The headline on the Pittsburgh Tribune-Review website says it all – “Collectors willing to overpay for silver.”

The article highlights an ongoing silver scam in Pennsylvania and other states featuring “US State Silver Bars.”

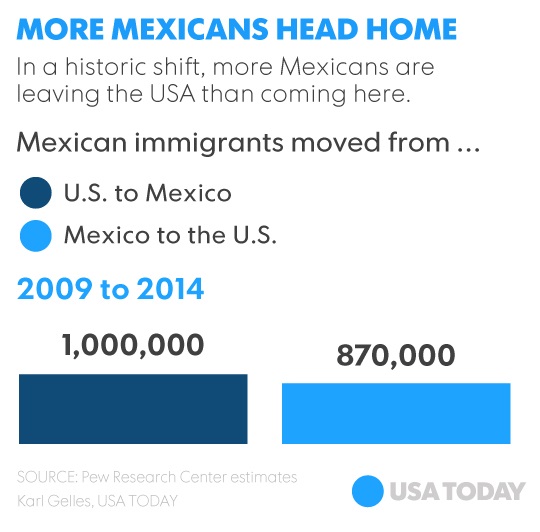

Mexican immigrants are going home.

For the first time in more than 40 years, more Mexicans are leaving the United States than entering. Citing a Pew Research Center report, USA Today notes that from 2009 to 2014, an estimated 870,000 Mexicans came to the US, while 1 million returned home. That represents a net loss for the US of 130,000.

Pew director of Hispanic research Mark Hugo Lopez cited a number of reasons for the immigration shift:

More than 80,000 student loan debtors can now apply for loan forgiveness through the US Department of Education after the conclusion of an investigation into now defunct Corinthian Colleges this week.

The company once owned more than 100 for-profit colleges. It filed for bankruptcy in May in the wake of a probe into its practices. According to a Bloomberg report, the investigation found Corinthian systematically misrepresented the chances of landing a job with a degree from its schools in order to enroll new students.

The Federal Reserve released its October meeting minutes yesterday, and the financial media largely interpreted them as saying a December interest rate hike is still a lock. However, Peter Schiff points out to CNBC that the minutes weren’t nearly that conclusive. As far as he’s concerned, the minutes leave plenty of wiggle room for the Fed to make excuses for delaying right hikes even more, just as they’ve done all year long. Whatever happens, Peter believes the Fed’s actions will be bullish for gold.

I think that the Fed has not raised interest rates all year, because they’re afraid to do it. I think they’re worried about the economy. They don’t want to admit that, so they pretend to raise rates. They keep coming up with excuses about why they’re not going to do it. There are plenty of excuses they could use not to raise rates in December. Maybe if we get to December and the stock market is near all-time highs, and everybody thinks the rate hike is fine, is it possible that they’ll deliver a quarter point and then try to talk it back by saying one and done, we’re not going to do anymore? It’s possible, but I think if they do that they’re going to regret it.”

The silver market will likely face its third consecutive annual physical deficit in 2015, according to the recently released Interim Silver Market Review by Thomson Reuters.

A drop in supply due to flat mine production and a spike in demand for silver coins are among the factors figuring prominently in the predicted physical deficit.

Silver bullion coin sales hit record highs in the third quarter of 2015, totaling 32.9 million ounces. That represents a 95% year-on-year increase. A summary of the market review notes North American sales jumped an even more robust 103%:

On Friday, International Monetary Fund Director Christine Lagarde basically green-lighted the proposal to add the Chinese yuan to the IMF’s Special Drawing Rights basket of currencies. Peter Schiff told RT’s Boom Bust that this is just another step in the direction of China surpassing the United States as an economic power. Ultimately, Peter believes China could back its yuan with the gold reserves it has been stealthily amassing and present its currency as a stabler alternative to the US dollar.

Peter went on to argue that the Federal Reserve will not hike the fed funds rate in December, pointing to the Paris attacks as a new excuse the Fed could somehow use to maintain an easy monetary policy. This would allow the Fed to draw attention away from the fact that American consumers aren’t spending like they used to as the US tumbles into a new recession this holiday season.

This article is written by Peter Schiff and published by CNBC.

The September jobs report, which was released in early October, was so universally dismal that it managed to convince the majority of investors the Federal Reserve would not raise interest rates in 2015.

Since it is widely believed that gold rallies when interest rates stay below the rate of inflation, it is not surprising that in the two weeks following the release of the report, gold rallied from a multi-year low of $1,113 on Sept. 30 to $1,184 on Oct. 14, a gain of 6.4 percent. But the sentiment didn’t last. A number of pro-rate hike statements from Fed officials, a supposedly hawkish statement from the Fed’s October meeting, and a better-than-expected October jobs report released in early November, convinced the vast majority of investors and economists that a December rate hike was firmly back in play. This sent gold right back down, hitting a multi-year low of $1,075, a decline of over 9 percent in just two weeks.

Gold rallied in the wake of the tragic ISIS terror attack in Paris on Friday.

Multiple media reports framed the rise in the price of gold as “safe haven demand.” The Wall Street Journal put it succinctly:

The precious metal has long acted as a safe store of value during periods of heightened global uncertainty.”

As the WSJ explained, the focus on safe-haven investing has been largely overshadowed by speculation on what the Federal Reserve will do with interest rates in the coming months. The events in Paris jolted the market out of its Fed induced revelry, if only temporarily.

This article is written by Peter Schiff and originally published by Euro Pacific Capital. Find it here.

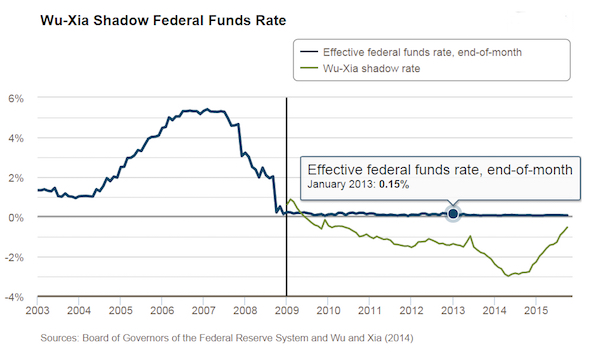

Nearly 92% of economists surveyed this week by the Wall Street Journal expect that our eight-year experiment with unprecedented monetary easing from the Federal Reserve will come to an end at the next Federal Reserve meeting in December. Since we have had the monetary wind at our back for so many years, at least a few have begun to question our ability to make economic and financial gains against actual headwinds. But in reality, the tightening cycle that the forecasters are waiting for actually started last year. Sadly, the markets and the economy are already showing an inability to handle it.

While it’s true that we have yet to achieve “lift-off” from zero percent interest rates, rates have not been the only means by which the Fed has provided stimulus. We also have to account for the effects of quantitative easing (QE) and forward guidance of the Fed. Changes in those inputs over the past year have already created conditions of monetary tightening.

After the last Republican presidential debate, candidate Ben Carson told Fox Business host Neil Cavuto he wouldn’t necessarily remove Janet Yellen as head of the Federal Reserve. His reasoning was astonishingly shallow.

Did he articulate some in-depth policy insights to bolster his comments? Did he cite some kind of Yellen policy success? Did he appeal to her breadth of economic wisdom?

Nope.

He had a much deeper reason for keeping Yellen on: