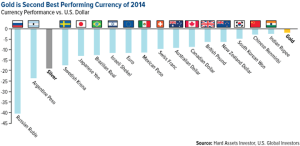

Gold Beat Every Currency but the US Dollar in 2014

World currencies lost a lot of value in 2014. If you lived outside the United States, you would have done much better holding gold rather than local cash this past year. Check out this chart from The Market Oracle:

Eventually the Federal Reserve will be unable to artificially prop-up the US dollar. When that happens, we need only look around the world to see what life will be like. Russia is the most dramatic example this year. Consumer prices there rose 11.4% in December alone! As Bloomberg reports, “Russia’s currency lost 44 percent this year, the second-most in the world after Ukraine’s hryvnia.”

Nearer to home, news broke yesterday of an official recession in Venezuela, which is also experiencing terrible inflation. “Twelve-month inflation reached 63.6% in November,” CNBC reports. Venezuela’s pain is largely due to the crash in oil prices.

Americans remain oblivious, believing the US economy is safe from the scourges of an international currency war. Of course, the strength of the US dollar remains a byproduct of the Fed’s money printing and zero-percent interest rates. The mainstream media and government maintain that inflation remains subdued in the US, which is officially 1.3%. But cracks are beginning to show in this narrative.

The latest data show that US rents rose about 3% this year and that more and more people are renting. The amount paid by US renters is up nearly 5% compared to last year, with total rental households increasing by 2%. Meanwhile, homeownership fell to a 20-year low in the third quarter of 2014. Forecasters see rents increasing 3.5% in 2015.

Rents aren’t the only major element of an American’s budget that is inflating much faster than the official measures. Food costs have also been climbing all year. The latest official data shows that food inflation in November 2014 reached 3.1%.

If you live outside the US, you certainly want to get into gold before its too late. For Americans, now might be the time to harbor some of your savings in the yellow metal before the currency war catches up to us.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about buying physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

[…] READ MORE […]

[…] Continue… […]