Just as Peter Schiff predicted, the Federal Reserve did not raise interest rates yesterday. In fact, in the press conference following the Federal Open Market Committee meeting, Janet Yellen admitted to a reported that it is not impossible that the Fed might hold rates at zero forever.

Peter discusses this news, the movement of the gold price, and the latest economic data in his podcast published yesterday.

Janet Yellen actually believes that if the Fed wanted to keep interest rates at zero forever that they actually could. I’m willing to rule out that possibility. There is no way that interest rates are going to be at zero forever. Not even close. They’re not even going to stay at zero until the end of this decade. There is going to be a currency crisis that forces the Fed to raise rates…”

Marc Faber spoke with Bloomberg TV this morning to explain why he thinks the Federal Reserve will take no significant steps towards raising interest rates when its meeting concludes today. Like Peter Schiff, Faber predicts the Fed will not commit to any steady schedule of rate hike increases and that a fourth round of quantitative easing is just around the corner.

They cut interest rates to zero in December 2008, so in three months time we will have the anniversary of almost seven years of almost zero interest rates. What I’m saying is that this has created a lot of distortions in the system, and I believe we’re going to pay for it…”

What has seven years of zero-percent interest rates done to the US economy? Find out in our free special report: Why Buy Gold Now?

Peter Schiff reviews the latest economic data ignored by the mainstream media and maintains his forecast that the Federal Reserve will not raise interest rates this week. Peter also explains why mainstream analysts are all wrong, whether they argue for or against a rate hike.

What does the Fed have to hang their hat on? All the economic data is pointing towards a decelerating economy, towards recession. All they can do it point to the jobs numbers and say, ‘Well, but we have a low unemployment rate.’ So what? First of all, employment has already been a lagging, rather than a leading, indicator. Companies don’t lay people off, and then we have a recession. That’s not how it works…”

Here’s another story for the “Peter Schiff was right” archive and another testament to just how clueless mainstream economists can be.

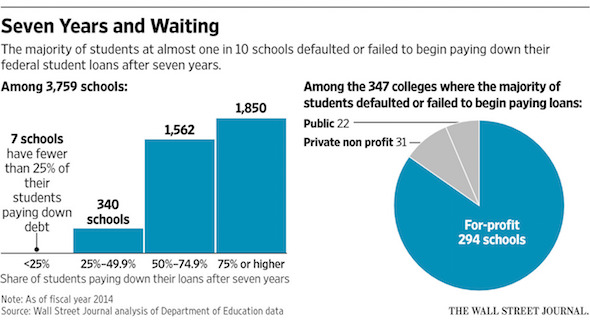

Three years ago, it was already becoming clear that ballooning student debt defaults were becoming a major problem. CNBC reported that the loan “industry underestimated defaults by a whopping $225 billion.” We wrote earlier this week about the latest White House data revealing just how much worse the defaults have become.

In the summer of 2012, Peter appeared on CNBC to debate why the federal government should get out of the student loan business. Diana Carew, an economist with the Progressive Policy Institute (PPI), appeared alongside Peter to defend the need for federal college funding.

You can watch the video below, in which Carew counters Peter’s economic arguments with straw men, suggesting that Peter wants to “get to decide who goes to college.” Carew used the same emotional rhetoric employed by politicians:

David Stockman, former Budget Director under President Reagan, appeared on Fox Business to warn that the United States faces a financial “time bomb” of $19 trillion of ballooning debt. This debt load will eventually become unsustainable when interest rates rise, which is an inevitability. Stockman points to the same historical data as Alan Greenspan – interest rates are traditionally 2-4% above the rate of inflation, and no amount of manipulation by the Federal Reserve can suppress them forever.

The 2% [inflation] is totally a made up target that conveniently allows them to shovel free money into Wall Street. It never does get to Main Street. The whole idea of zero interest rates is to get consumers and households all jiggy, and get them borrowing and spending. But that doesn’t work anymore, because we’re at peak debt. Households have $13 trillion of debt. “

Stockman’s warnings about debt are one of the key reasons investors should consider buying gold now.

At the end of 2014, the New York Fed reported a surprisingly high delinquency rate for student loans – 11.3%. Now the latest data released by the White House reveals that number may in fact be dramatically higher. As the Wall Street Journal reports:

New figures covering more than 3,700 schools were released as part of the White House’s College Scorecard, which allows consumers to explore data about debt and degrees. The average repayment rate among almost 1,200 for-profit schools—meaning these students were actively paying off loans—was 61%, the lowest of any sector. The average repayment rate among all colleges was 73%.”

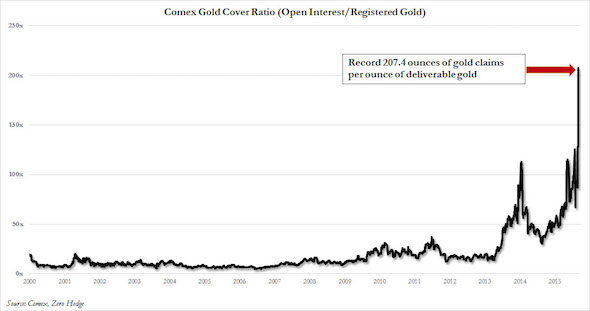

Bloomberg Business interviewed Peter Hambro, Chairman and Co-Founder of Petropavlovsk – one of the largest gold mining companies in Russia. Hambro presented physical gold to the Bloomberg anchors, who seemed genuinely dubious as to its value, insisting that gold is for “speculators.” Hambro clarified that “paper gold” is for speculators, and he believes the Comex futures market is going to come crashing down eventually – something we wrote about yesterday.

As an industry insider, Hambro shared invaluable insights into the physical gold market, especially when it comes to Asian demand:

In the Shanghai market, which is the only big physical market, recently introduced by the Chinese – year on year, they delivered 55 million ounces from August to August. That’s 65 billion dollars worth of physical gold. That is about half of the world’s mine supply.”

Hambro also shared Peter Schiff’s opinion that the Federal Reserve is not going to raise interest rates. Rather, all the Fed has to offer are economic bedtime stories to influence market perception. Click here to learn why you want to buy gold when perception becomes more important than reality.

Last weekend, Peter Schiff spoke with Free Talk Live, a nationally syndicated radio show. They discussed the growing student debt bubble, Peter’s imprisoned father Irwin, and the reasons why American businesses are moving to Puerto Rico. You can download the free report they discuss here: The Student Loan Bubble: Gambling with America’s Future.

The bubble in student loans is actually a small part of what is going on. The government has managed to reflate the housing bubble, the stock market bubble. We have a bond market bubble, a dollar bubble, a consumer loan bubble. The whole US economy is one gigantic bubble at this point. That’s all we got left…”

An apparent gold scam recently uncovered in Austin, Texas, serves as reminder for investors to use caution when dealing with small, unknown companies.

According to the Austin American-Statesman, the vaults belonging to an Austin company claiming to store millions of dollars in precious metals for its customers turned up virtually empty.

The latest update from CME Group shows a huge outflow of gold held for delivery by Comex. There are now less than 6 tons of registered physical gold available for delivery. For every 207 ounces of gold claimed by paper contracts on the Comex market, there is only one ounce of physical gold in Comex vaults. This is the lowest “coverage” ratio in the history of the Comex.