We are excited to announce that through a new partnership with BitPay, we now accept bitcoin payments! We are the largest precious metals dealer in the world to do so. Speak with one of our Precious Metals Specialists today for more information. Read the full press release below.

NEW YORK – BitPay, world leader in business solutions for Bitcoin digital currency, announces a partnership with SchiffGold (formerly Euro Pacific Precious Metals). Based in New York City, SchiffGold is a major international gold and silver dealer – and the world’s largest by volume to accept bitcoin to date.

SchiffGold is led by famed investor Peter Schiff and specializes in making high-quality bullion coins and bars part of its customers’ financial portfolio. The company has built a reputation for calling out unsavory practices in the gold dealer industry, and for its honest and competitive pricing across all product categories. Executives at SchiffGold regularly seek out new ways to make transactions easier and cheaper for its customers, which is why BitPay was chosen.

“Bitcoin offers tremendous benefits as a medium of exchange for both our domestic and international customers. A wire transfer of fiat funds can be slow and expensive for the customer, and credit card fees are too high to absorb at the low premiums we offer. Not only does BitPay’s service make business sense, but we are excited about giving owners of bitcoin the opportunity to inexpensively and reliably convert any excess holdings into precious metals rather than back to fiat currency,” said Michael Finger, Director of Marketing at SchiffGold.

This partnership marks another major milestone in the acceptance of bitcoin worldwide, as larger and more global companies embrace the digital currency.

“We are very excited to form a partnership with SchiffGold, especially right on the heels of our collaboration with Toshiba. BitPay is honored to have a role in helping such global and established companies integrate bitcoin into their payment systems, ” said Tony Gallippi, Executive Chairman of BitPay.

BitPay is attracting merchants who sell low-priced goods where credit card fees are expensive and high-ticket items such as gold and silver where chargebacks are common and costly. Accepting bitcoins allows merchants to make these transactions irreversible, while eliminating the risk of fraud and identify theft for the buyer.

About BitPay

BitPay is a Payment Service Provider (PSP) specializing in eCommerce, B2B, and enterprise solutions for Bitcoin digital currency.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

There was big news this week, when a Senate committee heard testimony about widespread precious metals fraud since 2001. The activity has picked up significantly since the financial crisis, with conmen targeting people who want to protect their savings from a crumbling US dollar.

According to the news, US regulators have done virtually nothing to effectively stop the criminal activity. Here are some of the highlights being reported:

• 10,000 American (most elderly) victims since 2001

• $300 million in total losses

• $54 million lost in Florida alone

• 21 prosecuted cases by CFTC – Nobody jailed!

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

We can’t ignore it anymore – the markets are rigged. The LIBOR scandal broke almost two years ago, and the banks found responsible for manipulating that key index are still dealing with lawsuits. Meanwhile, allegations of gold market manipulation have been simmering for over a decade and grew into an inferno after the spot price dropped dramatically last spring.

Yet I’m left wondering what the conspiracy theorists hope to accomplish. Yes, I believe in exposing truth for its own sake and that the individual investor should have the same opportunities in the marketplace as the big institutions. But with these conspiracists, there is often a subtext of, “Because the price is suppressed, buying gold is for suckers.” I think this conclusion is precisely wrong.

Deutsche Bank Resigns London Fix Seat

Reuters – Deutsche Bank has resigned its seat on the London gold and silver fixes as part of a larger decision to end the majority of its commodities-related business. Deutsche Bank could find no buyer for its seat, perhaps due in part to a US lawsuit that accuses the five London gold fix banks of price-rigging. Deutsche Bank has held its position on the fixes for two decades and officially leaves on May 13th. Just four banks will be left to set the gold fix – Barclays, HSBC, Bank of Nova Scotia, and Societe Generale. Just two – HSBC and Bank of Nova Scotia – remain to set the silver fix. Read Full Article>>

China Gold Demand to Grow 25%

Bloomberg – Chinese gold demand will grow 25% by 2017, according to the World Gold Council.

Last week, if you were looking for gold coin news, you were likely to come across two stories about the release of brand new collector’s coins being issued by national mints.

The Royal Canadian Mint has released silver and gold coins commemorating the canonization of Pope John Paul II. The US Mint has released a new gold coin as part of their National Baseball Hall of Fame program, which is being heavily marketed as the “first curved coins ever produced.”

By Peter Schiff

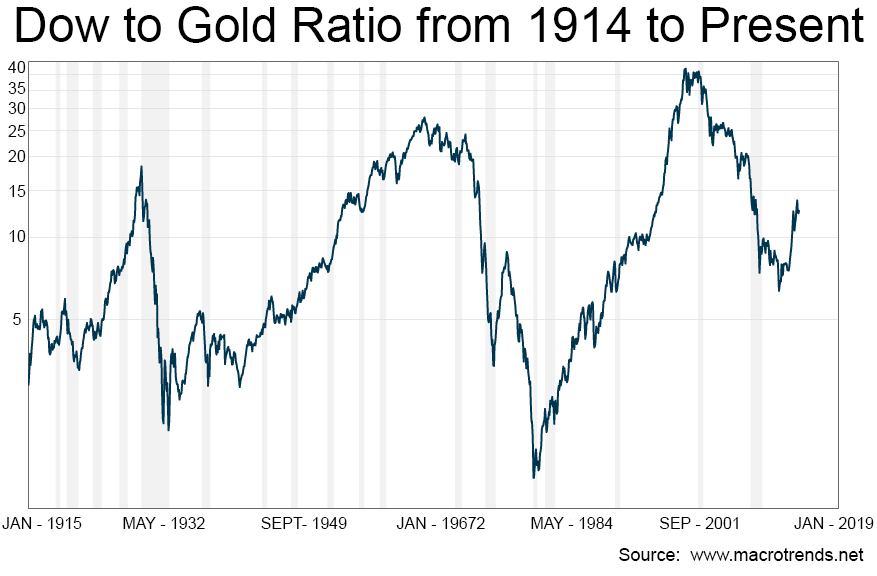

So far, 2014 has been a paradoxical year for gold. Many investors aren’t even aware that it has rallied more than 7%. On the rare occasion that the financial media mentions the yellow metal, it is only in the context of comparing the recent rise to last year’s decline.

In spite of this overwhelming negative sentiment, gold is experiencing a stealth rally as one of the best performing assets of the year. Let’s look at some important metrics of the most under-valued sector in this market.

By Jeff Clark of Casey Research

We’ve all heard of the inflationary horrors so many countries have lived through in the past. Developing nations and advanced economies alike – no country in history has escaped the debilitating fallout of unrepentant currency abuse. And we expect the same fallout to impact the US, the EU, Japan – all of today’s countries that have turned to the printing press as a solution to their economic woes.

Now, it seems obvious to us that the way to protect oneself against high inflation is to

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Korea Begins Spot Gold Trade

Wall Street Journal – The South Korean stock exchange has started trading physical spot gold for the first time, hoping to increase tax revenue from the yellow metal. South Koreans trade about 110 tons of gold every year, of which about 70 tons, worth $3 billion, are traded on the untaxed black market. Black market gold is a popular way to hide income and avoid taxes. The government is incentivizing gold traders to use the Korea Exchange by waiving import duties and offering tax reductions on these gold transactions. Read Full Article>>

China Gold Imports & Consumption Rise

Bloomberg – Chinese gold imports from Hong Kong increased to 109.2 metric tons in February, compared to 83.6 tons in January and 60.9 tons YoY. Chinese buyers purchased a total of 125 tons in February, compared to 102.6 tons in January and 97.1 tons YoY.