Peter Schiff appeared on Fox Business to explain why the bursting of the oil sector bubble could be the first of many collapsing bubbles that will push the United States economy back into recession.

We were surprised to see mainstream stock speculators actually recommending gold as a good buy last week. On Friday, stock traders on CNBC argued the bull and bear case for the yellow metal, and the bull won. He touched on two of the key fundamentals supporting gold: the ongoing international currency war and huge physical demand for gold.

Of course, none of these traders pointed out that the US dollar’s days are numbered thanks to the Federal Reserve’s policies. Perhaps that’s the black swan the bear doesn’t see coming.

Everybody is talking about how strong the United States economy is based upon the upward revision of GDP growth to 5% in the third quarter. In his latest podcast, Peter Schiff digs into the data underlying the third-quarter GDP, as well as the economic data that could tell us what to expect for fourth-quarter GDP growth.

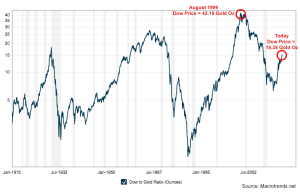

The Dow Jones Industrial Average broke through another record high yesterday, closing at about 18,030. A record high in United States dollar value, that is. When valued in ounces of gold, the Dow is nowhere near its historical high, which we saw in 1999. Take a look at this chart, showing the Dow to gold price ratio:

MarketWatch published an article reviewing the growing gold repatriation movement throughout Europe. While the author tries to take a “balanced” mainstream view and even throws in a few swings at gold bulls, he is forced to admit that the trend is troubling. There’s only one reason so many countries would want their gold back on sovereign soil – fears of a massive currency crisis. Matthew Lynn writes:

The point about having gold on your own soil is that it is an insurance policy against a chaotic return to national currencies. The fact that so many countries seem to want that insurance tells you something important about the euro — and it is hardly comforting. They still think there is a real possibility of collapse.”

Peter Schiff explains the reality behind the United States’ false recovery to an incredulous anchor on CNBC World.

Peter Schiff spoke to CNBC Europe yesterday about the true state of the United States economy and why the Federal Reserve will likely never raise interest rates.

SchiffGold is pleased to announce that we now feature junk silver bags amongst our product offerings. These bags contain United States dimes, quarters, or half dollars minted in or prior to 1964. That was the last year the US Mint used real silver to mint its circulating coins. These coins are 90% silver and worth much more than their face value (not to mention much more than their modern counterparts minted with base metals). A pre-1964 Washington quarter is worth a little under $3 at today’s silver price!

Junk silver coins make a great holiday gift for your friends and family. Not only will you give them something of real value to add to their savings, but you can also use the opportunity to educate them about the value of sound money.

Click Here to See Our Junk Silver Offerings

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Lots of smart people are wondering if Russia might adopt a gold backing for the ruble to strengthen its ailing currency and economy. The idea is even getting traction in mainstream news with a new article from CNBC. Alasdair MacLeod, an expert precious metals analyst, explains why Russia would favor a gold standard:

There is no doubt that Russia and China, plus the other Eurasian states in their sphere of influence are all accumulating gold and the indications are they see it as central to replacing the US dollar for cross border trade.

…

It is already in Russia’s interest to cast itself off from inflating western currencies and to base their economy on sound money, aka gold.”

Peter Schiff covers a wide range of topics in his latest interview with Chris Waltzek on GoldSeek Radio. Of course, they look closely at the precious metals markets and how they’re being influenced by the Federal Reserve’s monetary manipulation. However, they also discuss the price of oil, Russia’s ruble problems, and the future of the United States housing market.