RT America hosted Peter Schiff and Mark Weisbrot from the Center for Economic and Policy research to discuss why the United States markets have been so volatile. While they both agreed that the US economic recovery has been poor, Weisbrot insisted that this is because the US government hasn’t done enough with its monetary policy. Peter, of course, argued that big government and a dovish Fed are precisely what have kept America from truly recovering from the Great Recession.

This market is all about the Fed. That’s the only thing that has been propping it up. If the Fed takes away the zero percent interest rates, this market is going to implode and we’re going right back into recession. That is the real story. That is what is hurting markets around the world. It’s the fear of higher interest rates. That’s propping up the dollar, that’s depressing emerging markets, that’s depressing commodity prices. This is the problem. But nobody believes or realizes that the Fed is bluffing…”

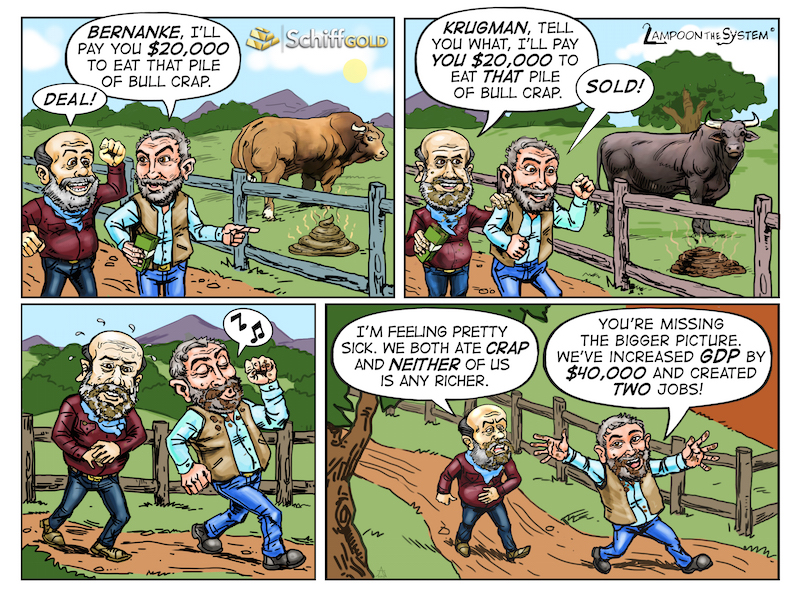

Below is a short scene from Paul Krugman’s recent visit to the funny farm where they send Federal Reserve Chairmen when they retire. It’s an odd place, where the plants are overwatered until the ground is bare (but at least the gardeners are never out of a job). Meanwhile, the cows are shipped to China to be milked, then shipped home again. Such inefficiencies might be puzzling, but to a Keynesian they are the hallmarks of a well-regulated economy.

While riding a bull market, investors are more than happy to eat up the stories fed to them by government economists and the Fed. It might seem like a good bet at the time, but as some investors are learning this week, you won’t end up any richer. Peter Schiff has responded directly to Krugman’s bull in the past, calling him out on his terrible track record:

Peter Schiff told Newsmax TV what he thinks is behind the big drops in the United States stock market recently. Unlike the mainstream financial media, Peter doesn’t think China has anything to do with yesterday’s volatility. Instead, he believes the markets are starting to wake up to the fact that the Federal Reserve is propping up the financial markets with its stale and destructive monetary policy.

[When] the year began, we were divided between two camps: those that thought the Fed would move in March and those that thought they would wait until June. They were both wrong. I was the only one that was saying the Fed won’t move at all in 2015, because they can’t do it at all without pricking their own bubble…”

Jim Grant appeared on CNBC this morning with an explanation of the underlying reason why United States stocks just plummeted. His core message is that capitalism requires both success and failure. When central bank monetary policy corrupts pricing as thoroughly as it currently has, it ruins the market’s ability to withstand healthy business failures. Grant doesn’t talk about it in this interview, but just a month ago he reminded us of the best assets to hold as protection from this distorted financial world – precious metals.

The prices themselves are the cosmetic evidence of underlying difficulty. So if you misprice something, it’s not just the price that’s wrong, it’s the thing itself that has been financed by the price. So you have perhaps too many oil derricks, too many semi-conductor fabs. We have too much of something, which is financed by an excess of credit or debt. That, to me, is the essential backstory to this morning’s difficulties. It’s the mispricing of asset values, led by central banks who think that by inflating or lifting up stocks, bonds, real estate, they will thereby engender prosperity…”

Chris Waltzek interviewed Peter Schiff on GoldSeek Radio a couple weeks ago and released the interview this past weekend. In the interview, Peter predicted the Dow Jones Industrial Average could be down 10% from its high before September. This morning, the Dow is down almost 10% on the year – more than 12% from its high.

Most of their interview was a review of the gold market, from the problems with paper speculators to China’s official gold holdings.

Former Federal Reserve Chairman Alan Greenspan appeared on Fox Business this week with two strong messages for investors:

1. The United States economy is “extraordinarily sluggish,” and part of this problem is the massive amount of government entitlements. He pointed out that entitlements have grown nearly 10% a year for the past 50 years, no matter which political party is in office. This adversely affects savings, which is the foundation for economic growth – a message Peter Schiff has been sharing for years.

2. Interest rates have never been kept this low for this long, so a huge bubble in bonds is forming. While this could correct itself slowly, history tells us that it will likely pop quickly, with devastating effects for the financial markets.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Most people who buy physical gold and silver these days tend to be those who are worried about our financial system.

They see unbacked, untrustworthy fiat currencies as an intrinsically flawed foundation for an economy. They see skyrocketing debt that doesn’t stop rising. They see an overvalued stock market, inflated by repeated rounds of quantitative easing. And they see world governments that cannot be trusted to act economically responsible – especially in light of how things have played out recently in Cyprus and in Greece. These are all good reasons to distrust and opt-out of the banking system and put one’s wealth in physical gold and silver instead.

Of course, not everyone is onboard with these ideas. Many do not see the sky falling so quickly and are still hopeful that our financial system is going to pull through okay.

Regardless of whether you are a gold bug or maintain faith in the “system,” there is still a very strong argument for holding up to 5-10% of your portfolio in precious metals — something that Peter Schiff has always recommended. And that is simply the argument of diversification.

After the Federal Open Market Committee’s meeting yesterday, the markets finally started to wake up to the fact that Janet Yellen’s Federal Reserve has no clue when or how it will raise rates. Analysts are starting to realize what Peter has said before – how will the Fed deal with the next recession if rates are stuck at zero? Of course, nobody but Peter is pointing out that a fourth round of quantitative easing is the Fed’s only solution.

The price of gold moved up on the news, while stocks were choppy. As usual, Peter Schiff took the time to dig into the latest economic data that reveals the economy is in no condition for the Fed to raise rates in September, let alone this year. This is just one of many reasons why now might be the perfect time to invest in physical gold.

Case in point was the Empire State Manufacturing Index that came out earlier this week on Monday. This is for August. Last month in July, that index was 3.86%, which is a really low number. The consensus was for a slight improvement to 4.75%. That’s what everybody thought. Well we actually got minus 14.92%… It wasn’t even in the realm, anywhere close. The lowest forecast that anybody made was 3%. Positive 3%.”

CCTV America interviewed Peter Schiff last week about the benefits of moving your business to Puerto Rico. Earlier this year, Peter discussed how moving to Puerto Rico is the next best thing to renouncing your United States citizenship without having to pay exit taxes to the federal government. In this interview, he also points out how Puerto Rico may be in debt, but when compared on a per capita basis to the United States, America is in much worse shape. It’s just a matter of time before America’s creditors realize this is the case.

Peter Schiff appeared on Alex Jones’ InfoWars last week to share some sad news. Peter’s father, Irwin Schiff, has just been diagnosed with terminal lung cancer. With a couple more years left in his prison sentence, this effectively means Irwin Schiff will serve a life sentence for his political beliefs. Peter and Alex discussed the hypocritical policies of the Internal Revenue Service and the federal court system that imprisoned Irwin Schiff.

I’ve sat around people who have admitted to me. Lawyers have said, ‘Look, your dad is technically right. He’s legally right, but the government won’t let him get away with it.’ I mean, that’s an important thing. I’ve talked to judges who have told me that. ‘Okay, yes, technically your dad may be right, but it doesn’t matter.’

“What Americans are willing to accept today – the type of taxation, the type of regulation – is off the charts compared to the tiny, little bit of government that Americans were protesting from King George…”

Peter has chosen the less risky route of paying his taxes in accordance with federal laws, though he continues to support Irwin’s ideals. Rather than withdrawing from the tax system, Peter advocates owning gold and silver as a way of withdrawing your savings from the US dollar. The inflation caused by quantitative easing is less apparent, but just as insidious as the official tax system.