The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

As Peter Schiff put it in a Facebook post, Trump promised to drain the swamp, but today, “The swamp is now bigger and more expensive than ever!”

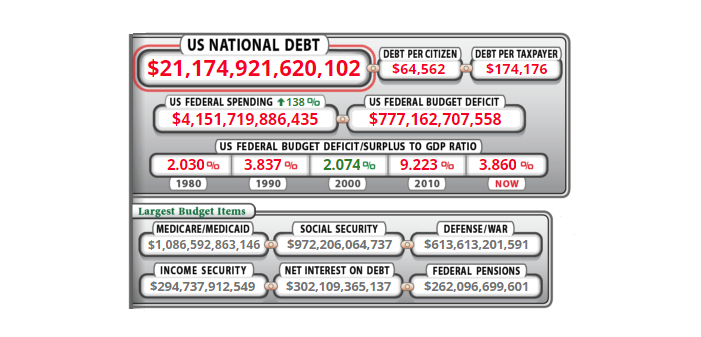

The US government spent a record $433.3 billion last month, running up a monthly deficit of $214 billion, according to data released by the US Treasury Department.

That’s $433 BILLION spent in a single month.

At the current trajectory, the cost of paying the annual interest on the US debt will equal the annual cost of Social Security within 30 years, according to a recent report released by the Congressional Budget Office.

By 2048, as interest rates rise from their currently low levels and as debt accumulates, the federal government’s net interest costs are projected to more than double as a percentage of GDP and to reach record levels. Those costs would equal spending for Social Security, currently the largest federal program, by 2048.”

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

A lot of seemingly positive economic data came out last week, but in his most recent podcast, Peter Schiff said it is just feeding into a delusional economic narrative that ignores the most fundamental storyline – debt. Everybody is talking about a new era of prosperity, but Peter said it’s a phony prosperity and it isn’t going to last.

One of the favorite Republican talking points is that tax cuts will “pay for themselves” by spurring economic growth. This seems plausible. But GOP talking heads underestimate just how much growth would be necessary to pay for the massive tax cuts and spending increases recently passed by Congress. In fact, the Congressional Budget Office released its analysis Monday and said that the tax cut plan will “balloon” the deficit over the next several years.

As we’ve reported, the US government is spending money like a drunken sailor. But nobody really seems to care.

Since Nov. 8, the US national debt has risen $1 trillion. Meanwhile, the Russell 2000 (a small-cap stock market index) has risen by 30%. Former Reagan budget director David Stockman said this makes no sense in a rational world, and he thinks the FY 2019 is going to sink the casino.

In all of the talk about tax reform, nobody is considering the more fundamental problem facing America – the size and scope of the federal government.

Peter Schiff has described the Republican tax plan as “tax cuts masquerading as reform.” When it’s all said and done, Americans aren’t going to get tax relief. They are going to get big government on a credit card. The balance will come due down the road.

The real issue is the total cost of government. In an article originally published on the Mises Wire, Ryan McMaken argues that if Republicans really want to ease the burden of government, they need to cut spending.