A recent note to clients authored by Goldman Sachs analysts, including Jeffrey Currie and Michael Hinds, emphasized the continuing importance of gold and silver to investors, saying precious metals remain a relevant asset class in modern portfolios. The report focused on precious metals’ durability and intrinsic value, noting they are neither a historic accident nor a relic, even with new assets such as cryptocurrencies emerging.

The use of precious metals is not a historical accident – they are still the best long-term store of value out of the known elements.”

The note also focused on Bitcoin, saying investors shouldn’t consider cryptocurrencies the “new gold.”

Stock markets continue to surge higher on a seemingly endless upward trajectory. On Tuesday, the Dow Jones crossed the 23,000 mark for a time and closed just below that threshold at 22,997.

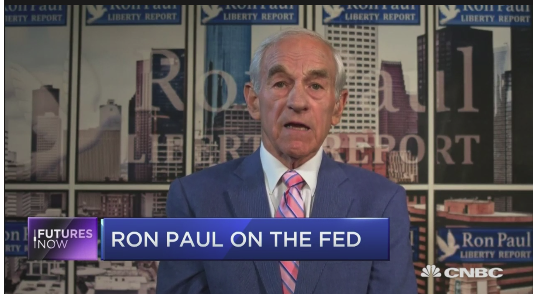

It almost seems like this can go on forever, but Ron Paul said it would eventually come to an end during an interview on CNBC Futures Now last week. He said it reminds him of “delusions and the madness of crowds.”

News of hotter than expected inflation numbers caused gold to sell off Tuesday. The markets seem to think rising inflation is bullish for the dollar and bearish for gold.

But is it really? Is higher inflation really bad for gold?

As Peter Schiff points out in his latest podcast, this whole notion is rather absurd.

Speculation continues to swirl around the question of who President Trump will appoint as Federal Reserve Chair when Janet Yellen’s term comes to an end in February.

Trump will reportedly meet with Yellen this week to discuss the possibility of her staying on as the head of the central bank. During the presidential campaign, Trump was highly critical of Yellen, saying she is “obviously political,” and accusing her of “doing what Obama wants her to do.”

Palladium probably isn’t something you think about when you consider investing in precious metals.

Maybe you should.

Palladium broke through the $1,000 mark on Monday. The price of the metal has spiked nearly 50% in 2017 and is at its highest level in 16 years.

Could silver be set to soar?

Analysts Barron’s spoke with recently think so.

An article published on the business journal’s website last week predicted the white metal will emerge as a winner for the second straight year.

With a per-ounce price of $17.41 for silver futures as of Friday, analysts say the white metal is poised for a big climb, particularly as the gold-to-silver ratio stands well above historical averages.”

Australian gold output will peak in just four years and then begin a steep decline, according to a report issued by a Melbourne-based industry adviser.

According to MinEx Consulting analysis reported by Bloomberg Business, Australian mine output will max out in 2021 and then fall by half into the mid-2050s, as aging mines close down.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The Aztecs described gold as the “excrement of the gods.”

Apparently, it’s also the excrement of mere mortals.

In a widely circulated story, the Swiss Federal Institute of Aquatic Science and Technology (EAWAG) reports that about $3.6 million in gold and silver are lost each year in wastewater and sludge discharged from Swiss wastewater plants each year.

People seem to enjoy pitting gold and Bitcoin against each other. But do I really have to pick just one?

While cryptocurrency and precious metals have many similarities, in many ways they are polar opposites. And you can have both.