Peter Schiff recently appeared on RT Boom Bust to talk about Fed monetary policy and the possibility of a taper. He said even if the Fed does slow asset purchases, the taper won’t last long. Ultimately, the Fed will expand QE.

The Labor Department released its August jobs report on Friday. To say the numbers were disappointing would be an understatement.

According to the report, there was an increase of only 235k jobs, well below the estimated 720k. That’s a miss of nearly 500k jobs.

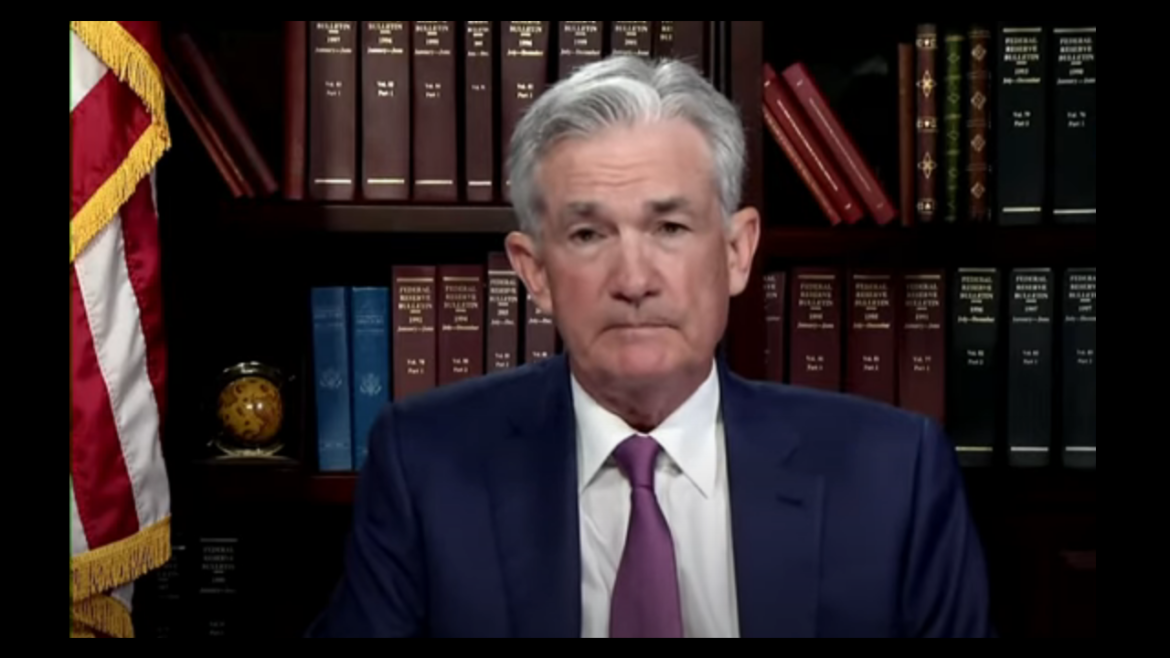

Federal Reserve Chairman Jerome Powell spent most of his Jackson Hole speech continuing to try to convince everybody that inflation is transitory. As Friday Gold Wrap podcast host Mike Maharrey points out in this episode, whether it is or isn’t transitory, inflation is a real thing that has a real impact on real people. In this show, he also breaks the news on the August jobs numbers and discusses taper talk.

The month-on-month trade deficit fell in July but remains far larger than it was a year ago. And the Trailing Twelve Month figure hit a new record.

There’s been a lot of talk about the Federal Reserve tapering quantitative easing. So far, it’s been nothing but talk.

A lot of people expected Federal Reserve Chairman Jerome Powell to offer some details and perhaps a timeline for the taper during his Jackson Hole speech. We got no such thing. Instead, he tapered the taper talk. In fact, Powell never uttered the word “taper.” he spent most of the speech trying to prop up his “transitory” inflation narrative.

Personal income is rising.

But inflation is eating it up.

Before factoring in inflation, personal income from all sources rose by 2.7% in July year-on-year. The month-on-month gain was a solid 1.1%. This includes wages, stimulus payments, transfer payments (unemployment, Social Security benefits, etc.) along with income from other sources such as interest, dividends, and rental income.

Jerome Powell delivered his much-anticipated speech virtually during the Jackson Hole summit on Aug. 27. Peter Schiff talked about the speech during his podcast. Everybody expected a hawkish speech outlining the Fed’s plan to taper quantitative easing. Instead, Powell tapered the taper talk.

The “transitory” inflation swamping the country has stubbornly persisted into July. Producer prices posted a second straight 1% month-over-month increase, which brought the full-year number to a record 7.8%. Twelve-month US export prices rose 17.2%, and nearly 22% if the rate of the first seven months of 2021 were annualized. (I find it telling that those prices – which are subject to no after-the-fact data collection adjustments – are rising at a rate that is nearly triple the CPI).

Jerome Powell will speak today at the Jackson Hole economic summit. Everybody is on pins and needles in anticipation of the Fed chairman’s speech. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey discusses the Fed’s messaging and then moves past the talk to discuss the “here and now” reality. He also spends some time talking more fundamentally about gold as part of an investment strategy.

Dallas Federal Reserve President Robert Kaplan has been one of the more hawkish Fed members. On Aug 11, he said the Fed should announce a quantitative easing taper in September and begin slowing asset purchases in October. But two weeks later, Kaplan backed off that assertion, saying that with the surge of COVID-19, he was open to adjusting his view. In an interview on CNBC’s “Squawk Box,” financial analyst Jim Grant explained why the Fed is playing with fire.