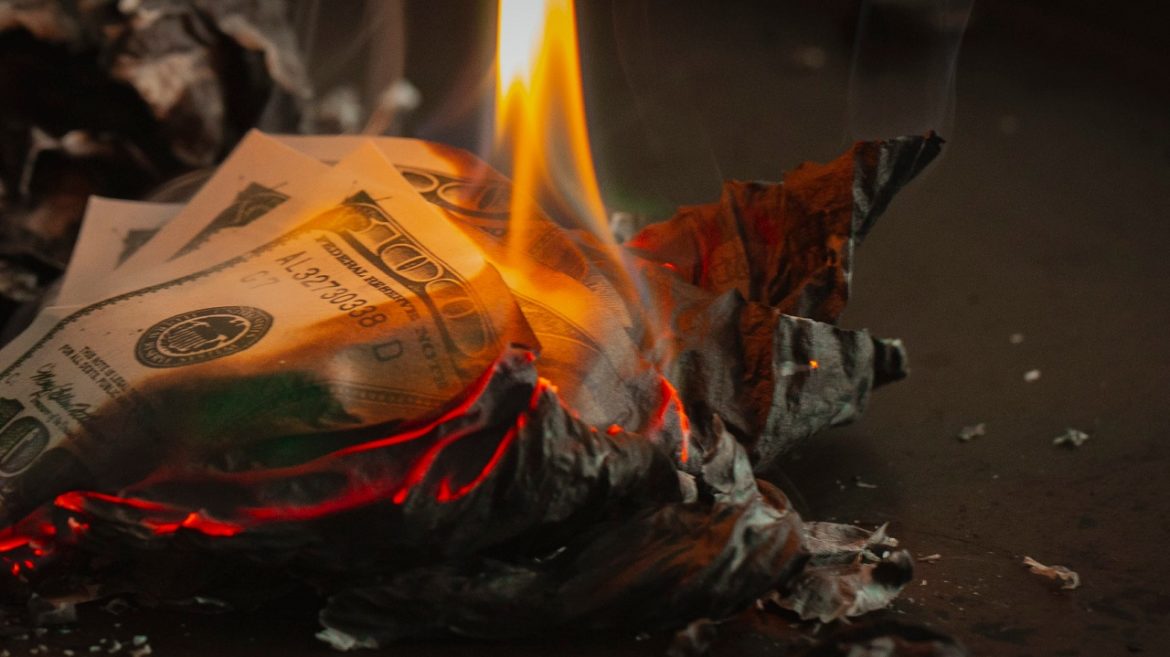

Even as US stock markets rally and people anticipate a quick recovery as economies open up, a tsunami of defaults and evictions looms on the horizon.

The mainstream narrative has been that although the coronavirus shutdowns have rocked the economy, it’s not a financial crisis like we saw in 2008. Back in April, Peter Schiff said that we were absolutely heading toward a financial crisis and it will be worse than 2008.

US stock markets continued their inexplicable rally despite the economic destruction wrought by the coronavirus-induced shutdown. The S&P500 is only down about 3.5% on the year and the NASDAQ is actually up. As a result, a lot of investors seem to be getting out of safe havens, including gold. But in his podcast, Peter Schiff explains why selling gold is a mistake if you understand what’s really going on. In a nutshell, stocks are rising because the Fed is printing money. And no matter what the mainstream says, money printing matters.

The Chinese government has launched a pilot program for a digital version of the yuan. The virtual currency ups the ante in the war on cash and creates the potential for the government to track and even control consumer spending. It also raises some concern that the Chinese could threaten dollar-dominance.

Protests have rocked the US in the wake of George Floyd’s death at the hands of a Minneapolis police officer. In some areas, peaceful protests have crossed the line into violence and looting. But the real question is what are the long-lasting political ramifications that will come out of the unrest?

Peter Schiff talked about it during a recent podcast and worried that it could lead to bigger government and more socialism.

The solar power industry is expected to create a steady source of demand for silver in the coming years, according to a new report released by the Silver Institute.

Silver just charted its best month in nine years, with the price of the white metal gaining 20.7% in May.

In a speech at the Cambridge House Vancouver Resource Investment Conference back on Jan. 19, 2020, Peter Schiff said it was “game over” for the Federal Reserve. It’s interesting to look back at his remarks in context with what’s going on over at the central bank today. If it was game over then, where are we now?

Silver just had its biggest monthly gain in nine years.

The spot price of the white metal went into May at $14.96 per ounce and closed on May 29 at $17.98, a 20.7% increase. Silver futures did even better, with the price of silver for July delivery hitting $18.50 per ounce Friday.

On Friday afternoon, Federal Reserve Chairman Jerome Powell did a Q&A session with Princeton economist Alan Blinder. Powell admitted that the central bank had “crossed a lot of red lines,” but insisted he was comfortable with the actions given “this is that situation in which you do that, and you figure it out afterward.”

In his podcast, Peter Schiff called it the Nancy Pelosi version of monetary policy. “We need to print the money to see where it goes.”

I have a love-hate relationship with social media.

On the one hand, I now have a number of really close friends that I would have never met without Facebook. I’m talking people I connected with on the social media platform and now hang out with in real life. It’s pretty amazing to be able to interact with like-minded people across the US, and even around the world.

The Dow Jones is back of 25,000 and despite increasing tensions with China, people seem pretty optimistic about the economic future as states begin to open back up. SchiffGold Friday Gold Wrap host Mike Maharrey says people should know better. He makes his case by digging into some of the long-term ramifications of the economic shutdown and the government/central bank response to it. He also recaps the last month in the gold and silver markets.