The national debt has pushed above the $22 trillion mark, but it’s not just Uncle Sam borrowing himself into oblivion. US household debt climbed to a record $13.54 trillion in the fourth quarter of 2018, according to a report released by the Federal Reserve Bank of New York.

Total household debt (including mortgages) now stands $869 billion higher than the previous peak of $12.68 trillion in the third quarter of 2008 (right before the crash) and 21.4% above the post-financial-crisis trough reached in the second quarter of 2013.

The national debt has pushed beyond the $22 trillion mark.

According to Treasury Department data released Tuesday, the national debt now stands at $22.01 trillion. When President Trump took office in January 2017, the debt was at $19.95 trillion. That’s a $2.06 trillion increase in the debt in just over two years.

As we pointed out in an article last week, the US federal government has added $1.5 trillion to the national debt over the last 12 months. As a result, the US Treasury Department is flooding the market with bonds. Meanwhile, the biggest buyers of US debt – China, Japan and the Federal Reserve – are shrinking their Treasury holdings. For the past several months, we’ve been saying this is a big problem for the US government that most people are overlooking. And we aren’t the only ones sounding warning bells.

Last week, the chair of the Treasury Borrowing Advisory Committee (TBAC) sent a letter to Steven Mnuchin containing what the Financial Times called “a bombshell.”

Gold is on a nice little bull run. The yellow metal is up almost 3% since the first of the year and nearly 13% since touching one-and-a-half year lows last summer. But as a recent article in Barron’s pointed out, the relative strength of the dollar has disguised an even more substantive bull market for gold.

Sharps Pixley CEO Ross Norman told Barron’s that gold has seen a widespread, strong and sustained value appreciation around the globe against 72 currencies.

The Democrats led by Alexandria Ocasio-Cortez released their “Green New Deal” last week. As Peter Schiff put it in his latest podcast, the Green New Deal is really red – as in socialist red.

The whole thing is an economic train wreck.

It’s masterful politics though.

Once upon a time, quantitative easing was considered an “extreme measure.” But it may become more commonplace. According to a Reuters report, central bankers in the US are discussing whether they should turn to that “tool” more often.

In other words, the Fed may make the “extreme” the norm.

When I was a kid, I thought people in elected offices were among the brightest and best. Then I grew up, started interacting with politicians and realized they are no smarter than anybody else. And in fact, a lot of them are downright dumb.

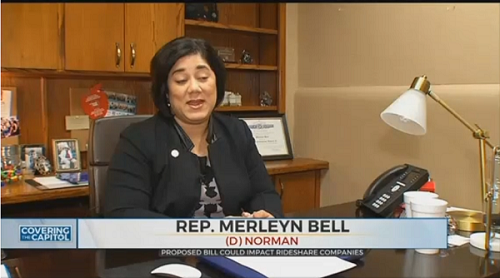

Well, I’ve got an Oklahoma lawmaker for you that fits neatly into the downright dumb category.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Total holdings of gold in gold-backed ETFs grew for the fourth straight month in January.

Globally, ETFs added 72 tons of the yellow metal to their holdings last month, according to the latest data released by the World Gold Council. This brought the total amount of gold held by funds worldwide to 2,513 tons valued at about $107 billion.

All of a sudden, former Federal Reserve chair Janet Yellen sounds a little bit like Peter Schiff.

During an interview on CNBC, Yellen conceded that the next Fed move could be an interest rate cut.

Of course, it’s possible. If global growth really weakens and that spills over to the United States where financial conditions tighten more and we do see a weakening in the US economy, it’s certainly possible that the next move is a cut.”