Walk into the small restaurant near the shore of Lake Michigan in Manitowoc, Wisconsin, and the smell of burgers and deep-fried cheese curds will assault your senses. According to the Blaze, locals will tell you Late’s has the best burger in town. It’s a throwback kind of restaurant, complete with a long, winding dining counter and spinning stools.

Late’s also features some throwback pricing for customers willing to pay with silver coins minted before 1965.

High on the south wall, up near the ceiling, hangs a sign featuring the special prices. In big bold letters it reads, “Late’s prices, if you pay in US silver coins dated 1964 or earlier.”

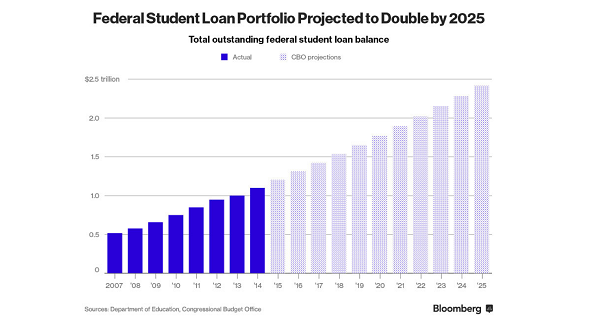

A federal case now under consideration in the First Circuit Court of Appeals could have huge ramifications for millions of Americans buried under student loan debt, as well as lenders and US taxpayers.

Bloomberg reports Robert Murphy is closer than ever to victory:

After record-breaking world-wide silver demand in the third quarter of 2015, the surge continued in September, with Bloomberg reporting sales at the Perth Mint in Australia hit the highest level in at least three years last month.

Sales of silver coins and minted bars jumped to 3.35 million ounces in September from 707,656 ounces the previous month, the mint said on its website on Friday. That’s the highest on record according to mint data compiled by Bloomberg dating back to 2012. Gold sales rose to 63,791 ounces, the highest in a year, from 33,390 ounces in August.”

Goldman Sachs officials are ready to push back their rate hike forecast to late 2016. As Bloomberg reported, they are hedging their bets on a December rate hike (probably to save face):

Goldman Sachs Group Inc. said there’s a chance U.S. policy makers will delay raising interest rates well into next year. While Goldman Sachs’s central forecast is still for a December liftoff, a slowdown in output and employment may justify the Fed keeping rates near zero for ‘much longer,’ the bank said in a report.”

Peter has been saying the Federal Reserve won’t raise rates all year. Now, as the year winds down and bad economic data continue to leak out, the mainstream appears to be catching up. Peter said it will eventually wake up completely.

The pretense that the Fed is about to raise rates, that a rate hike is just around the corner is going to end. It cannot withstand all of this negative economic news.”

Dr. Ron Paul hosted Peter Schiff on his Liberty Report this week. They discussed the failures of the Federal Reserve and how its policies have subsidized an irresponsible federal government. While the long-term effects are going to be disastrous for the United States, Americans still have a chance to protect themselves from an inevitable currency crisis. If they prepare wisely, they may even profit from the coming collapse.

I do believe this window of opportunity will be rapidly closing. People need to act quickly to get out of US dollars, to accumulate foreign assets in places like Switzerland or Singapore or New Zealand, to buy some gold, buy some mining stocks. Do that before the bottom really drops out of the dollar, when everybody else finally wakes up to the reality, instead of the fantasy world they’ve been living in…”

Rick Santelli and Charlies Biderman, CEO of TrimTabs Investment Research, discussed the slowing economic engine of the United States. The root of the problem? As Santelli put it: “We used to lead the rest of the world, thinking free markets do it. Now, all of a sudden, we’ve joined the rest of the world thinking only governments can do it.”

Biderman agreed, and pointed out that Obama’s background as a community activist has only exacerbated this dangerous economic mindset, which the Fed has increasingly embraced. He has the same forecast as Peter Schiff – a new round of stimulus will be the Fed’s next significant action:

The only thing the Federal Reserve can do is keep interest rates low. And as a matter of fact, as I’ve been saying on your show for the last year and a half, no interest rate hikes are possible given that we’re now entering into a global recession. I actually think the next move by the Fed will be some sort of stimulus.”

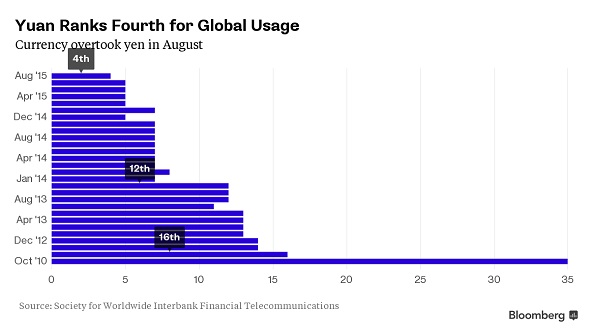

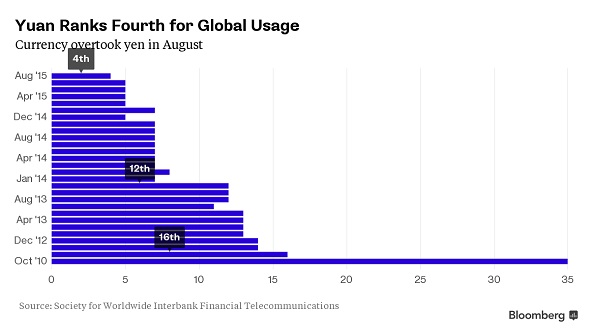

The Chinese yuan continues to gain stature on the world financial stage, overtaking the Japanese yen to become the fourth most-used currency for global payments.

Bloomberg reports the yuan rose to its highest ranking ever in August, boosting its claim for reserve status.

Barter with gold or silver provides a means of conducting business using real money with real value. SchiffGold has created an innovative tool to help you get started today.

The ability to barter can be a lifesaver during a currency or banking crisis, as the situation in Greece vividly demonstrates. But you shouldn’t wait for a crisis to establish barter relationships. You can begin to cut the government’s inflationary paper dollars out of your economic life today. In doing so, you’ll develop an invaluable hard money trading network.

One thing holds many people back from jumping into barter with gold or silver. Precious metal transactions get tricky when it comes to determining the value of the coins. While the spot price is readily available, it is not meant for everyday, person-to-person transactions.

SchiffGold has come up with an innovative solution to that problem – an easily accessible widget showing the current trade price of gold and silver in real time:

Two persistent myths convince gold bears that the price of gold will remain low – a looming series of interest rate hikes from the Federal Reserve and the fact that gold did not rally during the last round of quantitative easing. Peter Schiff explains why both of these myths are ready to die following Friday’s terrible job report. The silver price surged significantly higher on Friday’s news, and Peter thinks it won’t be long before gold also breaks out of its trading range. Investors are quickly running out of time to take advantage of these low prices.

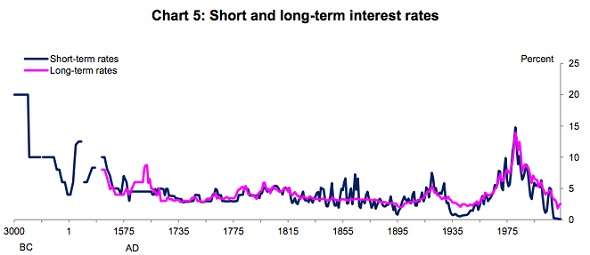

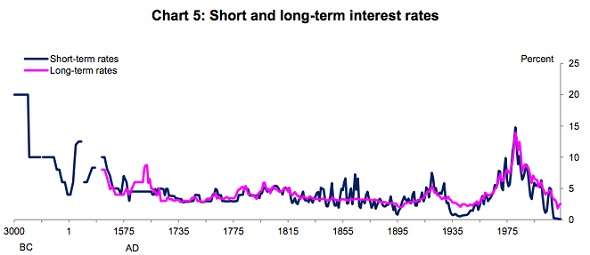

Bank of England chief economist Andy Haldane dug through thousands of years of historical data and found interest rates now sit at the lowest levels in some 3,000 years.

Wonkblog economic affairs reporter Matt O’Brien places the historic state of interest rates in vivid perspective in a Washington Post op-ed:

This is the best time to borrow money in recorded history…Now, it is true that rates almost got all the way down to zero during the Great Depression, but they have gotten all the way down there today. Indeed, interest rates are all-but-zero in the United States, the United Kingdom, the euro zone and, for the past 16 years now, Japan. Those are economies that, in nominal terms, make up more than half of the global economy.”