Trump Calls for Obama-Era Monetary Stimulus

The “Powell Pause” is not enough. President Donald Trump not only wants interest rates cuts; he wants to put quantitative easing back in play.

During an interview Friday, the president once again complained about the Fed’s 2018 interest rate increases, saying “they really slowed us down.” Trump wants stimulus and called on the Fed to resume Obama era QE.

Well, I personally think the Fed should drop rates. I think they really slowed us down. There’s no inflation. I would say in terms of quantitative tightening, it should actually now be quantitative easing. Very little if any inflation. And I think they should drop rates, and they should get rid of quantitative tightening. You would see a rocket ship. Despite that, we’re doing very well.”

The Fed has already committed to ending tightening later this year.

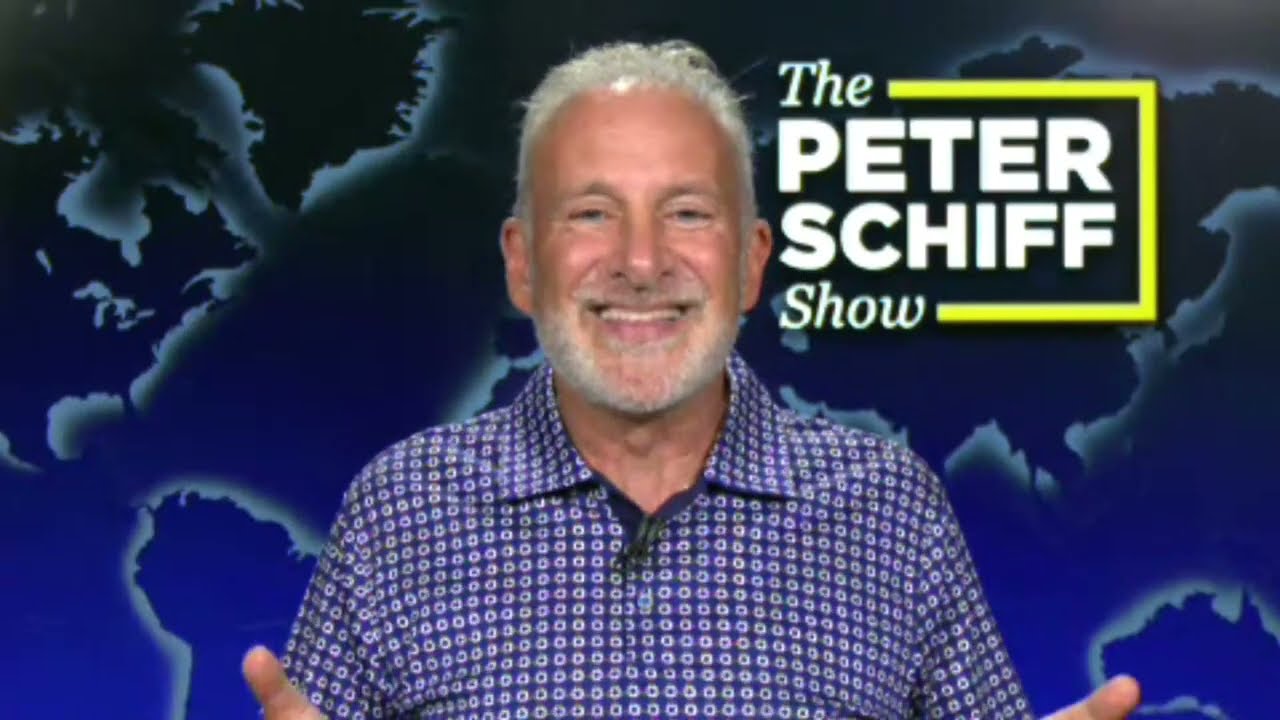

In his latest podcast, Peter Schiff pointed out just how incomprehensible Trump’s position is.

Donald Trump is, on the one hand, saying we’ve got the greatest economy ever in the history of the country, yet he’s also saying we need the same type of stimulus that we had during the Great Recession.”

So, which is it? Either the economy is strong or it isn’t.

If we need life support, it’s not strong.”

Ironically, Trump was a big critic of QE when Obama was doing it. And he was right to do so. But now that he can benefit politically from the same kind of Fed policy, he wants it.

Now, as president, he is calling for the Federal Reserve to do exactly what he criticized the Federal Reserve for doing when Obama was president. But now he’s president and he wants the Fed to do political things because he is the beneficiary, because now it’s the Trump economy so it’s the Trump bubble. And so he wants the bubble to get bigger and bigger, and so he wants the Feds to make the same mistakes under his administration that it made under the Obama administration, and he no longer gives a damn about the long-term consequences that may be negative because the furthest in the future that Donald Trump can now see is the 2020 election, and he wants a second term.”

But Peter said he doesn’t think this is only hypocrisy on the president’s part. He also thinks Trump’s call for QE exposes the lie.

I think when Donald Trump talks about how great the economy is, I don’t think he believes it. I think it’s just talk. I think it’s just a show that he’s putting on. I think it’s all public relations. I think, deep down, if you could get the president in a room and he could talk in confidence, I think he would admit that the economy is not doing well. I think he knows it’s the same big, fat, ugly bubble that he called out when he was a candidate.”

Peter has been saying all along the Fed will eventually go back to quantitative easing once it realizes the recession is upon us. But Trump wants QE now, hoping that it will delay the recession until after the 2020 election.

If the Fed waits for the recession to start, the recession is not going to be over before the election. And if the economy goes into recession, now what is the basis for Trump’s campaign for reelection? It’s supposed to be ‘Keep America Great Again.’ Well, if America is back in recession, who’s going to want to keep that?”

Trump is positioning himself to blame the Fed if we do fall into recession before the election.

Peter also touched on Trump’s nomination of Herman Cain and Stephen Moore. Some people have expressed optimism that maybe Trump wants to reform the Fed. Peter said he doesn’t think that’s the case.

Trump is not talking about putting Cain or Moore on the Federal Reserve because he wants to go back to the gold standard. He wants them there because they’re Republicans, and they’re partisan, and they’re his friends. And they understand, I think, that the Federal Reserve has inflated a bubble. just like Trump, and their main goal at the Fed will be to keep the party going long enough to reelect him.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Photo by Gage Skidmore

Peter leads off this week with an episode covering last Friday’s stock catastrophe, Bitcoin’s recent performance, and the start of President Trump’s so-called “hush-money” trial.

Peter leads off this week with an episode covering last Friday’s stock catastrophe, Bitcoin’s recent performance, and the start of President Trump’s so-called “hush-money” trial. Peter’s back in Puerto Rico this week for his podcast after another week of record gold prices. In this episode, he discusses media coverage of inflation, this week’s CPI report, and Bitcoin’s weakening price relative to gold.

Peter’s back in Puerto Rico this week for his podcast after another week of record gold prices. In this episode, he discusses media coverage of inflation, this week’s CPI report, and Bitcoin’s weakening price relative to gold. This week Peter recaps another stellar week for precious metal. He also discusses Friday’s jobs report, commodity prices, and Bitcoin.

This week Peter recaps another stellar week for precious metal. He also discusses Friday’s jobs report, commodity prices, and Bitcoin. This week Peter returned from vacation, and he was just in time for a surge in the price of gold. He discusses the factors contributing to gold’s record prices, the similarities between today and the 1970s, and data pointing to future inflation in America.

This week Peter returned from vacation, and he was just in time for a surge in the price of gold. He discusses the factors contributing to gold’s record prices, the similarities between today and the 1970s, and data pointing to future inflation in America. This time Peter tackles Jerome Powell’s speech from Wednesday, in which he announced that the Fed is holding the federal funds rate between 5.25 and 5.5%. He also briefly discusses Bitcoin’s pullback and the media’s lies about Donald Trump.

This time Peter tackles Jerome Powell’s speech from Wednesday, in which he announced that the Fed is holding the federal funds rate between 5.25 and 5.5%. He also briefly discusses Bitcoin’s pullback and the media’s lies about Donald Trump.