The World Gold Council has announced plans to form a committee that will help set up India’s first physical gold exchange. Officials say they hope to have the exchange up and running in 12 to 18 months.

The committee will not actually set up the exchange, but will provide guidance. WGC Indian operations managing director PR Somasundaram told Bloomberg the council is in the process of creating an industry committee of jewelry trade associations, dealers, miners, regulators, foreign and Indian banks, and eventually some consumers.

After surging in August, gold continued to flow into ETFs last month, signaling continued strong demand for the yellow metal – specifically in North America.

According to the World Gold Council, gold-backed ETF holdings increased by 22.4 tons in September. This follows on the heels of a 31.4 ton increase in August.

What happens when government officials spend with virtually no restraint and they don’t have a printing press that can crank out more money?

Hartford, Connecticut.

Last week, both S&P Global Ratings and Moody’s Investors Service downgraded Hartford’s credit rating deeper into junk status. According to a Reuters report, the downgrade puts Hartford near the bottom of the credit scale. This means the agencies view the city as essentially in default with little prospect for a full bondholder recovery.

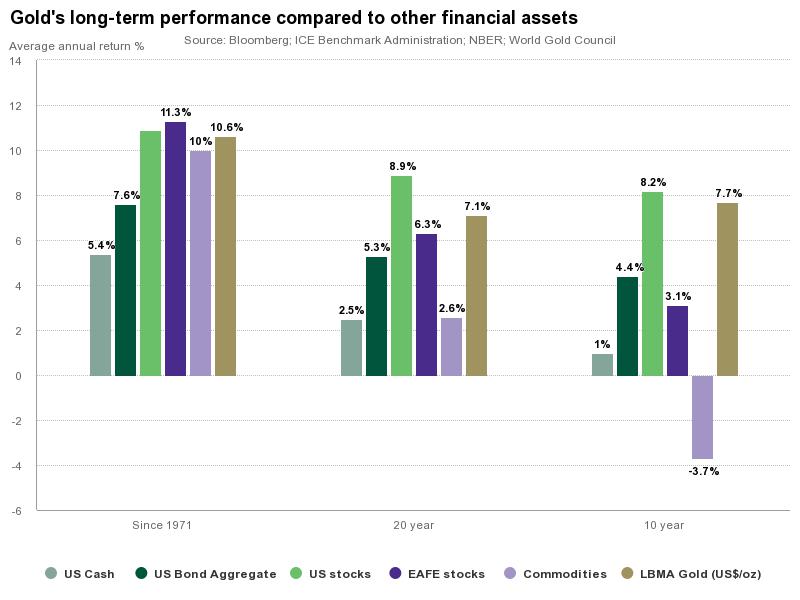

Conventional wisdom holds that gold is a good store of value, and provides a hedge of protection against inflation and economic upheaval. But a close look at the data reveals gold offers a long-term growth trajectory comparable to other financial asset classes.

Gold sales at Australia’s Perth Mint doubled in September. Meanwhile, sales of silver surged 78%.

Sales of gold coins and minted bars jumped to 46,415 ounces in September, up from 23,130 ounces a month ago. Silver sales during the month came in at 697,849 ounces, compared with 392,091 ounces in August.

Earlier this month, US Treasury Secretary Steven Mnuchin threatened China, saying the US would “put additional sanctions on them and prevent them from accessing the US and international dollar system” if they don’t go along with the most recent round of sanctions slapped on North Korea. We argued that the threat may be meaningful, but it also might be empty.

In a recent article published on the Mises Wire, Ryan McMaken added another layer of analysis, arguing that if the US were to follow through on the threat, it would imperil the US dollar. McMaken’s reasoning dovetails with a point we’ve made more generally about Trump’s penchant for tariffs – that they will undermine the dollar. Of course, that’s good for gold.

Indians love gold. Despite rising prices, a tax increase, and government attempts to tighten regulation of the jewelry industry, gold imports into the country nearly tripled year-on-year in August. India ranks as the second largest gold consuming country in the world, trailing only China. But gold isn’t the only precious metal Indians covet. They also buy a lot of silver.

According to a new report by the Silver Institute, India consumed 160.6 million ounces of silver in 2016, accounting for 16% of global silver demand.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

A few Fridays back, I shared some of the innovative ways people have come up with to smuggle gold. Like I said in that article, gold smuggling is a very lucrative business. People want gold, and they’ll go to great lengths to have it. But smuggling isn’t as easy as you might think, and people have put gold in some places … Well, let’s just say it couldn’t have been a comfortable experience.

OK – I’ll just come out and say it. More than a few smugglers have resorted to sticking gold up their butts.

Last week, Janet Yellen announced the Federal Reserve will begin the much anticipated “tapering” of its massive balance sheet. The Fed chair also hinted another interest rate hike is in the works. After the most recent FOMC meeting, we raised the question: Is this a viable path forward, or is the central bank playing a game of monetary chicken? Peter Schiff has argued that the Fed ultimately won’t be able to reduce its balance sheet to any significant extent. So, despite the Fed’s hawkish stance, the path forward seems far from certain.

In a recent article published on the Mises Fed Watch, Tho Bishop also raised some poignant questions about how the Fed will actually move forward with monetary policy.