The head of a major silver mining company says he thinks we will see triple-digit silver prices in the near future.

Keith Neumeyer serves as CEO of First Majestic Silver Corp. The company ranks as the second largest silver producer in Mexico – the world’s leading country in silver production. Neumeyer told Bloomberg a major Japanese electronics maker approached the company last month seeking to lock in future silver stock. This is a sign that supply concerns could significantly boost the price of the white metal – perhaps as much as nine-fold:

For an electronics manufacturer to come directly to us — that tells me something is changing in the market I think we’ll see three-digit silver.”

Neumeyer said he believes the price of silver could surge to $140 per ounce as early as 2019.

Will the Federal Reserve raise rates in June?

Peter Schiff says it’s immaterial.

Peter appeared on CNBC’s Fast Money and created a firestorm when he said he sees this as a repeat of what happened at the end of last year and suggested everybody knows the Fed is at the end of its tightening cycle.

You know, the Fed launches a trial balloon, they raise the possibility of a rate hike, and they wait to see how the markets react. And the markets are basically acting positively, just like they did in December last year. Everybody was convinced there was a rate hike, but the markets were rising anyway. And I think it was the increase in the markets that gave the Fed the false confidence to actually raise rates. But as soon as they did, the markets sold off. We had the worst start to a year in history, and I think the same thing will happen if they raise rates in June. I think the market is going to sell off. I think gold is going to rally again. And I think the dollar is going to sell off. Because these rate hikes are too little too late.”

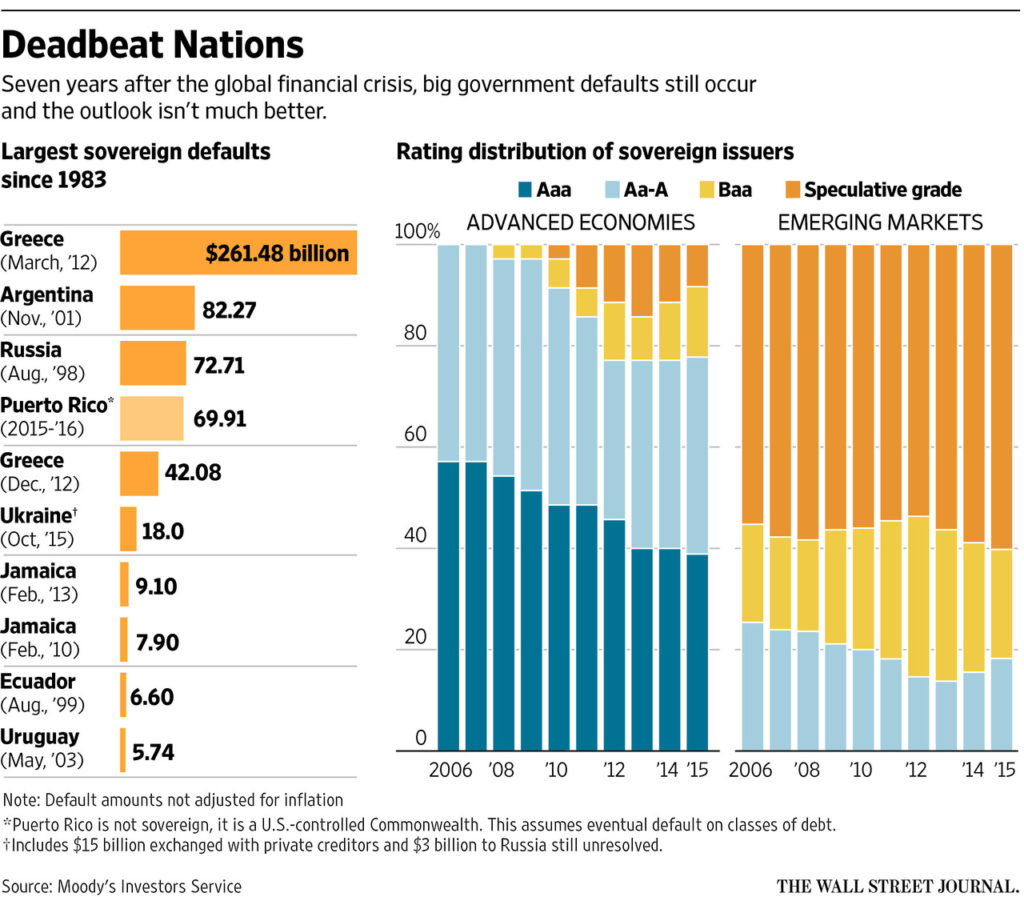

Good morning Puerto Rico. Default is coming.

Legislation moving in Congress would set up an oversight board to guide the US territory through what essentially amounts to bankruptcy. It would not expend federal funds to bail out Puerto Rico, but would allow the island’s government to pay back debtors at less than 100%.

This is just a taste of things to come.

A default was unthinkable just a couple of years ago. The national obligation to repay what it owes was once considered almost sacrosanct. In 2013, Puerto Rico Gov. Alejandro García Padilla said paying back all of its debt was not only constitutional, but “a moral obligation.”

Times have changed, as the Wall Street Journal points out:

Though markets have met the event with a shrug, that shouldn’t diminish the significance of the moment. It underlines how much the stigma about government default has faded. Investors would be wise to build this risk into their calculations when lending to governments from now on, especially since arithmetic suggests more defaults are on the way. With less moralizing and more planning, both creditors and debtors will be better off.”

Although it seems to be almost a foregone conclusion in most circles at this point, not every analyst believes the Federal Reserve will hike rates in June, or if they do that it means a long-term upward trajectory.

Jim Rickards recently appeared on RT’s Boom Bust and said he thought a rate hike was unlikely, and if the Fed does act, it will spur a nasty market crash. In his most recent podcast, Peter Schiff agreed, saying even if the Fed does nudge the rate up a quarter point next month it isn’t going to matter. That will be the end of it, then the Fed will cut. [Scroll Down to listen to the podcast.] And Earlier this week, Jim Grant weighed in on Fox Business and said the Federal Reserve probably won’t raise rates because the economy is just slogging along:

The Federal Reserve will not act. The Fed I think it wants to. I think it would love to normalize things, but I think it has missed its chance. As they say on Wall Street, it missed its market…I don’t want to dogmatize too much, but my opinion is no rate hike.”

Grant went on to engage in a wide-ranging discussion focusing on how central bank policy distorts the economy. Low interest rates accelerate consumption and defer problems. Companies and individuals can take advantage of easy credit and push things into the future. But eventually, this piling on of debt catches up and the whole thing comes crashing down.

The intellectual framework by which the Fed directs our monetary fortunes has been shown to be ineffective at anticipating the future, which they say they are in the business to do.”

Fed watching has become an obsession. Every day, talking heads parse and dissect the words of central bankers, trying to read the tea leaves and figure out if the Federal Reserve will or will not raise rates next month.

But a well-known mainstream market analyst says Fed-obsessed pundits miss the bigger picture. It’s not all about the Fed – especially when it comes to gold.

Lindsey Group chief market analyst Peter Boockvar appeared on CNBC’s Futures Now and talked about gold. He said now is the time to get in, whether you think the Fed will hike rates in June or not. He said analysts and investors focused only on Fed policy completely miss the bigger picture. They need to think beyond June, and recognize policies of other central banks matter too. Boockvar said we shouldn’t forget we have entered a negative interest rate world:

In order to be bearish on gold, you have to believe that the Fed is going to embark on 100 to 200 basis points of hikes over the next couple of years, which I think is completely unrealistic. And also you have to look at gold not just what the Fed may do, but what’s going on with interest rates around the world. We all know that trillions of dollars of sovereign bonds have negative yields… I think this is the beginning of a new bull market in the metals.”

Last week we reported that central banks were jettisoning US debt and buying gold.

Figures released by the IMF this week indicate central bank gold hoarding has not abated.

Russia and China both extended their prolonged buying spree in April. Russia added 16.2 tons to its reserves. China increased its holdings by 10.9 tons. Another major buyer was Kazakhstan. The former Soviet Republic raised its tonnage by 3.2 tons. Turkey added 2.6 tons to its stash.

Not only is the Chinese central bank continuing to expand its gold reserves, the country is steadily becoming a major player in the world gold market. Earlier this month, the largest Chinese bank bought one of the biggest gold vaults in Europe, as it expands its influence on global gold trade.

A June interest rate hike is the talk of the town. Jim Rickards doesn’t think it will happen, but if it does, he says, “Look out below.”

Rickards appeared on RT’s Boom Bust to explain why. First, he makes the case that we shouldn’t listen to every word that comes out of every Fed regional bank president’s mouth. He suggests they are likely “testing the waters.” As for the constant harping on jobs numbers, Rickards agrees with what we’ve been reporting. The employment outlook isn’t really all that good:

It’s nowhere near full employment because obviously a lot of the jobs are part-time. Some of the people are working two jobs, so they get counted twice. Labor force participation went down in the last jobs report. So there is plenty of slack in the economy.”

So, Rickards doesn’t think the economic factors warrant a rate increase. But he says if the Fed does make the move, it will send the stock market into a spiral and spark another round of currency wars:

We’ve said before that the growing level of debt in the US is the elephant in the room we are going to have to address at some point. We’ve talked about the massive government debt and the drag it puts on the US economy. We’ve talked about the crushing weight of student loan debt – increasing at a rate of about $2,726 per second. We’ve talked about the mounting corporate debt, doubling since 2008.

And then there is personal debt.

Americans are burning up the plastic. Credit card balances are on track to hit $1 trillion this year. That is getting close to the all-time peak of $1.2 trillion hit in July 2008, just as the financial crisis was intensifying.

All of the talk lately is about a Federal Reserve rate hike in June. In fact, in many circles, it has become a forgone conclusion. On Monday, Philadelphia Fed Bank president Patrick Harker said he could see up to three hikes before year’s end.

But Steen Jakobsen, chief economist and CIO of Saxo Bank, says if the Fed does move forward with a hike, it will be a huge mistake. He said the data the Fed is using to justify the rate hike doesn’t indicate an increase in economic momentum. In fact, Jakobsen argues the US economy continues to perform significantly below its potential. He believes the Fed is talking rate hike so they can cut them again.

As Fed is now communicating this willingness to hike despite these economic circumstances, it seems like that Fed is trying to manage something else, which in my opinion is the fact they want some ability to be able to hike rates now in order to take them down later. Basically the Fed knows – the Fed acts as if they are in a corner, and they’re trying to increase the amount of tools available to them.”

Jim Rickards recently appeared on CBC News’ The Exchange and made the case for $10,000 gold.

He said the recent jump in the price of gold represents a world-wide vote of no-confidence in central bankers.

The increase in the dollar price of gold is just a reflection of the decline of the dollar. So, it’s sort of a vote of no-confidence in central bank policies. Investors are looking around saying. ‘We’re losing confidence in central bank money. We’d like another form of money, thank you very much.’ It’s called gold. So, that’s part of the reason gold is going up.”

Rickards went on to explain why he thinks gold will ultimately hit $10,000. He said it’s not a guess, and he doesn’t just throw that number out to get attention or to be provocative. He actually has mathematical calculations behind his assertion. Rickards explains his reasoning in this video.