July Trade Deficit Shrinks but Trailing Twelve Month Number Hits New Record

The month-on-month trade deficit fell in July but remains far larger than it was a year ago. And the Trailing Twelve Month figure hit a new record.

Current Trends

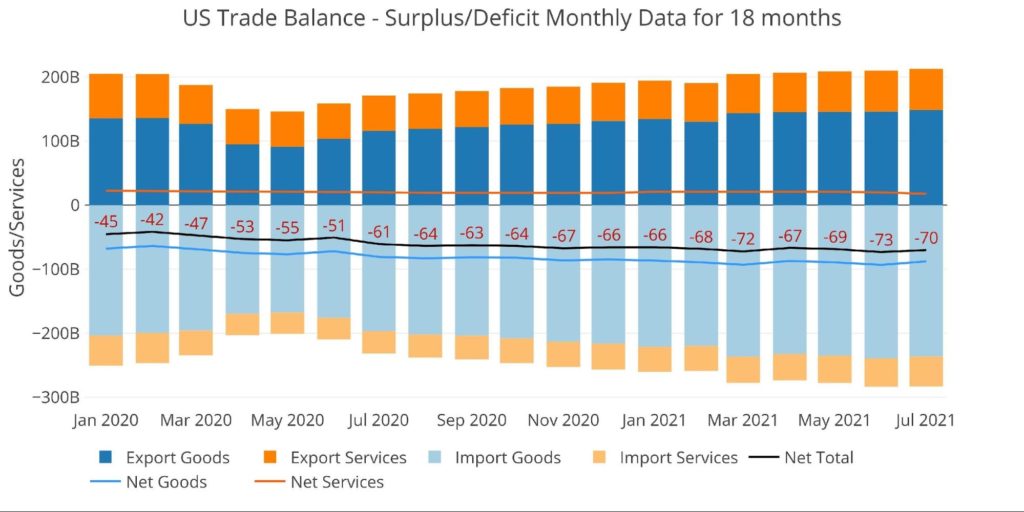

July 2021 saw a total trade deficit of -$70B which is down 4.3% compared to June’s -$73.2B but 15.3% larger than the -$60.7B posted in July 2020. The plot below shows Imports, Exports, and Net figures (lines) over the last 18 months.

The Services Surplus collapsed by 11.8% to $17.7B, the smallest Services Surplus since Jan 2012.

Figure: 1 Monthly Plot Detail

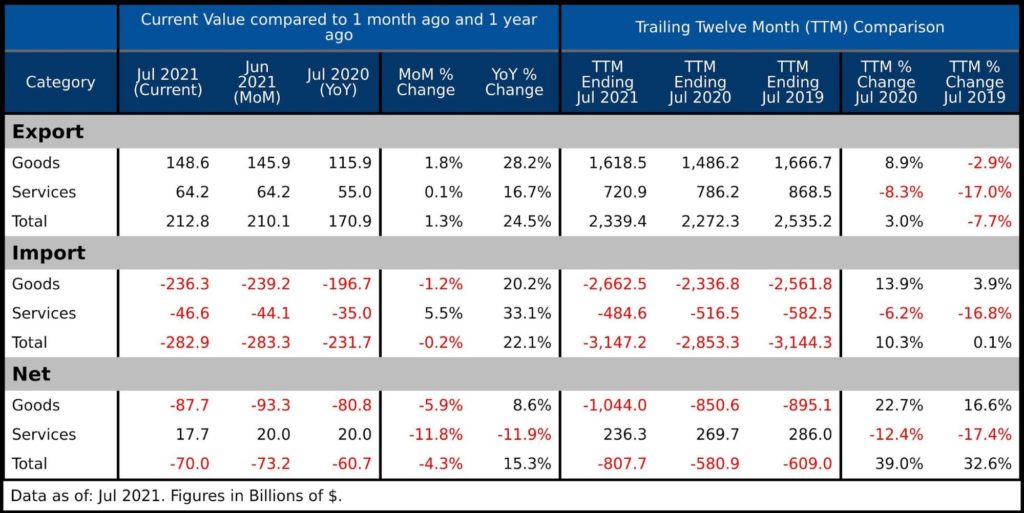

The table below provides a deeper look into the numbers. Some key takeaways:

- The MoM change was driven by increasing exports (+2.7B) and falling Imports (-$0.4B)

- Imported Services actually increased by $2.5B but Imported Goods fell by $2.9B

- Because Exported Services was flat, the Services Surplus fell by nearly 12%

- The trend in a falling Services Surplus has been discussed before

Looking at Trailing Twelve Month:

- The Total Net deficit has surged 39% from $581B in July 2020 to $808B. This represents a massive 39% increase in the TTM trade deficit.

- Much of this is due to the collapse in trade activity due to Covid last year

- Even looking pre-Covid, the TTM deficit is up 32.6% from the $609B in July 2019

- The Total Net surge is due primarily to Imported Goods increasing by almost $100B while Exported Services has decreased by $150B when comparing 2021 to 2019

- Interestingly Imported Services fell by $100B keeping the Total Imported flat at 3.1T

- Net Services has seen a big decline of 17.4% falling over $50B from $286B to $236B since 2019

The surging trade deficit is being attributed to the US recovering faster than every other nation and thus having more money to demand Imported Goods. The current theory states that as the rest of the world also recovers, the gap will close as US Exported Goods rebounds.

In this most recent month, that theory has gained support as Exported Goods increased 1.8% while Imported Goods fell 1.2% (probably due to stimulus money running out). Will this trend hold in the months ahead?

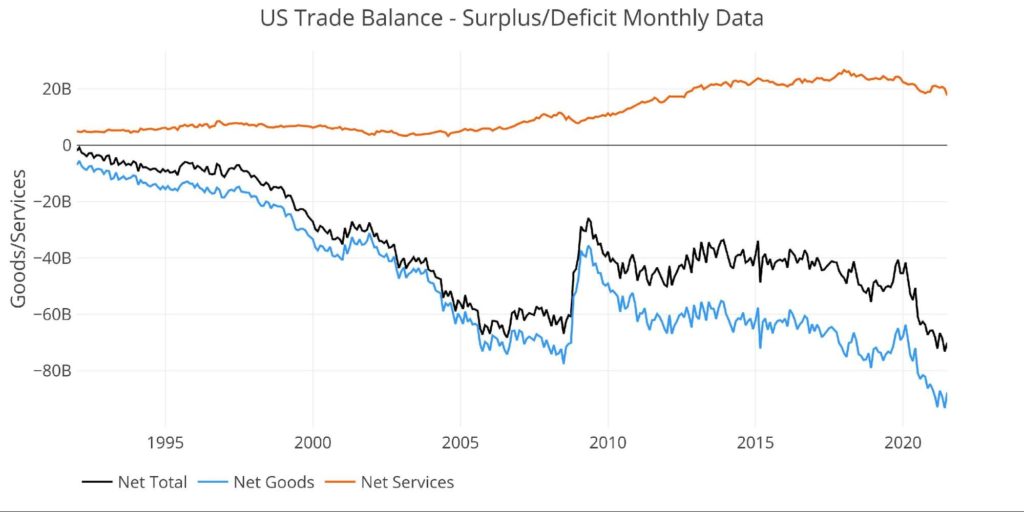

The US has maintained a surplus in Services for decades, even increasing the Net Services figure since 2008. The trend has changed since 2018 (see line chart below). If this does not reverse it will provide a stronger tailwind to increasing Total Net Trade Deficits in the months and years ahead.

To really demonstrate the effect, consider that in Dec 2019 Net Goods Deficit of $69.2B was offset by a Net Services Surplus of $23.8B. In the most recent month, the Goods Deficit is $87.7B vs only $17.7B offset in Net Services Surplus. The ratio has almost doubled from 2.8 to 4.95!

Figure: 2 Trade Balance Detail

Historical Perspective

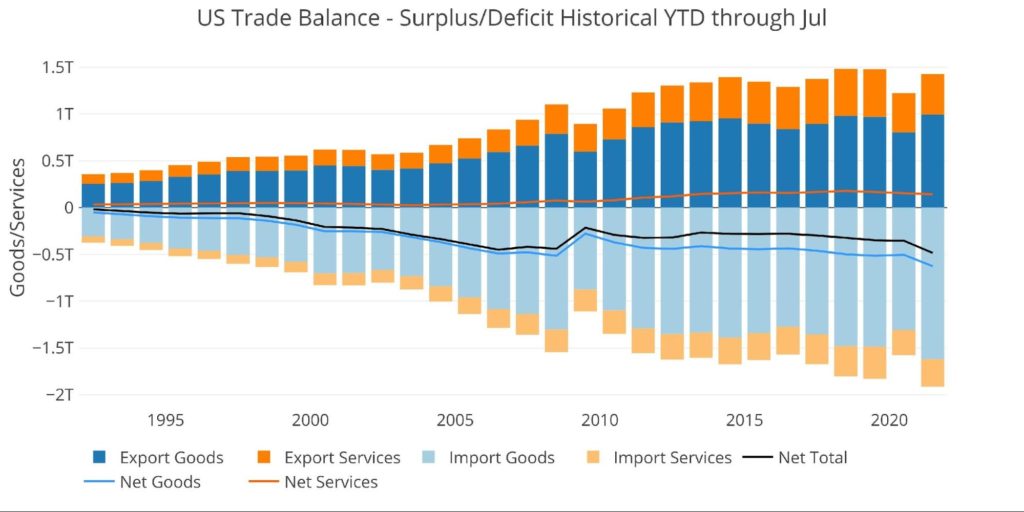

Zooming out and focusing on the Net numbers shows the longer-term trend. This plot demonstrates just how much larger the Goods deficit is compared to the Services surplus. As mentioned above, the services surplus has been declining since Jan 2018.

Figure: 3 Historical Net Trade Balance

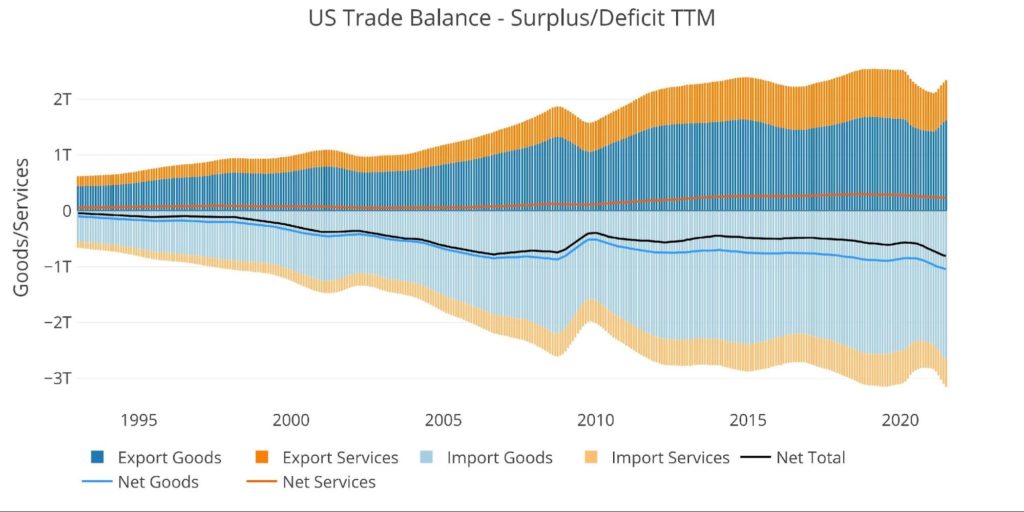

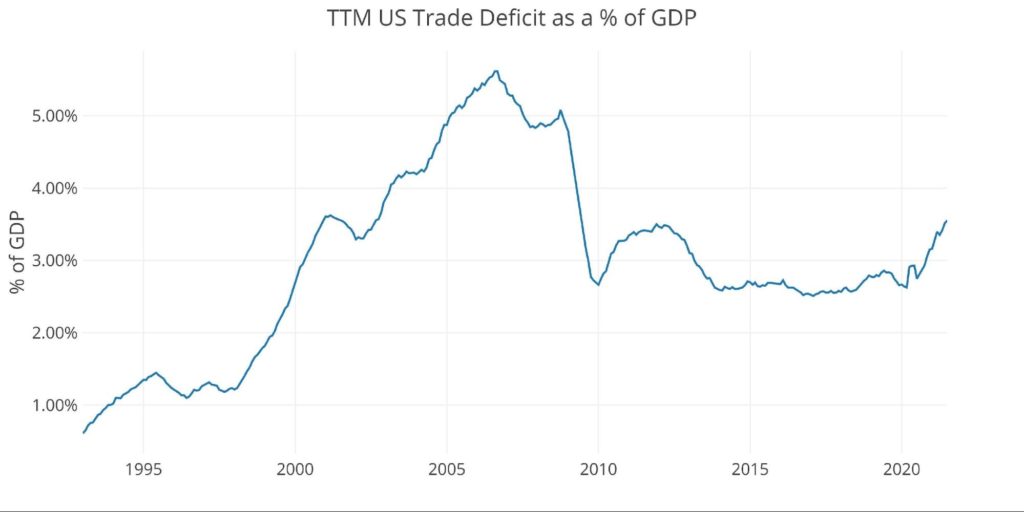

To put it all together and remove some of the noise, the next plot below shows the Trailing Twelve Month (TTM) values for each month (i.e. each period represents the summation of the previous 12 months). This latest 12 month period of -$807B is the largest ever, having strongly exceeded the record set in June of $798B (adjusted down from $812B), which was the largest since September 2006 of $779B.

Figure: 4 Trailing 12 Months (TTM)

Although the Net dollar deficits are hitting all-time records, they can be put in perspective by comparing the value to US GDP. As the chart below shows, the current records are still below the 2006 highs before the Great Financial Crisis.

That being said, the trend has reversed strongly, reaching 3.55% in the latest month.

Figure: 5 TTM vs GDP

Finally, to compare the calendar year with previous calendar years, the plot below shows the Year to Date (YTD) figures for each year through the current month. 2021 can clearly be seen as having bent the trend in a more steeply downward sloping direction.

Figure: 6 Year to Date

What It Means for Gold and Silver

The Trade Deficit matters for gold and silver because it shows how much the US is importing in exchange for US Dollars. A trade deficit means that the difference has to be made up with dollars rather than Goods and Services. Think about trading in a used vehicle for a new one. Because the old car is not as valuable as the new car, the customer must make up the difference with cash. The US exports are not as valuable as the imports coming into the US, thus the difference is made up by sending dollars abroad to trading partners.

Not only does this demonstrate a weak economy that consumes more than it produces, but it means the supply of dollars around the world continues to grow. With more dollars circulating internationally, it puts downward pressure on the US dollar exchange rate when compared to other currencies. As the dollar loses value in the global economy, it supports the price of commodities measured in dollars, specifically hard currency like gold and silver.

Data Source: https://fred.stlouisfed.org/series/BOPGSTB

Data Updated: Monthly on one month lag

Last Updated: Sep 02, 2021 for Jul 2021

US Debt interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on. In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter.

In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter. Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect.

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect. Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]

Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […] The CME Comex is the Exchange where futures are traded for gold, silver, and other commodities. The CME also allows futures buyers to turn their contracts into physical metal through delivery. You can find more details on the CME here (e.g., vault types, major/minor months, delivery explanation, historical data, etc.).

The CME Comex is the Exchange where futures are traded for gold, silver, and other commodities. The CME also allows futures buyers to turn their contracts into physical metal through delivery. You can find more details on the CME here (e.g., vault types, major/minor months, delivery explanation, historical data, etc.).