When I was a kid, I thought people in elected offices were among the brightest and best. Then I grew up, started interacting with politicians and realized they are no smarter than anybody else. And in fact, a lot of them are downright dumb.

Well, I’ve got an Oklahoma lawmaker for you that fits neatly into the downright dumb category.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Total holdings of gold in gold-backed ETFs grew for the fourth straight month in January.

Globally, ETFs added 72 tons of the yellow metal to their holdings last month, according to the latest data released by the World Gold Council. This brought the total amount of gold held by funds worldwide to 2,513 tons valued at about $107 billion.

All of a sudden, former Federal Reserve chair Janet Yellen sounds a little bit like Peter Schiff.

During an interview on CNBC, Yellen conceded that the next Fed move could be an interest rate cut.

Of course, it’s possible. If global growth really weakens and that spills over to the United States where financial conditions tighten more and we do see a weakening in the US economy, it’s certainly possible that the next move is a cut.”

Last year was tough for silver with lower demand muting prices. But the Silver Institute is bullish on the white metal for 2019, projecting a rebound in demand coupled with lower mine output.

After Jerome Powell indicated that the Federal Reserve tightening cycle was on pause during last week’s FOMC meeting, Peter Schiff said, “The monetary drug pushers at the Federal Reserve gave the addicts on Wall Street exactly the fix that they had been craving.”

Peter often compares the markets to drug addicts. They are addicted to the easy money the central bank provides. Reuters used that same imagery to describe America’s business community in the wake of the “loose money era,” saying it left a “trail of US corporate debt junkies.

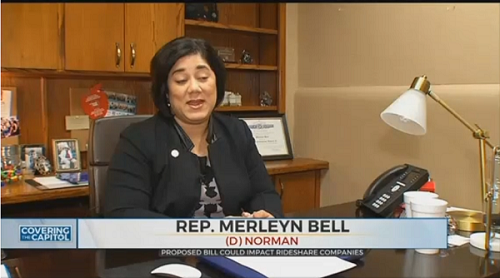

Several state legislatures are considering bills that would repeal taxes on the sale of gold and silver.

Fundamentally, gold and silver are money. But most governments treat precious metals as a commodity. They don’t accept it as payment. Worse than that, they tax it. Think about the absurdity of this policy.

Over the past 12 months, the US federal government has added $1.5 trillion to the national debt.

As of Jan 30, the debt stood just under the $22 trillion mark at $21.97 trillion, according to the latest Treasury Department data. As WolfStreet put it, we’re seeing these rapidly increasing levels of debt during “good times when the economy is hopping. At the next recession, this is going to get cute.”

But even as the US added to its debt load, foreign holders of US Treasurys are gradually selling them off. So, who’s buying up all of this debt? And is it sustainable?

During his keynote speech at the Vancouver Resource Investment Conference, Peter Schiff said we are at the beginning of the end.

The Fed appears to have paused interest rate hikes in order to save the stock market. The markets have reacted positively and a lot of analysts seem to think we’re out of the wood. But Peter traces the moves of the Federal Reserve all the way back to the first rate hike of December 2015 and shows how the central bank has put us on a path toward a financial crisis that will be bigger than 2008. Peter insists he’s been right about what would happen all along, it’s just taken us a little longer to get here than he expected.

Global gold mine output marked its 10th year of annual growth but continued to show signs of slowing in 2018, according to the World Gold Council.

Gold production rose fractionally by about 1% totaling 3,346.9 tons. That compares with 3,318.92 tons mined in 2017 — a 28-ton increase year-on-year.

Meanwhile, global gold demand grew by 4%.