You may have seen the explosive debate between Rick Santelli and Steve Liesman on CNBC’s Halftime Report this week. Santelli admittedly “blew a gasket” when he began to challenge the conventional “wisdom” that the Federal Reserve has actually helped the economy with its quantitative easing. So was Santelli completely off-base? Has the Fed’s stimulus been successful? Absolutely not. In a longer segment on his radio show this week, Peter Schiff reviewed Santelli’s points and defended his argument that the Fed’s stimulus is actually laying the groundwork for much worse economic woes.

When the collapse finally comes, they’re going to say, ‘Nobody could have seen this coming!’ … They’re not going to realize that this phony recovery and the economic monetary policy behind it is going to be the reason for the next crisis. But because it takes years to unfold, they can’t connect the dots, and they think that anybody who saw it early and warned about it is just a stopped clock.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Major news hit this week that the BRICS have launched their own development bank to challenge the currently Western-dominated banking system. Read about it here. Who could better explain the rationale behind this new bank than the author of the book Currency Wars, Jim Rickards? Rickards appeared on CNBC this week to share his thoughts. His message? The world is ready to leave the dollar behind and kick the irresponsible United States out of the economic driver’s seat.

Every single member of the BRICS, multiple times has voiced dissatisfaction with the dollar, the dollar hegemony, the dollar-based system, and the IMF, which is really dominated by the US. So it’s not that there’s a revolution that happens overnight, but it’s more of an evolution away from the dollar.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

More and more mainstream investors are waking up to the economic problems stemming from the Federal Reserve’s unprecedented amount of money-printing in the last six years. This new opinion piece from Investor’s Business Daily takes a look at Janet Yellen’s congressional testimony and explains why the economy will be reeling for years from the damage done by QE. If you agree with people like Peter Schiff and believe that the “Real Crash” is approaching, make sure you’ve protected your savings with physical gold and silver.

The recovery is not yet ‘complete,’ Federal Reserve Chairwoman Janet Yellen suggested Tuesday, but the central bank plans to let interest rates rise anyway. We’ll soon learn just how solid this so-called recovery is.

‘The economy is continuing to make progress toward the Fed’s objectives of maximum employment and price stability,’ Yellen told Congress, predicting ‘a moderate pace’ of growth for the economy ‘over the next several years.’

Sadly, we don’t fully share her rosy outlook. Indeed, we think the Fed’s extraordinary interventions over the past 5-1/2 years have distorted markets and prices, and have held the economy back.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In a new commentary published by The Gold Republic Journal, renowned author and economist Jim Rickards explains why the Federal Reserve cannot safely exit its quantitative easing program. Rickards argues that the supposed strength of the US markets is a complete mirage created by the Fed’s policies.

The Federal Reserve, the central bank of the US, is nearing the end of its ability to manipulate the US economy without producing consequences worse that those it set out to avoid in 2008. The Fed has no good exits from seven years of market manipulation. If it continues its current policy of reducing purchases of assets, the so-called ‘tapering,’ it risks throwing the U.S. into a recession. If it reverses course and pauses the taper and later increases asset purchases, it risks destroying confidence in the dollar among foreign creditors of the U.S. Both outcomes are potentially disastrous, but there are no good outcomes on the horizon. This is the result of manipulating markets to the point where they no longer function as markets providing useful price signals and guiding the efficient allocation of capital. Today markets are a mirage, created by the Federal Reserve, which is caught in a prison of its own device.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

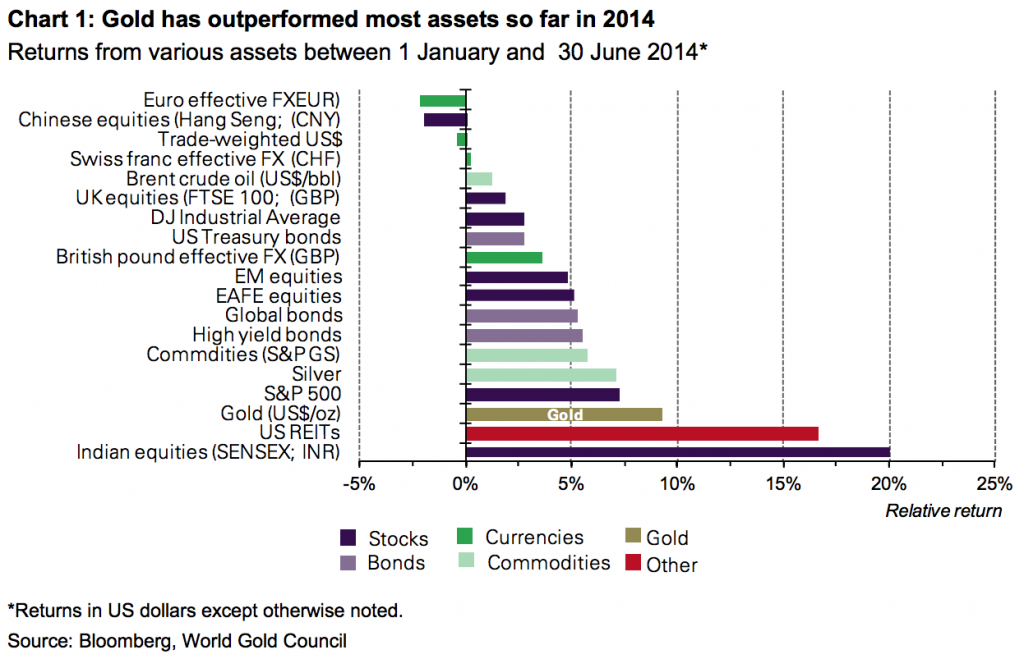

In its latest Investment Commentary, the World Gold Council explains why gold outperformed most assets in the first half of 2014, contrary to many analysts’ predictions. The report also shares the latest research on why gold is an essential asset for protecting your portfolio from high-risk debt and potential market volatility. The big takeaway – when it comes to risk protection in the second half of 2014, gold is one of your cheapest and most reliable options.

Gold is up by 9.2% so far this year. This surprised many market participants as most analysts predicted lower prices. Some investors took advantage of last year’s price correction to buy gold but investment demand has remained tepid. We consider that the current environment of high bond issuance, tight credit spreads and record low volatility continues to offer a prime opportunity for investors to add gold. In our view, gold can reduce overall portfolio risk and it is cheaper to implement than many volatility-based strategies.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold Interested in learning about the best ways to buy gold and silver? Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In the first edition of the new Gold Videocast, Peter delivers his verdict on the gold market for the first half of 2014, analyzes Janet Yellen’s performance so far as Fed Chair, and makes some contrarian forecasts for the rest of the year.

In this long segment on CNBC’s Futures Now, Peter Schiff, Marc Faber, and Dennis Gartman discuss the massive bubbles forming in almost every asset class. Faber called for a potential bear market correction of 30% in US stocks. All three agreed that gold is the best option for retail investors to protect themselves from the Federal Reserve’s inflationary monetary policy.

The only place there’s not a bubble is in gold, and that’s the only place that most people on Wall Street think they see one. They’re oblivious to the actual bubbles, but they’re overlooking the value in gold…”

Marc Faber, Schiff, and Gartman talk markets from CNBC.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Russia Today spoke with Peter Schiff about the United States’ international spy activity and what effect it will have on the strength of the US dollar.

[Europe is not economically dependent on the US.] I think it is the other way around – the US is very dependent on the rest of the world. It is just incumbent on the rest of the world to figure that out. But the US dollar is still functioning as a reserve currency, so the dollar is a part of larger transactions but there is no reason for the dollar to be at the center of these transactions because the dollar shouldn’t be a reserve currency. Maybe at one time when we were the world’s largest exporter, as far as biggest trade surpluses, we had high savings rates, and the dollar was backed by gold. [At] one time maybe the dollar deserved to be a reserve currency, but certainly those conditions have changed dramatically.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

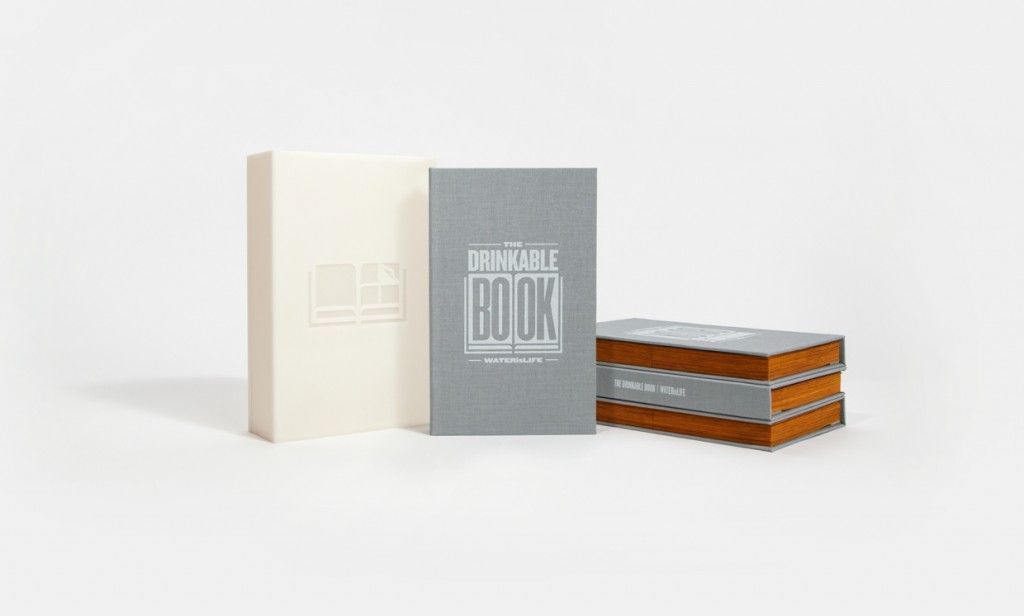

The June edition of the Silver Institute’s Silver News is now available. This issue is full of news from the silver industry, highlighting some of the most interesting inventions and applications using silver today. Silver’s natural anti-microbial properties are being explored by industries around the world, ensuring demand for the white metal for many years into the future. Among other news, you’ll learn about:

- A new “drinkable book” that uses silver to filter water with its pages.

- Silver for use in bone implants.

- Cyanide-free, silver-based finishes from Dow.

- The rapidly growing market for silver inks and pastes.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The news came out last week that Germany has changed its mind and will allow its foreign gold reserves to remain in the vaults of the New York Federal Reserve. Read the story here. With the World Cup occurring simultaneously, Lampoon the System couldn’t help but poke a little fun…

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!