Peter Schiff recently spoke at the January 2022 Virtual MoneyShow. He talked about the impacts of inflation and said stagflation is going to shock the markets.

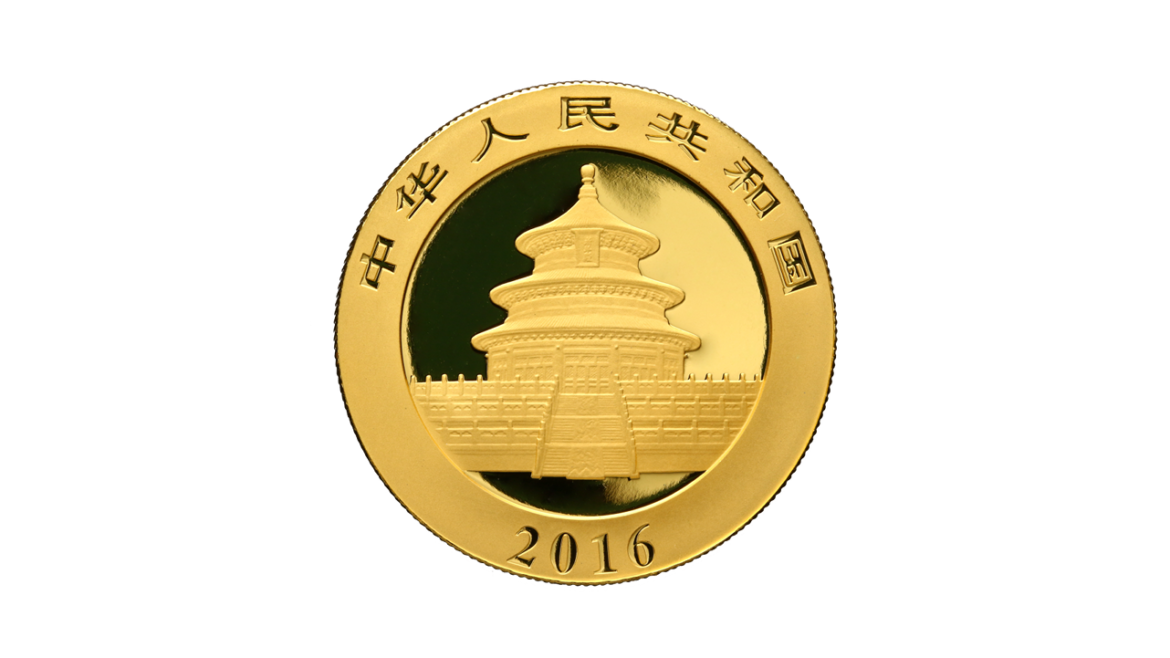

Chinese gold consumption rebounded in 2021, rising by 36.53% year on year as the market continues to recover after taking a hard hit during the coronavirus pandemic.

More significantly, gold demand was up 11.78% compared with consumption in 2019, before the pandemic.

China ranks as the world’s number one gold consumer.

Is bitcoin an inflation hedge?

Peter Schiff recently appeared on RT Boom Bust with Natalie Brunell of Coin Stories to discuss inflation and whether bitcoin is a hedge. Peter said bitcoin is not an inflation hedge. He called it a “speculative token” with its price driven by supply and demand.

But what about gold? It didn’t perform like an inflation hedge in 2021 despite the inflation freight train. Peter said the reason gold has had some problems is because the market wrongly believes the Fed.

The Fed is talking taper. But it seems to be having a hard time actually tapering. The central bank added another $100 billion to its balance sheet in January.

The Federal Reserve held its first FOMC meeting of 2022. The central bank didn’t do anything, but the tone coming out of the meeting was widely perceived as even more “hawkish.” Everybody is convinced the Fed really means it now. The inflation fight is on. Is it though? Host Mike Maharrey talks about the messaging and perceptions coming out of this meeting and calls it a big flim-flam.

Several states are considering bills to repeal the sales tax on precious metal bullion during the 2022 legislative session. Passage into law would relieve some of the tax burdens on investors, and would also take a step toward treating gold and silver as money instead of as commodities.

The Federal Reserve wrapped up its first Federal Open Market Committee meeting of the year yesterday without any real surprises. Despite everybody screaming about an inflation problem, the Fed will keep its loose, inflationary monetary policy in play for at least two more months.

M2 increased by $201 billion in December.

This represents a 0.94% MoM increase which annualizes to 11.9%. For the entire year of 2021, M2 grew by an incredible $2.5 trillion or 13.1%!

This is extremely rapid money supply growth! The Fed can taper their asset purchases, but shrinking the Money Supply is the only way to rein in inflation.

The world’s largest gold ETF saw record inflows on Friday, a bullish sign for the yellow metal.

SPDR Gold Shares (GLD) ranks as the world’s largest gold fund. It saw a net inflow of $1.63 billion on Friday. It was the largest net inflow in dollar terms since the fund was listed in 2004.

Peter Schiff was a guest on the Wharton Business Daily podcast produced by the Wharton School of Business at the University of Pennsylvania. Peter talked about inflation and how it will impact the US economy moving forward. He said ultimately, we’re heading toward stagflation.