During the Mauldin Strategic Investment Conference, Jim Grant said if you want to make money, you have to be willing to go into “scary places.” In an interview after his speech, he clarified what he meant saying you have to have the guts to go against the flow and do things the mainstream will ridicule you for.

Buying gold definitely fits that definition, at least here in the West.

Grant said he just doesn’t understand the mainstream’s disdain for gold:

Gold I think is seen as the vestigial organ of money. People who hold that view necessarily hold the view that the stewards of our paper and digital currencies have the answers. That this monetary improve conducted for the past seven or eight years by the Western central bankers certainly and those in Japan – that this is the way forward. And I try to understand what they’re saying, but I can’t make head or tail out of it. Seems to me the opposite is so obviously true.”

Will the Fed raise rates? Will it hold steady? What will the next move mean for gold?

Investor and creator of Things that Make You Go Hmmm Grant Williams doesn’t really care. He’s going to buy gold regardless. In fact, during an interview at the Mauldin Strategic Investment Conference, Williams said he doesn’t really pay attention to the price of the yellow metal:

I think what the Fed does could have short-term impact, but I don’t buy gold around it. I don’t buy gold at $1,100 because I think it’s going to $1,200, I buy it for what it does, not what the price is, the price is the last consideration for me.”

Williams went on to say as the economic picture comes into sharper focus, people will realize that “gold is the answer.”

Williams said investors should focus on owning physical gold, not paper promises:

The more things change, the more they stay the same.

After pumping up a real estate bubble in the years leading up to the most recent economic crash, it appears the central bankers and government policymakers may have managed to orchestrate a repeat performance.

Real estate mogul Sam Zell appeared on CNBC recently and hinted that a real estate bubble might be about to pop. The chairman of Equity Group Investments and of apartment mega-landlord Equity Residential said the market for apartment and office buildings in some markets have already peaked.

And they say actions speak louder than words. Well, according to Wolf Street, Zell is selling.

The US faces a massive debt problem. We all know it. But politicians and government officials are either unwilling or incapable of doing anything about it.

David Stockman mentioned the burden of debt in a recent interview with Neil Cavuto on Fox Business:

We have $63 trillion of total debt in this economy. The public sector – county, state, and local – is nearly $25 trillion. And we’re getting old. The Baby Boomers are retiring, 10,000 a day. In another 5 or 10 years we’re going to have a massive increase in the retired population. How do you fund all that? Who’s going to pay the taxes?”

Despite the glaring magnitude of the problem, government officials seem content to keep their heads buried in the sand and ignore it until it’s too late. Even when they acknowledge it, they seem utterly incapable of effectively dealing with the issue.

Illinois offers a prime example. The Prairie State has the lowest credit rating of any state in the US, and it hasn’t had an operational budget for almost a year. The situation passed the level of a “crisis” months ago. Still, with the end of this year’s legislative session looming, the state doesn’t appear close to getting a budget in place. The Wall Street Journal recently reported on the Illinois budget debacle:

Over the last few weeks, the mainstream has been fixated on the prospect an interest rate hike. Janet Yellen insists the economic fundamentals will support a hike. Pundits keep talking about a “strong economy.” But David Stockman recently appeared on Fox Business with Neil Cavuto and said the next president will inherit a recession.

Cavuto asked Stockman what makes him think it’s going to pop now:

We have been living beyond our means for 30 years. It’s only a matter of time. People said that in 2007. ‘Don’t worry. They’ll muddle through. Remember Goldilocks.’ And then wham, the bottom fell out, the meltdown happened, the panic was on.”

Stockman then provided some economic data to make his case: a recession is upon us.

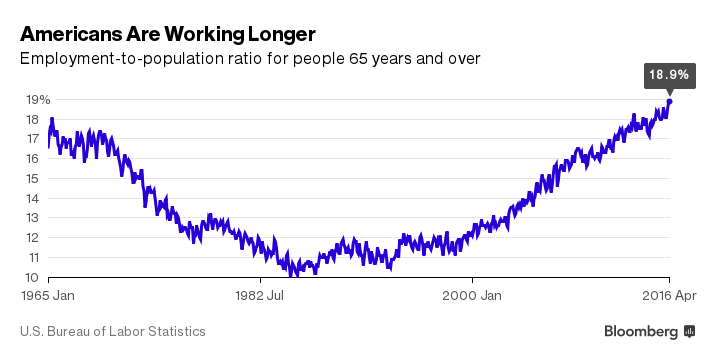

Will you ever retire?

More and more Americans will not.

According to the latest data from the US Bureau of Labor Statistics, almost 20% of Americans 65 and older are still working. That’s the largest percentage of older Americans on the job since the early 1960s. With Baby Boomers hitting retirement age, it’s the largest number of Americans over 65 working ever.

Surveys indicate a growing number of people plan to continue working past retirement. The number of Americans who said they intend to continue working “as long as possible” came in at 27%. A full 12% said they don’t plan to retire at all.

When you think about government, innovation isn’t exactly the first thing that comes to mind. Just last week, CNN reported that the US Department of Defense still uses 1970s era computing systems that require “eight-inch floppy disks.” Some of these ancient computers run US nuclear weapon systems:

Such disks were already becoming obsolete by the end of that decade, being edged out by smaller, non-floppy 3.5 to 5.25-inch disks, before being almost completely replaced by the CD in the late 90s. Except in Washington that is. The GAO report says that US government departments spend upwards of $60 billion a year on operating and maintaining out-of-date technologies.”

But when it comes to finding ways to wring money out of their citizens, governments suddenly become exceptionally innovative.

A British barber and businessman recently floated the idea of a “beard tax.”

The head of a major silver mining company says he thinks we will see triple-digit silver prices in the near future.

Keith Neumeyer serves as CEO of First Majestic Silver Corp. The company ranks as the second largest silver producer in Mexico – the world’s leading country in silver production. Neumeyer told Bloomberg a major Japanese electronics maker approached the company last month seeking to lock in future silver stock. This is a sign that supply concerns could significantly boost the price of the white metal – perhaps as much as nine-fold:

For an electronics manufacturer to come directly to us — that tells me something is changing in the market I think we’ll see three-digit silver.”

Neumeyer said he believes the price of silver could surge to $140 per ounce as early as 2019.

Will the Federal Reserve raise rates in June?

Peter Schiff says it’s immaterial.

Peter appeared on CNBC’s Fast Money and created a firestorm when he said he sees this as a repeat of what happened at the end of last year and suggested everybody knows the Fed is at the end of its tightening cycle.

You know, the Fed launches a trial balloon, they raise the possibility of a rate hike, and they wait to see how the markets react. And the markets are basically acting positively, just like they did in December last year. Everybody was convinced there was a rate hike, but the markets were rising anyway. And I think it was the increase in the markets that gave the Fed the false confidence to actually raise rates. But as soon as they did, the markets sold off. We had the worst start to a year in history, and I think the same thing will happen if they raise rates in June. I think the market is going to sell off. I think gold is going to rally again. And I think the dollar is going to sell off. Because these rate hikes are too little too late.”

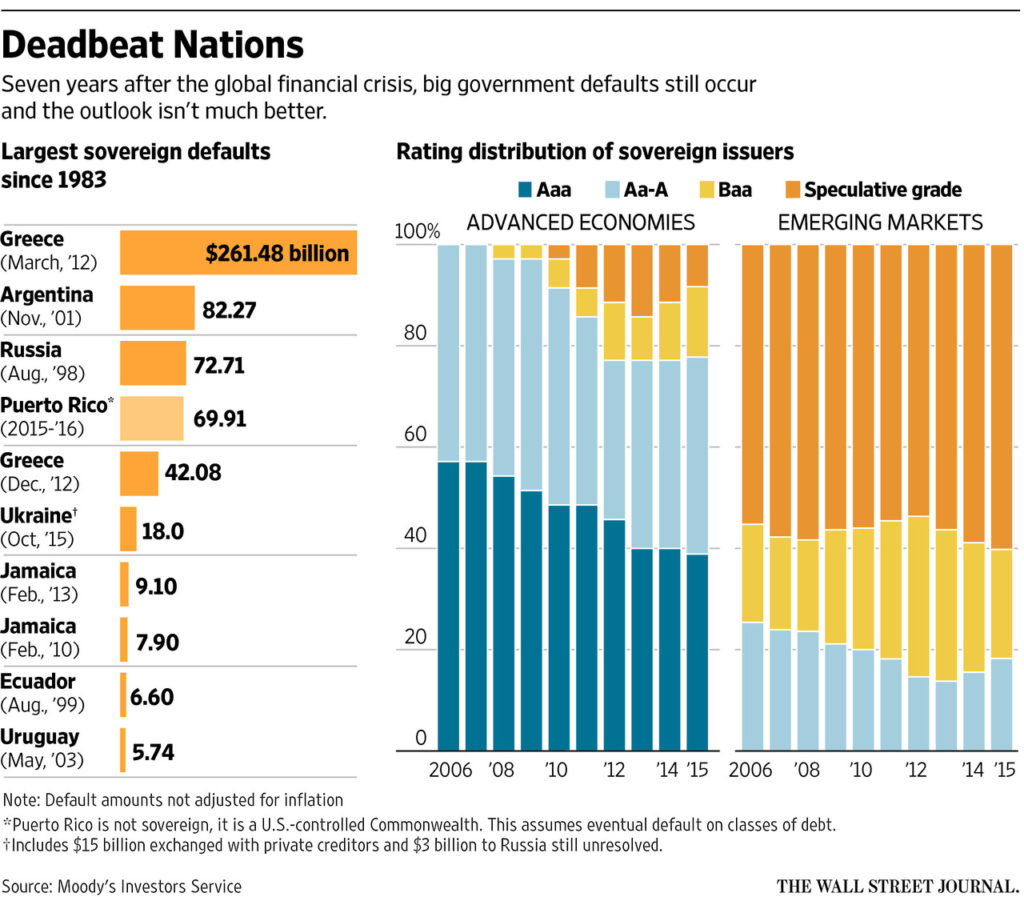

Good morning Puerto Rico. Default is coming.

Legislation moving in Congress would set up an oversight board to guide the US territory through what essentially amounts to bankruptcy. It would not expend federal funds to bail out Puerto Rico, but would allow the island’s government to pay back debtors at less than 100%.

This is just a taste of things to come.

A default was unthinkable just a couple of years ago. The national obligation to repay what it owes was once considered almost sacrosanct. In 2013, Puerto Rico Gov. Alejandro García Padilla said paying back all of its debt was not only constitutional, but “a moral obligation.”

Times have changed, as the Wall Street Journal points out:

Though markets have met the event with a shrug, that shouldn’t diminish the significance of the moment. It underlines how much the stigma about government default has faded. Investors would be wise to build this risk into their calculations when lending to governments from now on, especially since arithmetic suggests more defaults are on the way. With less moralizing and more planning, both creditors and debtors will be better off.”