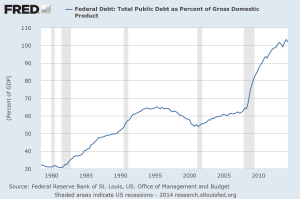

The national debt of the United States officially surpassed $18 trillion this past week. The news has been making the rounds of every media outlet, with many economists reminding us of the very shaky footing of the US economy. However, there are other analysts who play down this outrageously irresponsible amount of debt.

In his latest in-depth commentary, David Stockman explains the larger narrative of US fiscal policy that delivered this growing debt load. Stockman should know something about the topic. He was Director of the Office of Management and Budget under Reagan back in the early 1980’s, which is when US debt passed $1 trillion for the first time.

Think about that – it took more than 200 years for US debt to reach $1 trillion. But as Stockman points out, the last $1 trillion of debt accumulated in about 1 year.

China has officially surpassed the United States as the largest economy in the world, based upon economic output as measured by the International Monetary Fund. China’s production of real goods and services will touch about $17.6 trillion this year, while the US will produce $17.4 trillion.

This gap will continue to grow, according to the IMF. By 2019, China is projected to produce about $26.8 trillion, while the US will produce about $22.1 trillion. That translates to a growth rate of more than 52% in the next five years for China, while the rate of US economic growth will be nearly half of that – just 27%.

An article on MarketWatch explores this news in more detail, and touches on the profound implications of this trend. :

Yes, all statistics are open to various quibbles. It is perfectly possible China’s latest numbers overstate output — or understate them. That may also be true of U.S. GDP figures. But the IMF data are the best we have.

Make no mistake: This is a geopolitical earthquake with a high reading on the Richter scale. Throughout history, political and military power have always depended on economic power. Britain was the workshop of the world before she ruled the waves. And it was Britain’s relative economic decline that preceded the collapse of her power. And it was a similar story with previous hegemonic powers such as France and Spain.“

This is, of course, a long-term development. The US will continue to dominate the world for some time, but the winds are changing. Those winds are blowing East, to a land where the government and people still inherently understand the value of real money – physical gold.

Peter Schiff was on RT’s Boom Bust to talk about the latest jobs figures, the price of oil, the Swiss gold initiative, and the many uses of physical gold.

More than three years ago, a jury found Bernard von Nothaus guilty for “making, possessing and selling his own coins,” which Nothaus had dubbed the Liberty Dollar. This week, a judge has passed a very lenient sentence on Nothaus despite pleas for a long prison term from the prosecution. More importantly, the judge ruled that the $7 million worth of confiscated silver be returned to Nothaus.

Nothaus was selling silver bullion coins that the government claims too closely resembled American silver coins. Therefore, Nothaus was a counterfeiter in the eyes of the government. The prosecuting attorney even went so far as to claim that Nothaus was attempting to “undermine the legitimate currency of this country,” and that this was “a unique form of domestic terrorism.”

Here’s a picture of the coin – anyone familiar with US Mint silver coinage can clearly see that the Liberty Dollar is different.

The truth is that Nothaus simply wanted to get physical silver into the hands of Americans, while simultaneously educating them about the loss of purchasing power in the dollar.

Peter Schiff and Rick Santelli spoke today about Peter’s latest article published in the Washington Times. Read the article and then watch the video below.

Recent statements by Federal Reserve officials would lead just about anyone to believe that one of the bank’s central missions has always been to guard against the lurking threat of deflation. They warn that since official inflation has remained below the Fed’s 2 percent target for almost two years, the country is liable to fall into a stagnant morass unless the Fed acts boldly to hit its target. It may surprise many that this view is strictly a 21st-century development. The fear (some would say paranoia) regarding sub-2 percent inflation was nowhere in evidence in the past, even when inflation was lower than it is today.”

In December’s Gold Videocast, Peter Schiff responds to the Swiss voters’ rejection of the “Save Our Swiss Gold” initiative. He explains why the results of the referendum spell the end of a stable Swiss franc, but also the long-term success of gold. With no truly sound, safe-haven currencies left in the world, both Swiss and international investors will inevitably return to gold to protect their savings. Peter stresses that the Swiss vote is a wake-up call to the world: you can’t rely on central banks to protect the purchasing power of your currency. However, you can start your own, personal gold standard today.

This afternoon, CNBC Europe asked Peter Schiff about the effects of low oil prices on the European economy. Peter used the opportunity to explain why the governments of Europe, the United States, and Japan are all playing the same game: claiming inflation is good for the economy, when in fact it just allows politicians to escape the responsibility of giant national debts. The truth is that higher inflation equates to a lower standard of living.

No one can deny how poor retail sales were this past holiday weekend. Yet the media is spinning this news as proof that the United States economy is improving. In his latest Schiff Radio podcast, Peter Schiff picks apart this ridiculous narrative by looking closely at retail figures, media reports on the phenomenon, US box office results, and more.

India – once the world’s largest gold consumer – has eased restrictions that had limited its gold imports and allowed China to overtake it in gold consumption. The so-called “80:20 rule” has been dropped, which required gold importers to reexport at least 20% of their imported gold. The rule was supposed to shrink a high current-account deficit, but it also led to a surge in illegal smuggling across the country.

In the immediate future this is positive news for gold investors – the second largest consumer of gold in the world will likely very soon begin to officially buy more gold.

Swiss Vote “No” on the “Save Our Swiss Gold” Initiative

Wall Street Journal – Swiss voters voted down the Swiss gold referendum that would have forced the Swiss National Bank to hold 20% of its assets in gold. About 78% of voters were against the initiative, which was heavily opposed by the SNB and much of the Swiss parliament. Opponents said the measure would have made it too difficult for the bank to maintain its monetary policy that depends on pegging the Swiss franc to the weaker euro. Advocates for the initiative hoped it would strengthen the weakening Swiss franc. The measure would have also prevented the SNB from selling gold and required it to repatriate its gold. The SNB currently has 1,040 metric tons of gold, only about 7.5% of its assets.

Read Full Article>>

Netherlands Repatriating Gold Reserves from US

Wall Street Journal – The Dutch central bank (DNB) will be moving some of its gold reserves held at the New York Federal Reserve back to the Netherlands. The DNB currently holds 11% of its 612 metric tons of gold reserves domestically and wants to increase that to 31%. Currently, 51% of its gold reserves are stored at the NY Fed, but this will drop to 31% after the repatriation. The DNB is the latest European central bank to express concerns about the safety of its gold reserves held abroad, following the example of the German gold repatriation effort begun in 2013. According to the DNB, the repatriation will have “a positive effect on public confidence” by distributing its gold reserves in “a more balanced way.”

Read Full Article>>