Remember back when mortgage lenders loosened credit standards making it easier to get a loan and blew up a giant housing bubble?

That’s happening again.

According to a report released by Fannie Mae, lenders facing lower profit margins are trying to expand the borrower pool.

Facing constrained mortgage demand and a negative profit margin outlook, more lenders say they have eased rather than tightened home mortgage credit standards, according to Fannie Mae’s third quarter 2017 Mortgage Lender Sentiment Survey. Across all loan types – GSE Eligible, Non-GSE Eligible, and Government – the net share of lenders who reported easing credit standards over the prior three months reached a new high since the survey’s inception in March 2014, after climbing each quarter since Q4 2016.”

Obamacare repeal 3.0 went down in flames Tuesday. According to Bloomberg, opposition from three Republican Senators derailed the latest attempt to dismantle the Affordable Care Act.

Leaders decided the Senate won’t vote before Saturday’s deadline to use a fast-track procedure to keep Democrats from blocking a GOP-only bill. On Monday, Republican Senator Susan Collins of Maine added her opposition to that of GOP Senators John McCain of Arizona and Rand Paul of Kentucky, enough to sink the legislation in the 52-48 Senate.”

This raises broader questions: Can Republicans get anything done? Is there any chance of Trump pushing through his ambitious economic agenda?

During an interview at the Denver Gold Forum, the chairman of the World Gold Council said he thinks the world may have reached peak gold.

Peak gold means the amount of gold mined out of the earth will begin to shrink every year, rather than increase, as it has done pretty consistently since the 1970s.

Randall Oliphant said there are signs we’ve reached that point. He said in the near-term, production is likely to plateau at best, before slowly declining as demand rises, especially given global political risks and robust purchases by consumers in India and China

We’re not going to fall off a cliff in the near term, but in the same time it’s really hard to see how we’re going to produce enough gold to meet all this demand.”

Last December, Dennis Gartman called gold the top commodity to own in 2017. He followed up in March, swearing he wasn’t a “gold bug,” but then advising “buy gold.” Now the man known as the “commodities king” says keep buying gold.

In an interview on CNBC’s Futures Now, Gartman declared the bull run isn’t over and predicted the yellow metal will hit $1,400 in the near future.

A year from now gold will be demonstrably higher than where it is now.”

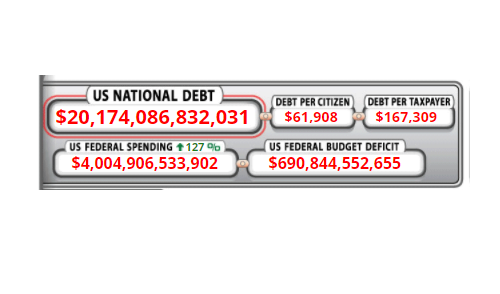

When Pres. Trump signed a bill raising the debt ceiling limit for the next three months, it instantly added approximately $318 billion to the national debt, raising it to $20.16 trillion. And Trump wants to do away with the debt ceiling altogether.

It’s hard to even conceptualize $20 trillion. What does that mean to the average person? Just the Facts Daily put together some interesting data that helps put the soaring national debt into perspective.

The founder of the world’s biggest hedge fund says every investor should own some gold.

Business Insider CEO Henry Blodget recently interviewed Ray Dalio, the founder of Bridgewater Associates.

You recommend that most portfolios should contain some gold.”

Dalio’s didn’t even hesitate.

Yeah. Of course.”

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Apple recently announced its new iPhone 10 to much hoopla. It will feature a retina display, increased storage and RAM, and enhanced facial recognition (which is either real cool or incredibly creepy, depending on your point of view.)

Of course, this will all come with a pretty hefty price tag of around $1,000. A lot of people were taken aback by the cost of the new Apple gadget. On the other hand, there are apparently at least a few people out there who think that isn’t nearly enough. I mean, who wants a plain old, boring $1,000 iPhone 10 when, for a mere $69,995, you can walk around with the solid gold Lux iPhone X Ingot pressed against your ear?

The Federal Reserve took a hawkish stance at its latest Open Market Committee meeting, announcing plans to begin unwinding its balance sheet next month. Fed chair Janet Yellen also indicated she plans to raise interest rates one more time this year.

Here’s the question: Is this a viable path forward, or is the central bank playing a game of monetary chicken?

Earlier this month, the US threatened to lock China out of the dollar system if it doesn’t follow UN sanctions on North Korea. Treasury Secretary Steven Mnuchin threatened this economic nuclear option during a conference broadcast on CNBC.

If China doesn’t follow these sanctions, we will put additional sanctions on them and prevent them from accessing the US and international dollar system, and that’s quite meaningful.”

The threat may be meaningful, but it also might be empty.