers tell you, there are a lot of reasons to buy gold. Download SchiffGold’s Free White Paper: Why Buy Gold Now?

Back in the day when Alan Greenspan’s economic philosophy fell more in line with the Austrian School of Economics, he understood what gold meant to the government. Greenspan wrote in his 1966 essay Gold and Economic Freedom:

This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

Gold falls under the true definition of money. Gold neither gains nor loses wealth, but acts as the measuring stick against every action of the Federal Reserve. Since the abolition of the gold standard, it is well known that the US dollar has depreciated by 98.5% in comparison to gold.

At the end of the day, it’s important to know the Fed will never have a keen attitude toward gold. Central bankers will always downplay the significance of the gold price appreciating, and they will also always over-emphasize the significance of the gold price falling. By extension, institutions that are influenced by the Fed will also condemn gold out of their own self-interest. For these reasons, you will do well to be skeptical of those who criticize gold.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

They hate gold , because they haven’t got any and they can’t print it.

They helped to push price of gold to $1920 but after 2011 they started to short the gold. Their plan was to push price to $700 or less and start buying, but of course they needed strong dollar too.

That’s why for last 5 years they were fooling everybody about improving economy.It kept strong dollar and weaker gold but sentiment is changing.They will try very hard to keep control and use whatever they have got to keep status quo

Maybe for them gold is useless , but don’t forget they need 3000tons of gold they owe to Germany.

Government does NOT control gold. But the US can always forbid private ownership as they have done before. Yes, and the commies were quick learners !