National Debt Surges By Over $350 Billion in One Day After Debt Ceiling Deal

I warned you.

I said when the fake debt ceiling fight ended, the real problems would begin.

Well, the debt ceiling fight is over, and here we are.

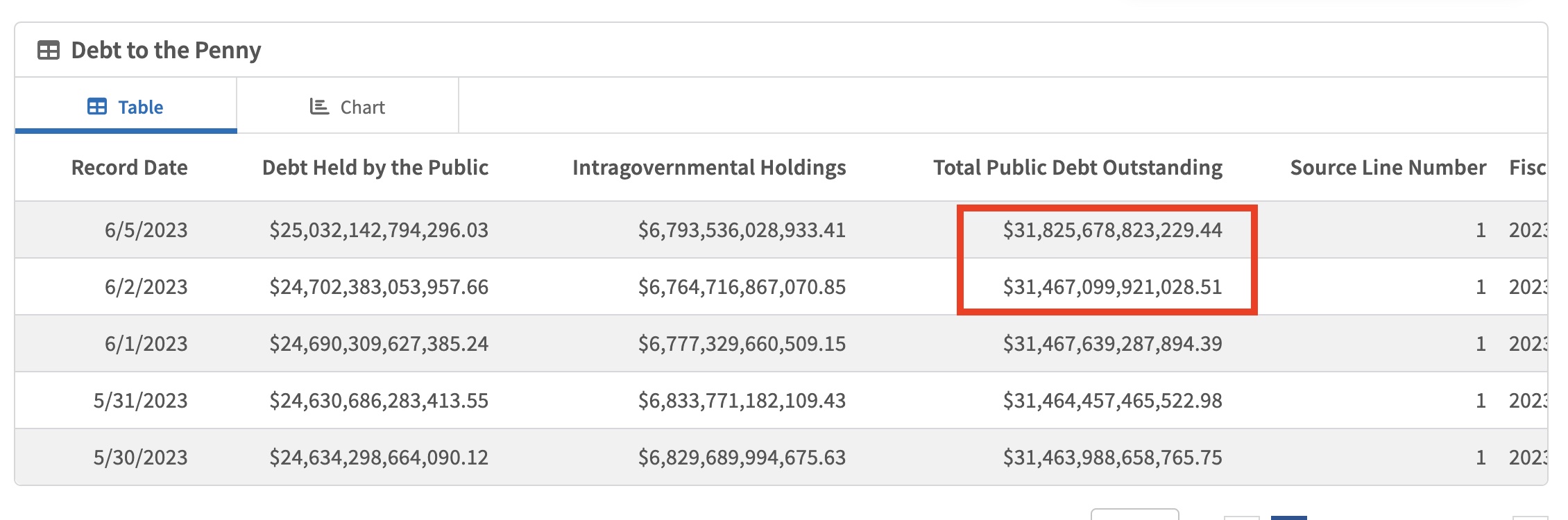

On the first working day after the so-called Fiscal Responsibility Act went into effect, the national debt surged by $359 billion.

On June 5, the US Treasury reported that the debt increased from $31.467 trillion to $31.826 trillion.

And you can expect more eye-popping single-day national debt increases in the days ahead.

Sorry, you’re going to have to wait for the fiscal responsibility part. (I wouldn’t hold my breath.)

When it was all said and done, the debt ceiling deal got Uncle Sam a shiny new credit card with no borrowing limit, and it got us some fake spending cuts. The mentality now seems to be that everybody can go back to business as usual because the problem is solved.

But the problem isn’t solved.

In fact, the deal exacerbated the problem.

The fundamental issue wasn’t that the US government couldn’t borrow enough money. The fundamental problem was, and still is, that the US government spends too much money. Despite the pretend spending cuts Republicans bragged about, the deal didn’t address that problem. Even with the new plan in place, spending will go up. That means big budget deficits will continue and the national debt will mount.

After months up against the borrowing limit, the balance in the federal government’s checking account (called the Treasury General Account or TGA at the New York Federal Reserve Bank) was dangerously low. At the end of last week, the balance was a mere $23 billion, down from nearly $1 trillion. That balance has to be replenished with new borrowing. That’s on top of the borrowing that will be necessary to maintain massive monthly deficits.

So, they’re back to borrowing, as evidenced by the big jump in the national debt.

We can also see it in an increase in outstanding Treasuries. Marketable Treasury securities (bonds that can be traded in the bond market) spiked by $330 billion on June 5. And that’s just the beginning.

According to analysis by Goldman Sachs, the US Treasury will have to sell as much as $700 billion in T-bills within six to eight weeks just to replenish cash reserves spent down while the government was up against the borrowing limit. On a net basis, the Treasury will likely have to sell more than $1 trillion in Treasuries this year.

The first question is who is going to buy all of these bonds?

And the second question is how will it impact the financial markets?

The market will almost certainly be able to absorb all of that paper, but it will likely cause interest rates to rise as the supply of Treasuries spikes. And that will have a ripple effect though the broader market.

In effect, as the Treasury floods the market with new debt, bond prices will likely fall in order to create enough demand for all of those Treasuries. Bond yields are inversely correlated with bond prices, and as prices fall, interest rates rise.

A Bank of America note projects that the anticipated post-debt ceiling bond sale would have an impact equivalent to another 25 basis point Federal Reserve rate hike.

As WolfStreet noted, this will have a spillover effect.

Liquidity will be drained from the markets because the primary dealers and investors will buy all those Treasury securities that are being issued, instead of other stuff, and they will sell other stuff to fund their purchases of Treasury securities, and this flow of liquidity alters the buying and selling pressures.”

A liquidity drain coupled with rising interest rates is bad news for anybody in debt. And there are a lot of people in debt, from consumers, to corporations, to the federal government.

Exactly how this will impact the economy in the long term remains to be seen, but it’s pretty obvious this is an unsustainable trajectory. It will put even more strain on the financial system. Rising interest rates have already kicked off a financial crisis. It’s only a matter of time before something else breaks.

Looking further down the road, at some point, this unlimited borrowing is going to force the Federal Reserve to monetize some of this debt. That means a return to quantitative easing.

Even if it doesn’t happen immediately, QE is in the future. There is no other way for the market to absorb all of the debt the Treasury will have to issue to support spending that will mostly go onto a credit card with no limits.

In order to prop up the bond market and keep prices higher than they otherwise would be (and interest rates lower), the Fed will ultimately have to buy bonds to boost demand. It will buy those Treasuries with money created out of thin air.

That’s inflation.

In other words, you’re going to pay for all of this government spending through the inflation tax.

In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […]

In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […] Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […] California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […]

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […] The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]