CNBC Asia spoke with Peter Schiff last night. The anchors acted surprised when Peter suggested the Federal Reserve is pulling a “long con” on the global markets when it comes to its monetary policy. The Fed wants people to believe that a rate hike is coming, but Peter argues that a fourth round of quantitative easing is what we will actually see. How should investors prepare? Buy non-dollar investments and hard assets, like gold and silver.

I’ve been positioning myself in non-dollar investments… I think gold looks like it has probably put in a bottom. We’ll have to see… I do expect a spectacular reversal when people figure this out. It took a while for the people who were buying subprime mortgages to realize that what they were buying was worthless. But eventually the bottom dropped out of the market, and I expect the same thing to happen again when people figure out the truth behind the US economy and what the Federal Reserve is actually going to do – not what they’re pretending they’re going to do.”

Gold represents stability.

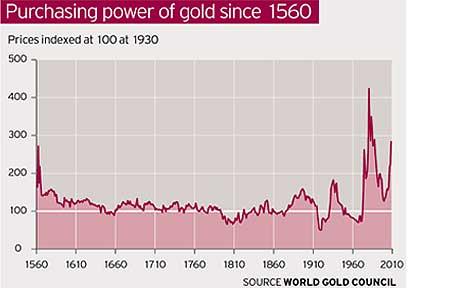

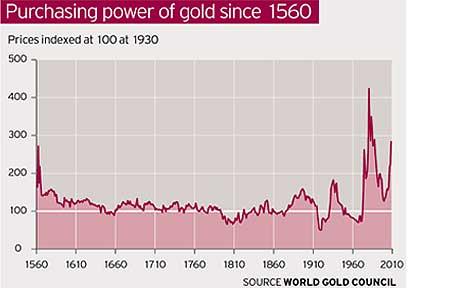

Buying gold makes a lot of sense as historically, gold holds its value. It also maintains a relatively constant level of purchasing power, especially when compared to the US dollar.

In 1976, University of California Professor Roy Jastram completed a long-term analysis of gold’s purchasing power stretching all the way back to 1560 and published his finding in The Golden Constant: The English and American Experience, 1560-1976. He found gold’s purchasing power remained remarkably stable over that period, as reported by the London Telegraph.

Todd “Bubba” Horwitz explained to Kitco the fundamental reasons for buying gold and silver right now. He agrees fully with Peter Schiff that the Fed won’t raise rates anytime soon:

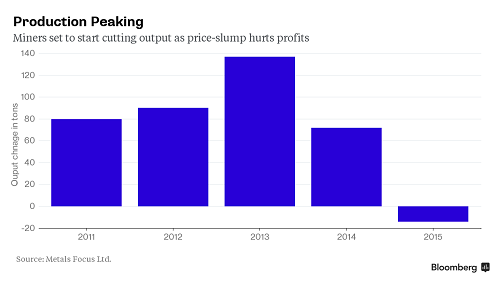

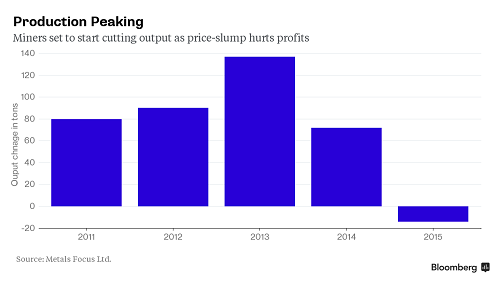

With many mining companies in the red, analysts expect gold production to drop for the first time since 2008.

According to a Bloomberg report, the anticipated drop in production follows a global surge. Gold output jumped 24% in a decade to a record 3,114 metric tons in 2014, according to data from industry researcher GFMS.

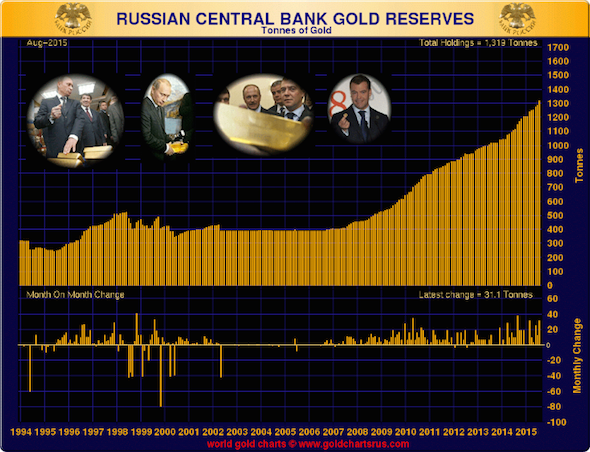

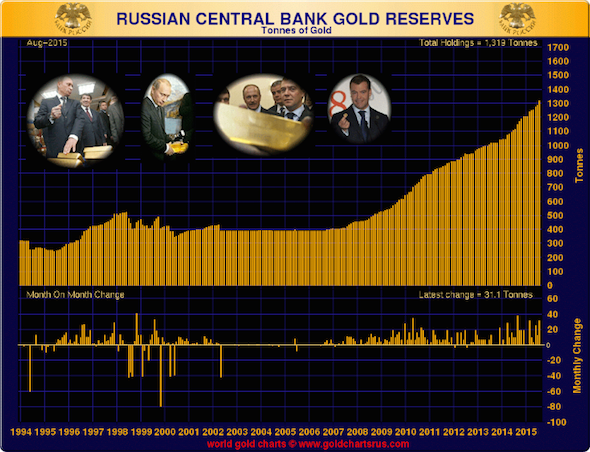

The the Bank of Russia bought 1 million ounces of gold in August alone. That boosted the country’s gold reserves to 42.4 million ounces as of Sept. 1, according to an announcement by the bank last Friday. The value of the central bank’s holdings rose to $47.68 billion from $44.96 billion a month earlier.

The Russian central bank’s gold purchases in August topped the 30.5 tons it purchased in March, and was the highest amount in six months.

On CNBC this afternoon, Peter Schiff got into another heated confrontation with Scott Nations about the Federal Reserve. Peter defended his record concerning Fed rate hikes, as well as his long-term advice to buy physical gold. Meanwhile, all Nations could turn to as proof of a coming rate hike in 2015 were unemployment figures. But as Peter has consistently pointed out, the phony unemployment data has been constantly improving – so why hasn’t the Fed raised rates?

Peter and Nations refer back to their last encounter in July – click here to watch it now.

I was telling people to buy gold when it was under $300, and it’s still over $1100. Gold has outperformed the US stock market since I made that call. Yes, gold is off the highs. So is the stock market. Gold is down less than the stock market today. I still think it’s going a lot higher, and probably Scott’s not going to buy any…”

The demand for physical silver rose through the first half of 2015.

The need for silver in manufacturing, its expanding use in health applications, and increased demand for silver jewelry all helped drive the surge.

According to GFMS Thomson Reuters, the precious metals consultancy, imports of silver into the United States jumped 11% through the end of May, as reported by the Silver Institute.

Our readers often ask tough questions about the economy, monetary policy and precious metal markets. During a recent interview, Gold Standard Institute USA president Keith Weiner provided some insightful and clear-cut answers to some of the complex issues facing us today.

Weiner was first asked to pinpoint the root of today’s economic mess. He summarized it in one sentence.

The short answer is: rising debt. It’s not only rising, but rising exponentially—the debt doubles about every eight years.”

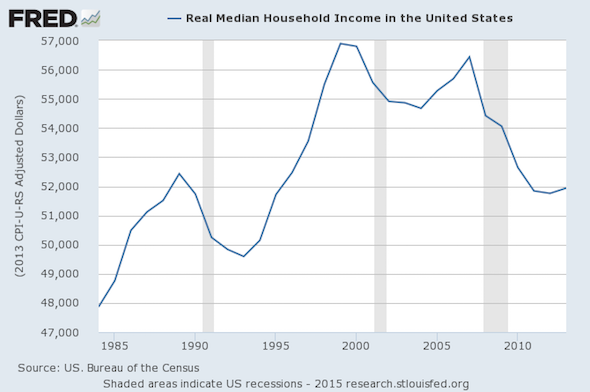

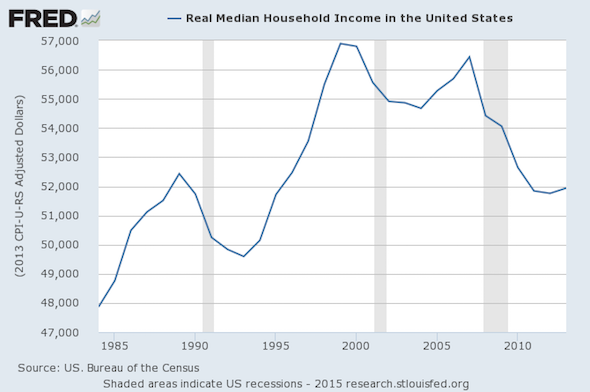

Thus far, the so-called economic recovery has done little to improve the lives of everyday Americans.

In yet another sign that the recovery is an illusion, figures released last week and reported by Reuters show American’s household income lost ground last year.

The data released by the U.S. Census Bureau on Wednesday, which showed the inflation-adjusted median income slipping to $53,657 last year from $54,462 in 2013, offered a reminder of the tepid nature of the economy’s recovery.”

Just as Peter Schiff predicted, the Federal Reserve did not raise interest rates yesterday. In fact, in the press conference following the Federal Open Market Committee meeting, Janet Yellen admitted to a reported that it is not impossible that the Fed might hold rates at zero forever.

Peter discusses this news, the movement of the gold price, and the latest economic data in his podcast published yesterday.

Janet Yellen actually believes that if the Fed wanted to keep interest rates at zero forever that they actually could. I’m willing to rule out that possibility. There is no way that interest rates are going to be at zero forever. Not even close. They’re not even going to stay at zero until the end of this decade. There is going to be a currency crisis that forces the Fed to raise rates…”