Foreign Central Banks Jettisoning US Debt at Alarming Pace; Buying Gold

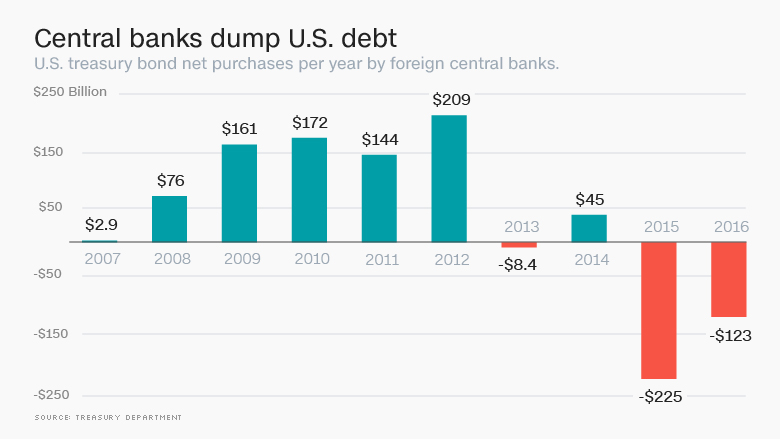

Continuing a trend that started last year, central banks around the world are dumping US debt at a record pace.

Central banks sold off a net $17 billion in US Treasury bonds in March. Sales set a record in January, hitting $57 billion. China, Russia, and Brazil led the way, each dumping at least $1 billion in US debt in March alone.

So far in 2016, global central banks have jettisoned $123 billion in US debt. Last year, they sold off $226 billion. According to the Treasury Department, central banks are selling US Treasuries at a pace not seen since at least 1978.

Once the biggest buyer of US debt, China is now selling Treasuries at what CNN calls an alarming rate:

Between December and February, China’s central bank sold off an alarming $236 billion to help support its currency, which China is slowly letting become more controlled by markets and less by the government. In March, China sold $3.5 billion in US Treasury bonds, Treasury data shows.”

Head of international fixed income at Federated Investors Ihab Salib said fear and economic instability is driving the selloff:

There’s still this fear of ‘everything is going to fall apart.'”

CNN Money said the selloff of Treasuries may be an effort to “prop up their currencies:”

By selling US debt, central banks can get hard cash to buy up their local currency and prevent it from losing too much value.”

Free Download: Classic Gold Scams And How To Avoid Getting Ripped Off

But many of these central banks aren’t just purchasing local currency. They are buying gold.

As we reported yesterday, central banks have gone on a gold-buying spree, with China and Russia leading the pack. According to the World Gold Council, Russia increased its gold reserves by 45.8 tons in the first quarter of this year. That was 52% higher than the same period in 2015. China purchased 35.1 tons between January-March, adding to the 103.9 tons it bought through the second half of last year.

Notice these are two of the countries dumping US debt the fastest. The strategy seems pretty clear – sell US treasuries and buy gold.

This makes sense in a world of perpetually low and even negative interest rates, coupled with rampant economic uncertainty and a looming recession. The yield on Treasuries and other sovereign debt becomes less and less attractive in a low-rate environment.

So, if central banks are dumping US Treasuries, who’s purchasing them? It appears US and foreign firms are the primary buyers. This seems to indicate the private sector is not buying all of the sunshine and roses Washington is selling when it comes to the US economy and is seeking the “security” traditionally offered by US government bonds. Last fall, Casey Research analyzed the current dynamics in the bond market and reached a similar conclusion, reporting “looming warning signs” in the US “wonderland economy.”

The Federal Reserve and US government central planners have built a house of cards on a foundation of debt . What is going to happen when nobody wants to buy US Treasuries anymore? Will the house of cards eventually come crashing down? Perhaps that is the real fear driving countries like Russia and China to dump US debt and buy gold.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

If they are selling treasuries, who is buying them? Who is selling tons of gold to Russia? That should be running up the price of gold.

Governments and bankers buy real metal. Sheople buy manipulated paper.

Canada

This is why the U. S. Is provoking (with war)The B. R. I. C. Coalition for leaving the Eco-Slav…-System.?

The above question as to who is buying DEFINITELY NEEDS AN ANSWER OR IT COMES OFF AS POSSIBLE PROPAGANDA. I believe in owning gold and silver, but I do not like unfounded propaganda. As I need good facts and logic to make my decisions.

Global government is buying it to delay turmoil until the exact moment they are ready.

Unfortunately I think we’ll find war is the solution.And if they kill off billions , then there will be alot more gold to go around .

I prefer my priceless Egyptian glassware collection , I can eat on that !

Also , it is possible that the Fed had worked out how to convert lead into gold . Its quite a scam , China can have as much lead as they want all at 1500 and oz !

Why is the price of Gold not moving up faster?

It appears going right to the heartbeat of America! The wealthy and rich corporations including banks are buy gold like there’s no tomorrow. Then the rush of debased USD currency flooding America like a title wave of worthless paper, burying the nation in a financial crisis it has never faced before!

All I know is paper $ is just paper………..WE give it value…………pretty shells were once used as currency……….. how many shell are on a beach………gold can not be printed out of thin air………… there is really very little of it.