It’s been months since the US started to reopen after the government-imposed coronavirus shutdowns and yet hundreds of thousands of Americans continue to file for unemployment every week. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey takes a close look at the labor market and concludes that a lot of these jobs are never coming back. He also talks a little about the upcoming presidential election and makes a prediction about the outcome.

In response to any economic downturn, the Federal Reserve cranks up the money printing press. The reaction to the economic chaos caused by the government response to the coronavirus pandemic was no different. The Fed launched what many have called “QE infinity,” and has increased the money supply at a record pace. A lot of politicians and pundits see no problem with this approach. After all, “inflation” remains muted despite the money printing.

It’s true that by some measures, we haven’t seen the rising prices you would expect after injecting trillions of dollars created out of thin air into the economy. But that doesn’t mean there isn’t inflation. In fact, defined correctly, increasing the money supply is inflation. And with our without rising consumer prices, inflation has pernicious effects.

When governments across the US forced businesses to close down in response to the coronavirus pandemic, everybody assumed the layoffs would be temporary. Despite the huge surge in unemployment, the expectation was people would quickly return to work once the crisis passed and the economy opened up again. But as the pandemic stretches into its eighth month, millions of Americans remain out of work and economists say many of those “temporary” job losses have become permanent.

Sell dollars and buy silver. That’s Goldman Sachs’ recommendation.

We’ve been warning about a dollar collapse. Now the mainstream is even getting bearish on the dollar.

As pundits and politicians continue to speculate about economic recovery, hundreds of companies large and small are struggling under loads of debt, filing for bankruptcy and closing their doors.

In September, 54 more large companies filed for bankruptcy, according to S&P Global intelligence. A total of 509 companies have gone bankrupt this year as of Oct. 4, exceeding the number of filings during any comparable period since 2010. That was piled on top of the 54 companies that filed for bankruptcy protection in August.

Globally, ETFs added gold for the 10th straight month in September and pushed total inflows to over 1,000 tons on the year.

The previous yearly inflow record was 646 tons set back in 2009.

Gold ETF holdings increased by 68.1 tons last month, despite the metal’s worst monthly price performance since November 2016, according to data released by the World Gold Council.

Regal Cinemas shut down all of its US theaters this week. The company said the closure is temporary, but it reveals the deeper strain in the retail sector. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey digs deeper into the retail mess and talks about what it is telling us about the broader economy. He also discusses the ongoing stimulus debate and the national debt news that nobody is talking about.

Gold-buying by central banks has slowed from the record pace we saw in 2018 and 2019, but many countries continue to load up on the yellow metal.

August saw the first net global decline in central bank gold holdings, but the number was skewed by a big sale by one central bank. Overall, seven countries increased their gold reserves by a ton or more in August, tying February for the highest number of buyers in a single month this year.

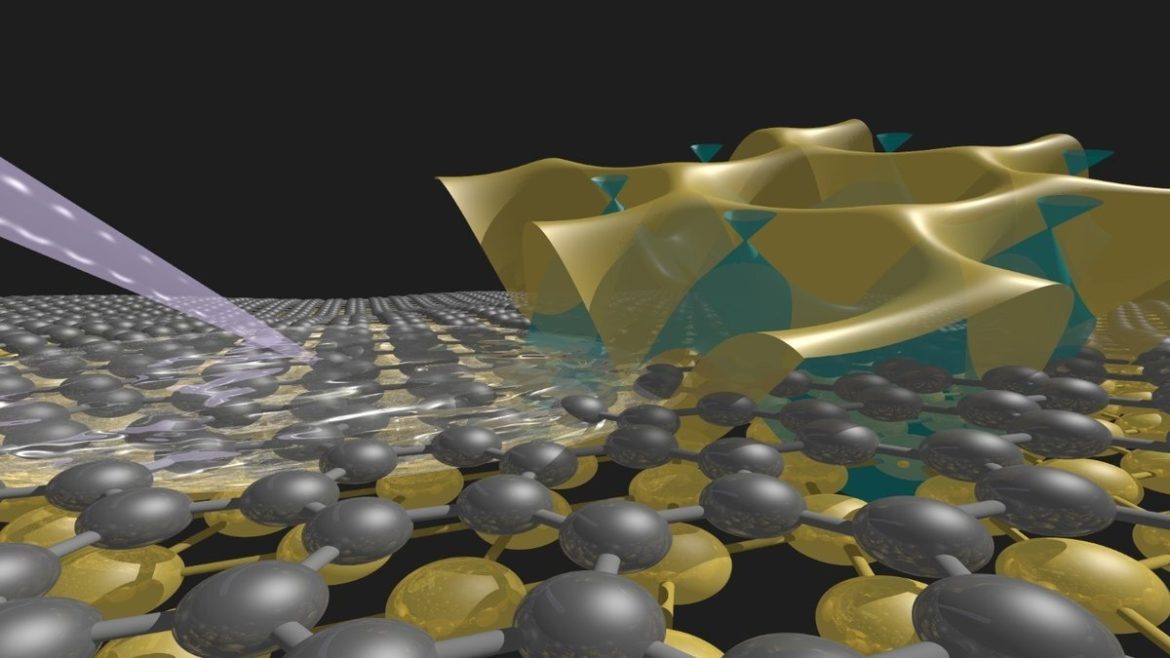

If you have ever handled gold leaf, you know it’s pretty thin. Paper-thin, in fact. But did you know we can go thinner?

In fact, scientists can take gold and silver into two dimensions. Sounds crazy, eh? Like flat earth or something. But the research team of Ulrich Starke and his former doctoral student Stiven Forti have successfully created a gold layer only a single atom thick. It’s two-dimensional gold, so to speak.