Coin Sales Soar, Driven by Greek Crisis and Low Prices

Reuters – The sale of gold and silver coins soared in July, with the Greek financial crisis and low prices pushing demand. With more than a week left until the end of the month, sales of US Mint American Eagle gold coins had already vaulted above 110,000 ounces, the highest monthly total since April 2013. July sales eclipsed the total of 76,000 ounces sold in June, and 21,500 ounces sold in May. On July 7, the US Mint temporarily sold out of its 2015 American Eagle silver bullion coins due to a “significant” increase in demand. Sales did not resume until July 27.

Read Full Articles Here, Here, and Here >>

China Discloses Gold Holdings

The Wall Street Journal – China released an update on its gold reserves for the first time in six years. At the end of June, China’s gold holdings totaled 53.32 million troy ounces, up 57% from the end of April 2009 when the People’s Bank of China last reported reserves. China’s official holdings are now the fifth largest in the world, behind the US, Germany, Italy, and France. China’s holdings now eclipse those of Russia and Switzerland. Despite the increase, China’s holdings were less than many analysts anticipated.

Read Full Article >>

You go to the bank, deposit your paycheck and walk away thinking your money will remain safe and secure, ready for you to withdraw whenever the need arises.

But as Greeks have discovered, that’s not necessarily the case. In the event of a crisis, you may not be able to access your money.

According to a Guardian article, some officials in the Greek government were prepared to take a page out of the Cypriot playbook and confiscate funds from banks.

This article is written by Peter Schiff and originally published by Euro Pacific Capital. Find it here.

While the world can count dozens of important currencies, when it comes to top line financial and investment discussions, the currency marketplace really comes down to a one-on-one cage match between the two top contenders: the US dollar and the euro.

In recent years the contest has become a blowout, with the dollar pummeling the euro into apparent submission. Based on the turmoil created by the European debt crisis and the continuing problems in Greece and other overly indebted southern tier European economies, many investors may have come to assume that euro boosters will be forced to ultimately throw in the towel and call off the entire experiment, thereby leaving the dollar completely unchallenged as the champion currency, now and for the foreseeable future. This is a stunning turnaround for a currency that was seen just a few years ago as a credible threat to supplant the dollar as the world’s reserve.

The Chinese yuan continues to gain stature in the world financial system.

Earlier this week, the London Metal Exchange announced it will begin accepting yuan as collateral for banks and brokers trading on its platform.

The LME is the largest metal trading venue in the world. It facilitated some $15 trillion in metal trades last year. The yuan joins the United States dollar, the euro, the British pound and the Japanese yen as allowable collateral.

The Wall Street Journal called the LME move “another milestone for China’s currency.”

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

The month of July has seen the most intense demand for physical gold and silver since April of 2013, setting numerous records for the year. On the heels of the spectacular drop in spot prices, buyers of physical metal have come out in droves. In fact, available supply is hardly able to keep up with the demand for immediate delivery of metals.

This betrays a fundamental reality about the market for physical gold and silver bullion that many investors – even regular buyers of bullion – are not aware of. There simply is not much supply available at any given time. In other words, gold and silver products spend very little time sitting on the shelf waiting to get bought, making inventory very tight. As such, in times of intense demand, the entire available supply can be bought up in a matter of weeks, or even days. This results in higher product premiums and extended shipping times.

This is exactly where the market is for physical metals is right now. Consider what has happened in just the last couple of weeks.

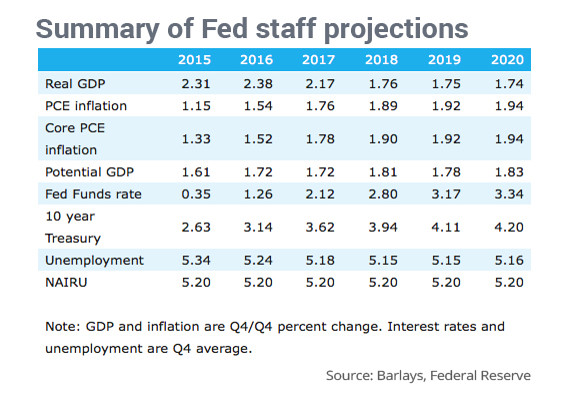

On Friday, the Federal Reserve accidentally published the economic forecasts of its staffers, which normally remain private. The numbers reveal that the Fed is painting a much rosier picture of the United States economy than they publicly admit. Peter Schiff dug into these numbers during his podcast published on Saturday. Use the chart below to follow along with Peter’s analysis. Peter also discusses the gold market, which he believes is setting itself up for a massive short squeeze.

A couple weeks ago, we shared a segment of Peter Schiff’s recent interview with Reason TV. Here is the full interview with Reason’s Matt Welch from FreedomFest 2015. They discuss the future of the United States economy, the upcoming presidential election, and China’s relationship to the US.

Things change quickly when they change. This idea that America is an all-powerful nation is just an idea. It’s based on a myth. At one time that was true. We were a mighty nation. We did manufacture the goods that everyone wanted to buy. We were the lowest cost producer of manufactured goods. We had the most economic freedom. We had the lowest rates of taxes, the fewest regulations. We were a very free society… We built an incredible country based on those principles. We’ve abandoned those principles, and the wealth has been abandoned as well.”

This article is written by Peter Schiff and originally published by Euro Pacific Capital. Find it here.

In his July 17th blog post, “Let’s Get Real About Gold”, author and Wall Street Journal columnist Jason Zweig likened investor interest in gold with the “Pet Rock” craze of the 1970s, when consumers became convinced that a rock in a box would provide continuous companionship, elevate their social standing, and give them something hip to talk about at parties. Zweig asserts that investor faith in gold, which he argues is just another inert mineral with good marketing, is similarly irrational, and has kept people from putting money in the much more lucrative stock market.

First off, Zweig’s comparison of gold to equities as an investment vehicle sets up a false dichotomy. Gold is not an investment. It is, as Zweig indicates, nothing but a rock. But it is a rock that is extremely scarce, with highly desirable physical properties that have resulted in its being used as money for all of recorded human history. As a result, it should not be compared to stocks or real estate, but to other forms of money, such as any one of a number of fiat currencies now in circulation. Ironically, in a world awash in fiat currencies that are created at an ever increasing pace, and whose value is solely derived from faith in the issuing state, gold is the only form of money whose value does not require a leap of faith.

Jim Grant joined Kitco News to share his thoughts on the gold market. Author of The Forgotten Depression and publisher of Grant’s Interest Rate Observer, Grant is one of the most reserved and staunch gold bulls in the financial media. Grant admits he is extremely frustrated with the gold market given the underlying fundamentals of the global economy. But with his typically patient demeanor, he maintains that now is a great opportunity to buy. Grant prefers to invest in non-numismatic, physical gold bullion, like Krugerrands. He also buys gold mining stocks.

We are in one of the most radical periods of monetary experimenting in the annals of money. It could be this all works out. That is a possibility. I rate that as a very low probability. For that reason, you want to have exposure to the reciprocal asset of the paper assets that are now most popular. Gold to me is now the conjunction of price, value, and sentiment. I am very bullish indeed.”

Banks in Greece reopened on Monday, and even with strict withdrawal limits in effect, it at least gave the appearance of a return to normalcy. But Greeks also woke up Monday to a painful new reality that should serve as a warning to Americans.

Massive tax hikes went into effect, part of the austerity measures demanded by creditors in the latest bailout deal. As the AP reported, the increased taxes are another blow to Greeks already battered by years of economic crisis.

There are few parts of the Greek economy left untouched by the steep increase in the sales tax from 13 to 23 percent. The new rates have been imposed on basic goods, from cooking oil to condoms, as well as to popular services, such as taxi rides, eating out at restaurants and ferry transport to the Greek islands.

“The tax hikes are part of a package of austerity measures that also include pension cuts and other reforms that the Greek government had to introduce for negotiations to begin on a crucial third bailout.”