The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Industrial demand for silver remains strong, particularly in electronic and electrical applications.

The Silver Institute highlighted the growing use of silver in electronics along with a number of technological innovations utilizing the white metal in the latest edition of Silver News.

What happens when central banks push interest rates to zero – in some cases below zero – and hold them there for nearly a decade?

You get debt.

Lots and lots of debt.

Record levels of debt, in fact.

After the worst Christmas Eve in the history of the stock market, the Santa Clause rally came late. Markets bounced back in the short trading week after Christmas. The Dow started with a 1,000-plus point gain, then dropped nearly 600 points the next day, before rallying late to close in the green.

The rally had some Wall Street pundits feeling giddy, but in an interview on RT America, Peter Schiff said the bubble has popped and this is exactly the kind of roller coaster ride you expect in a bear market.

Pending home sales hit the lowest level in nearly five years in November, a sign that the US housing market will continue to get uglier in the near future.

Not too long ago, we reported that the air was starting to come out of housing bubble 2.0. As just one example, home sales in California hit the lowest level in a decade. And it’s not just California.

Now we’re seeing more signs of trouble. Pending home sales tanked in November, according to data released by the National Association of Realtors last week. The Pending Home Sales Index plunged 7.7% compared to November 2017, the biggest year-over-year percentage drop since June 2014.

What can we do when the federal government exceeds its constitutional authority? Thomas Jefferson answered that question in 1798. He said, “nullification is the rightful remedy.” But what in the world is nullification? And how do you do it?

How are you weathering the great government shutdown of 2018?

We’re in day seven now. It’s been tough here in Lexington. I’m pretty sure I saw some kid setting up an unauthorized lemonade stand. I’m not sure we will survive the plague that’s sure to follow without the FDA to put a lid on such things.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

We often criticize the Federal Reserve for its three rounds of quantitative easing. Coupled with artificially low interest rates, Fed QE stimulus — essentially money creation –pumped up all kinds of asset bubbles. Now that the US central bank is trying to tighten, we’re beginning to see the air seep out of those bubbles.

But when it comes to QE, the Federal Reserve has nothing on the European Central Bank. The ECB just announced the end of its QE program this month. The ECB’s QE purchases totaled somewhere in the neighborhood of 2.6 trillion euros. The bank also pushed interest rates below zero. So, what did the EU get for all this stimulus? Not a whole lot.

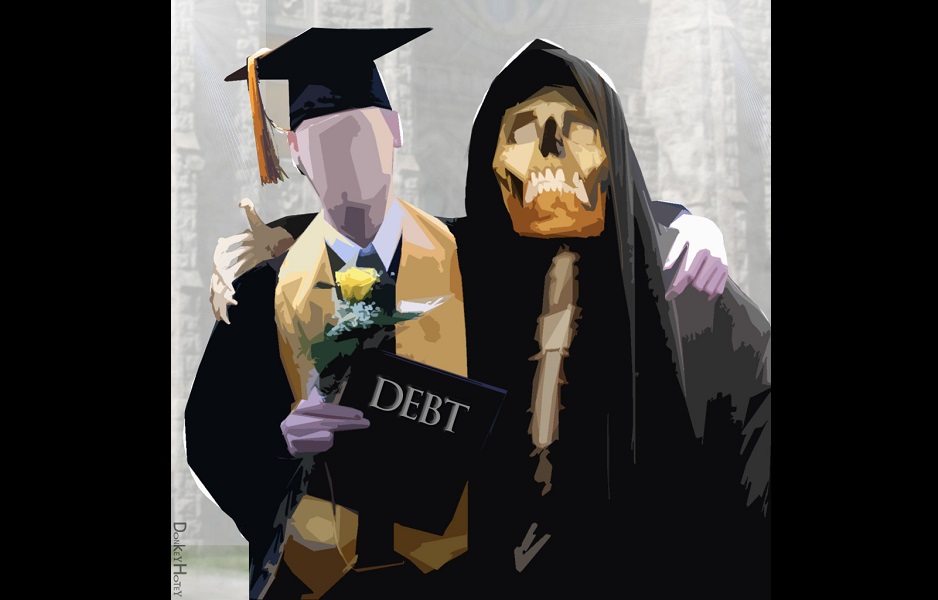

Student loan debt has grown to over $1.5 trillion. And that just accounts for loans held by Federal Student Aid. It doesn’t include private loans. Meanwhile, the Department of Education says 43% of those government-backed loans are considered “in distress.”

In a speech last month, Education Secretary Betsy DeVos put the current level of student debt in perspective.

One-point-five trillion dollars is almost impossible to fathom. So, let me put it this way: $1.5 trillion is more than $10,000 of someone else’s student loan debt for each and every American taxpayer—145 million of them.”