Peter Schiff appeared on Fox Business today to explain what the drop in oil and the strength in the gold market means for the wider United States economy.

In a new commentary from Euro Pacific Capital, Peter Schiff debunks the double-speak mantra of central bankers that claims falling prices in one sector (like oil) are good for consumers, while falling prices across the board will stagnate an economy.

The sudden fall in the price of oil provides a unique opportunity to examine the widely held belief that deflation is economic poison. As many governments and central banks have vowed to fight deflation at all costs in 2015, the question could hardly be more significant.

While falling prices may strike the layman as cause for celebration, economists believe that it can kick off a nasty, and often inescapable, negative cycle, which many believe leads inevitably to a prolonged recession, or even a depression. However, these same economists acknowledge that falling energy prices may offer a stimulus, equivalent to an enormous “tax cut,” particularly for lower and middle income consumers for whom energy costs represent a major portion of disposable income. They suggest that the money consumers and businesses no longer spend on gasoline and heating oil could be spent on other goods and services thereby creating demand in other areas of the economy. Even Fed Chair Janet Yellen, a staunch advocate of the economic benefits of rising consumer prices, has extolled the benefits of falling oil prices.

In his latest podcast, Peter Schiff reviews the most recent negative US economic data and the turmoil in the currency markets. He spends some time looking at the price of gold in other currencies, and what a break-out in these currencies could mean for gold’s long-term price. He also talks about the most dangerous bubble in the global economy: the faith and confidence in fiat currencies and central banking.

Jim Rickards spoke with Daniela Cambone on Kitco News about what he thinks 2015 will hold for the price of gold and the United States dollar. Rickards reminds us that we’re in a long-term currency war that could continue for years. There’s a good chance that gold will be needed to bring back confidence in paper currencies.

Chris Waltzek interviewed John Embry on GoldSeek Radio this week. Embry is Chief Investment Strategist at Sprott Asset Management and shares many of Peter Schiff’s views on the United States economy, which he believes is heading towards a currency crisis. He emphasized what a great opportunity investors have right now to get into precious metals at very low prices. American citizens should look to the inflation in Argentina or Russia to see why they want to be holding gold when the dollar starts to dive.

Peter Schiff had a very honest conversation about his predictions in his best-selling book The Real Crash with Wall Street Daily founder Robert Williams.

Williams started the interview by reminding the audience that while Peter is widely acknowledged for accurately predicting the 2008 financial crisis, few people remember what Peter’s bigger prediction is – that the ’08 crisis was just a foreshadowing of the real crash that is yet to come. Could 2015 be the year that crash happens? Peter thinks it might be.

China May Ease Gold Import Rules

Bloomberg – The People’s Bank of China (PBOC) is considering a plan to allow qualified miners and more banks to import gold. The intention is to attract more foreign investors and get China more involved in world markets. Chinese miners would be incentivized to “explore opportunities overseas,” said Wallace Ng, a Shanghai-based metals trader. If the PBOC follows through with the plan, it could drive down the premium on gold for Chinese consumers. In turn, this could expand demand and drive global prices higher.

Read Full Article >>

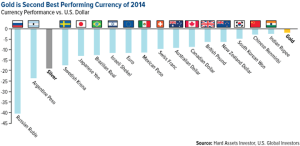

World currencies lost a lot of value in 2014. If you lived outside the United States, you would have done much better holding gold rather than local cash this past year. Check out this chart from The Market Oracle:

Eventually the Federal Reserve will be unable to artificially prop-up the US dollar. When that happens, we need only look around the world to see what life will be like. Russia is the most dramatic example this year. Consumer prices there rose 11.4% in December alone! As Bloomberg reports, “Russia’s currency lost 44 percent this year, the second-most in the world after Ukraine’s hryvnia.”

Back in the fall, former Federal Reserve Chairman Alan Greenspan stirred things up by making some public statements about the importance of gold, calling it “the premier currency, where no fiat currency, including the dollar, can match it…” Greenspan also indicated that he believes the Fed’s balance sheet will eventually catch fire and ignite some serious inflation. A good reason, he argued, to buy gold.

Well, now Greenspan is back in the news throwing a “wet blanket” on hopes for US growth, as Bloomberg puts it.

While few are as blunt as Peter Schiff in warning of another bubble in real estate, mainstream analysts are starting to worry that the US housing market isn’t as strong as many believe. Peter warns that rising home prices are a product of extremely low interest rates suppressed by the Federal Reserve. Robert Shiller, Nobel Laureate economist, seems to agree in a recent interview on CNBC:

There’s also the worry that the very low interest rates that we’ve had, with the 10-year just above 2%. That has also been driving this [housing] market. That is fragile… I’m not calling a turning point yet, but I feel a little bit of anxiety about the market.”

Shiller plays it cool, but admits that he thinks the market is looking like a bubble in San Francisco and possibly Miami: