In the past week, Peter Schiff released two podcasts, and appeared on CNBC, Fox Business, InfoWars and The Hard Line. The Federal Reserve’s decision to nudge interest rates up and the possible ramifications dominated discussions.

Follow these links to jump to the video or article you’d like to see:

1. Schiff Radio Podcast: CNBC Calls Me Out On Gold, Dec. 21

2. Commentary: Mission Accomplished, Dec. 18

3. InfoWars: All Fed Decisions Are Made for Political Reasons, Dec. 18

4. CNBC: The Battle Continues: Schiff vs. Nations on Gold & Fed Rate Hike, Dec. 17

5. Schiff Radio Podcast: Janet Yellen Gets Nuts, Dec. 17

6. Fox Business: If the Market Believes in the Fed, the Market has a Problem, Dec. 16

7. The Hard Line: Rate Hikes Are Over; Fed Will Ease Next, Dec. 16

Russia and Kazakhstan continued their gold buying spree in November, and Turkey added to its reserves as well. Meanwhile, India is on pace for a healthy increase in gold imports this year.

A paper recently published by the National Bureau of Economic Research found that a large percentage of the increase in college tuition can be explained by increases in the amount of available financial aid.

Peter Schiff was saying this as far back as 2012. That summer, Peter appeared on CNBC and debated an economist with the Progressive Policy Institute. Peter insisted that colleges are “basing their prices on the fact that students can borrow money with government guarantees.”

Economists Grey Gordon and Aaron Hedlund wrote their paper for the NBER after creating a sophisticated model of the college market. When they crunched the numbers, it confirmed exactly what Peter said in 2012. The demand shock of ever-increasing financial aid accounted for almost all of the tuition increase:

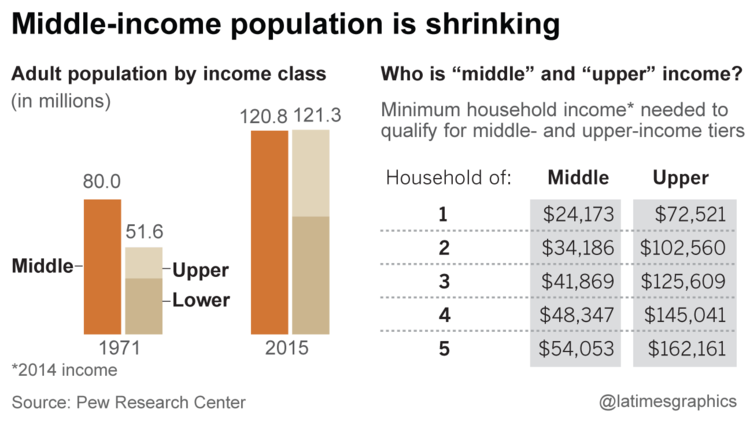

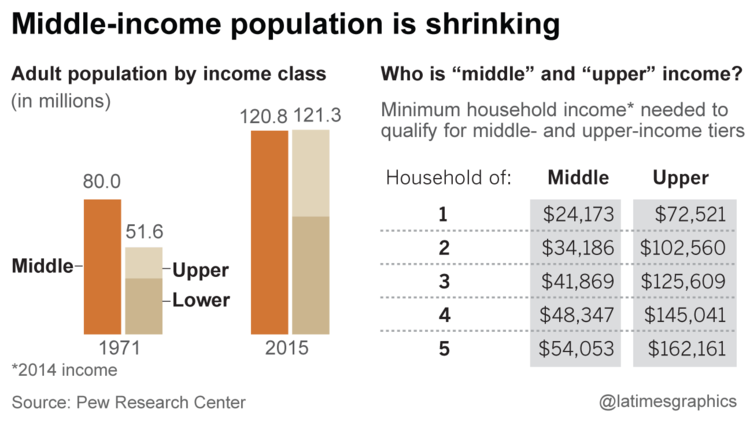

The US middle class continues to shrink, squeezed by government policy and an ever-increasing burden of debt.

According to a recent Pew Research report, the majority of American adults no longer are part of the middle class.

The middle class accounted to 61% of the population in 1971. The most recent figures put the middle class at just below 50%, according to a report in the Los Angeles Times:

Pew defined middle class as households earning two-thirds to twice the overall median income, after adjusting for household size. A family of three, for example, would be considered middle income if its total annual income ranged from about $42,000 to $126,000. Pew analyzed data from the Census Bureau and the Labor Department, as well as the Federal Reserve.”

Peter Schiff made his regular appearance on InfoWars last Friday. Guest host Paul Joseph Watson talked with him about the Federal Reserve’s rate hike decision and gold’s price movement in response. They also discussed the destruction of the American middle class, the ill effects of minimum wage laws, and the role the Fed will play in the 2016 election:

I think the only basis that they [the Fed] makes decisions on is political. I think that determines every move that they make. That is the sad reality. Janet Yellen is a very partisan democrat. She believes in big government and the big government policies of the New Deal and the Great Society. She wants to see the president’s party stay in power. I’m sure she wants to see Hillary Clinton as our next president, and she believes that Hillary Clinton will reappoint her as Fed Chairman. “

Peter Schiff’s appearance on CNBC’s Futures Now yesterday was quite different from his interview on Fox Business on Wednesday. CNBC anchors more or less scoffed at his suggestion that the Federal Reserve’s rate hike announcement was simply a strategy to cover the fact that the Fed has almost zero confidence in the United States’ economic recovery.

Regular readers of Peter Schiff’s Gold News will enjoy his ongoing argument with Scott Nations in the latter part of the interview. You can watch their past clashes here and here.

This time, Scott challenged Peter Schiff to defend his advice to buy gold over the past few years. Peter reminded Scott he was telling people to buy gold when it was under $300 per ounce. But Scott kept pushing – “Let’s talk about being so wrong,” Scott demanded. Peter silenced Scott with a simple question: “Have you ever told somebody to buy a stock at 19 and then it went to 17?” After stammering for a moment, Scott pressed Peter further on his gold predictions, and Peter stuck to his guns: “[Gold is] still going to go there [to $5,000].”

Shortly after the Federal Reserve’s rate hike announcement on Wednesday, Peter Schiff appeared on Fox Business alongside Moody’s Chief Economist John Lonski and Fox Business correspondent Charlie Gasparino. For once, everyone seemed to agree with Peter that the Fed’s decision does not actually mean the US economy is truly recovering. As Peter pointed out that everything from housing to sovereign credit is in a bubble, Lonski pointed to the terrible performance of the S&P 500 this year:

Even if we go to the S&P 500, throw out all the energy companies that got hammered in the third quarter, the remaining companies in the S&P 500 showing year-to-year sales growth of less than 1%. Believe me, there’s no way in the world we’re going to continue to see payrolls growing as rapidly as we did…”

The Federal Reserve made its much-anticipated move yesterday, nudging up the key interest rate by a quarter point.

Peter Schiff did an interview with The Hard Line on Newsmax TV a short time later, reiterating what he was saying before the Fed’s announcement – the rate hike does not indicate confidence in the US economy.

In fact, Peter argued the economy is about to enter into another recession, and may in fact already be in the early stages of a downturn:

The Fed appears to be skipping merrily toward an interest rate hike this afternoon, which is supposed to signal that the US economy has recovered. But as Peter Schiff has been pointing out relentlessly on his Facebook page, the actual economic data tells a completely different story. In fact, the economy isn’t nearly as good as advertised.

This is precisely why Peter and many other economists say they don’t think interest rates will stay above zero for very long, even if the Fed does indeed go forward with a hike.

Here are just a few of the warning signs over the last week or so.

Austria has started acting on its plan to repatriate a big chunk of its gold reserves.

Last week, the Austrian National Bank announced it brought 15 tons of gold back into the country. According to Reuters, a spokesman said the bank began repatriating the gold from London in October: