Ernie Hancock of Declare Your Independence interviewed Peter Schiff about the tragic death of his father, Irwin. They discussed Irwin Schiff’s legacy and his influence on Peter’s understanding of economics. Peter has chosen to promote his father’s principles by educating the public about how to avoid the US government’s most insidious tax – not the income tax, but the inflation tax that comes from the destruction of the dollar’s purchasing power. One of the best ways to protect your hard-earned savings? Buy physical gold and silver.

I’m trying to do the best that I can to help Americans protect themselves agains that tax. My father was trying to get people to not pay the income tax. Well, this inflation tax is going to be worse, because it’s going to hit your principal – not just what you earn, but everything you have. If you don’t want to lose what you have, you have to take action now…”

Investors and central banks around the world are buying gold.

Overall worldwide demand for the yellow metal surged during the third quarter. According to a Reuters report, demand for gold coins and gold bars, along with buying by central banks, drove a 7% Q3 increase.

Demand for gold coins and bars jumped by 26% year-on-year in the last quarter, GFMS analysts at Thomson Reuters reported in the Q3 update of their Gold Survey 2015. Retail investment surged in top consumers India, China and Germany, with buying rising 30%, 26% and 19% respectively. Those three markets alone accounted for an additional 26 tons of retail buying.”

Peter Schiff began his latest interview with Greg Hunter of USAWatchdog by explaining the history of the United States government’s debt ceiling. Peter argued that the idea of a real debt ceiling is a fantasy, just like the Federal Reserve’s narrative of a broad economic recovery. Greg pointed out that some analysts are predicting a further plunge in the price of gold, but Peter defended the yellow metal by pointing to long-term historical trends.

There will be deflation in terms of gold. If you want to price things in gold, stock prices are coming way down in gold. Real estate prices are coming way down in gold. Consumer prices are coming way down in gold. Commodity prices are coming way down in gold. They’re not going to come way down in dollar bills, because the government can create as many of those as it wants…”

Jim Rickards agrees with Peter Schiff – the United States is already in a recession. However, the Federal Reserve and Wall Street economists won’t realize this until long after the fact, because the models they use to forecast are deeply flawed. Rickards predicts that the Fed will begin another round of monetary easing in March of 2016. What form will it take? Rickards isn’t sure, but he lays out five options:

Even at zero [percent interest rates], there are five ways to ease. They can do QE4. They can do helicopter money. They can do currency wars – cheapen the dollar. They can do negative interest rates. The other way to do it is forward guidance, which is just talking. I actually expect they’ll reintroduce forward guidance. So gold is just a cross trade. If the dollar gets weaker, then the dollar price of gold is going to go back up again…”

In a speech delivered at Liberty Fest Houston, Tom Woods explores the concept of money and how it has been corrupted by modern governments. This is a great introduction to economics to share with your friends. Woods covers the history of money, the historical reality of deflation versus inflation, and how the boom/bust business cycle was created by central planning. He explains why Peter Schiff’s prediction of the 2008 financial crisis was based on sound economics, and how interest rate manipulation will continue to distort global economies.

Conceptually speaking, there’s no reason for a government to be involved [in the creation of money]. People can get to this point just by figuring out, ‘I need things and the best way for me to get them is to use a marketable good.’ … This comes about spontaneously. However, it’s money after all, and the government is going to want a piece of this somehow. So little by little, the government is going to insinuate its way into this process. It will do so in ways that will at first seem harmless…”

When asked by Bloomberg why he buys gold, Jim Grant explained that he is investing in monetary disorder. This disorder is already in motion, caused by central bankers who don’t understand that interest rates are actually a price. Manipulating interest rates is a type of artificial price control, which Grant warns always ends in disaster.

Gold is something to hold as an investment in the disorder of money as manipulated and managed by central bankers… One can observe that nominal interest rates without adjusting for anything were far higher during the Depression than they are now. These are the lowest nominal interest rates… in the history of the world. “

Last week, Donald Trump told Fox Business that he no longer buys gold. Dr. Ron Paul later rebutted Mr. Trump’s position, explaining the logic for long-term investment in the yellow metal. Much like Peter Schiff, Dr. Paul has been a consistent advocate for sound money and an opponent of the Federal Reserve. Watch and read some of Dr. Paul’s recent commentary here, here, and here.

I don’t think about these daily changes [in the price of gold]. I think about what happened in 1933. When you turned in an ounce of gold, you got 20 federal reserve notes that are worth 2 federal reserve notes now. If you kept your gold and turned it in today, you would get 1,170 federal reserve notes. That’s what counts.”

It appears likely the yuan will join the International Monetary Fund benchmark currency basket this year, according to sources close to the process.

Reuters reports IMF staff plan to give the all-clear for yuan inclusion, laying the groundwork for a favorable decision by policymakers. Three people briefed on IMF discussions said a draft report from the staff reached a favorable conclusion on including the Chinese currency. One officer said the path forward appears clear:

Everything is on course technically and there is no obvious political obstacle. The report leans clearly towards including the RMB in the (basket) but leaves the decision for the board.”

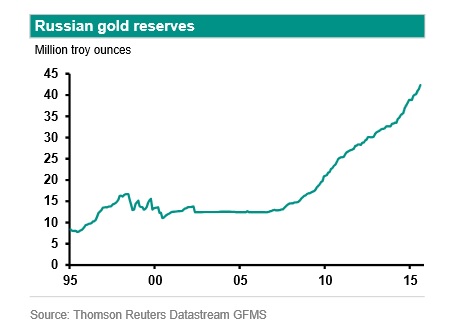

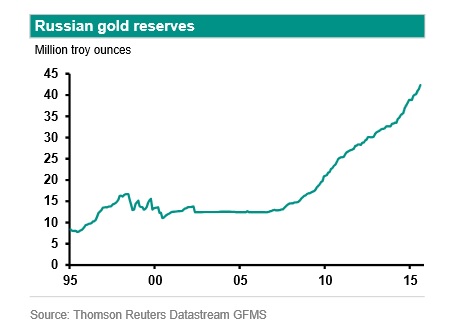

Russia and other countries formerly part of the Soviet Union continue to increase gold reserves at a steady pace.

Russia added another 34.2 tons of the precious metal in September. This follows on the heels of a 1 million ounce increase in Russian gold reserves in August, and continues a steady buying spree by the world’s seventh largest holder of gold.

Since the global financial crisis, Russia has increased its gold reserves at an average pace of about 300,000 ounces per month.

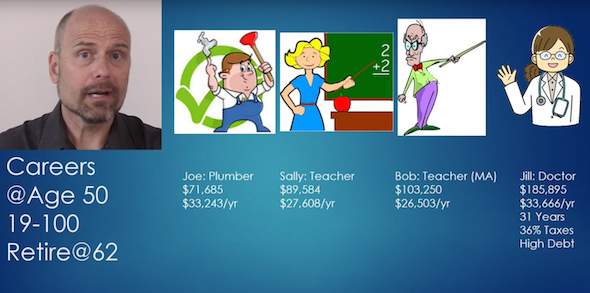

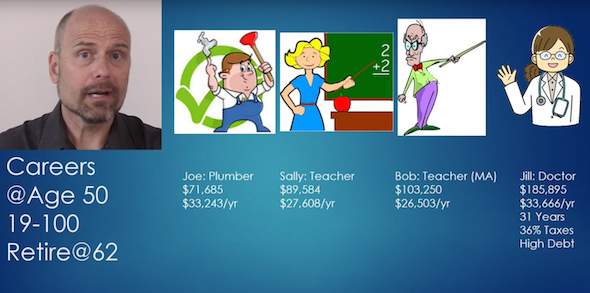

Nowadays, the mainstream assumption is that everyone is better off getting a college degree, no matter what. The economics of this logic are actually far more complicated. In a detailed video analyzing the cost of higher education, Stefan Molyneux of Freedomain Radio reviews some important studies debunking this new American myth. Molyneux has interviewed Peter Schiff in the past, which you can watch here.

One of the most notable parts of Molyneux’s video begins at 23:30, when he compares the average salaries of various careers and the costs of achieving that career. For instance, a plumber at age 50 will earn about $71K a year with just a couple years of apprenticeship or trade school.