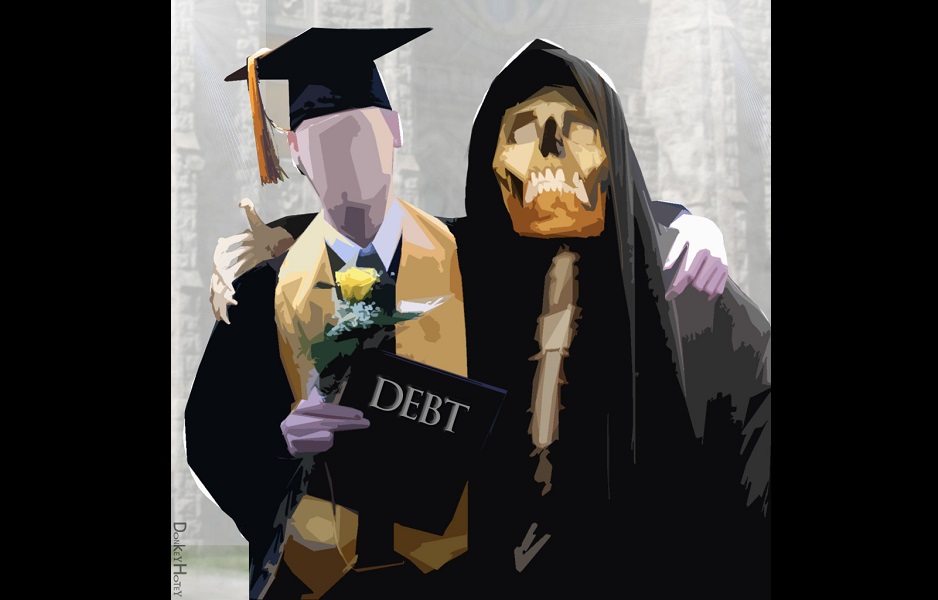

What happens when central banks push interest rates to zero – in some cases below zero – and hold them there for nearly a decade?

You get debt.

Lots and lots of debt.

Record levels of debt, in fact.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Student loan debt has grown to over $1.5 trillion. And that just accounts for loans held by Federal Student Aid. It doesn’t include private loans. Meanwhile, the Department of Education says 43% of those government-backed loans are considered “in distress.”

In a speech last month, Education Secretary Betsy DeVos put the current level of student debt in perspective.

One-point-five trillion dollars is almost impossible to fathom. So, let me put it this way: $1.5 trillion is more than $10,000 of someone else’s student loan debt for each and every American taxpayer—145 million of them.”

As WolfStreet put it, the $1.3 billion leveraged loan market has come unglued.

“Leveraged loans” are made to firms already deeply in debt. Think subprime loans for corporations. As with any risky loan, they could be difficult to either collect or resell in a downturn, putting both the borrower and lender at risk.

Americans took on another $10.9 billion in debt in September, according to data released by the Federal Reserve. That pushed total consumer debt to a seasonally adjusted $3.95 trillion. American indebtedness is growing at a 3.3% rate.

But there are signs that American credit card borrowing is slowing down and that’s not good news in an economy built on consumer spending and debt.

As we reported last week, China is dumping US debt. China’s holdings of US Treasuries fell for the third consecutive month in August. The Chinese shed another $6 billion in US debt, dropping its total holdings to $1.165 trillion. Over the last year, China’s holdings of Treasury bonds fell by $37 billion year-on-year.

But China has debt problems of its own. Local Chinese governments have reportedly piled up about $5.8 billion in debt. An S&P analyst called Chinese debt “an iceberg with titanic credit risks.”

Peter Schiff recently appeared on RT to talk about the US and Chinese debt.

In a podcast earlier this month, Peter Schiff talked about the “twin deficits” of national debt and trade. We’ve talked a lot about the federal debt spiral, and there has even been some discussion about it in the mainstream. But almost nobody is paying attention to the growing trade deficit. Peter is an exception. When the August numbers came out earlier this month, Peter noted it was the largest trade deficit in merchandise since the summer of 2008. And what happened right after the summer of 2008? The collapse of 2008.

The reason the trade deficit got that big is before the collapse, we had a bubble. We had a consumer debt binge where all the cheap money that was being created was feeding imports because Americans were taking their incomes, or their cheap money, and buying imported products. And so the big trade deficit was evidence of the bubble. And of course, the big trade deficits in and of themselves are unstainable.”

Antonius Aquinas has also taken note of the trade deficit. In the following article, he points out that tariffs aren’t going to make America Great Again. We need savings and investment, not a trade war.

On Tuesday, US stock markets rallied. The Dow was up over 500 points. That led a lot of people to conclude that the recent declines were just a correction. But as Peter Schiff pointed out in his most recent podcast, bear markets have rallies. Just because the market goes up a few days doesn’t mean we haven’t entered a bear market. The fact is — at this point we just don’t know.

But the dynamics are in place for a bear market. In fact, Peter has said the recession is obviously coming.

The end of last week was tough on US stock markets. The Dow fell off about 200 points on Thursday and another 180 on Friday. But despite those drops, the Dow was only down slightly on the week. The NASDAQ, on the other hand, fell more than 3% last week and the S&P 500 was off about 1%.

As Peter Schiff pointed out in his most recent podcast, the catalyst was rising interest rates, which the markets have been basically ignoring up until last week. Granted, the stock market drops weren’t steep compared to an October crash, but there is still plenty of time left in the month. Peter noted that high interest rates served as the backdrop for Black Monday in October 1987.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.